It hasn’t been all doom and gloom over the last few months…one commodity, in particular, continues to accelerate in the midst of a global market panic, and I’m not talking about crude oil.

Today, I’m going to discuss lithium and why recent price action for this mineral matters when you consider commodities more broadly.

Lithium has defied the odds; its acceleration is primarily down to future optimism in the uptake of electric vehicles (EVs). But in many ways, this commodity is a ‘one-hit wonder’ as it’s used principally in the manufacture of EV batteries.

Lithium has garnered a wide audience over recent months. Anything from fund managers to governments to celebrity CEOs, everyone seems to have a positive take on this ‘trendy’ metal.

Recently, Tesla’s Elon Musk piped in with comments suggesting lithium producers can structure their business as ‘a license to print money’.

But in my mind, the lithium story pales in comparison to the looming supply issues of other, more important, critical metals.

But more on that later.

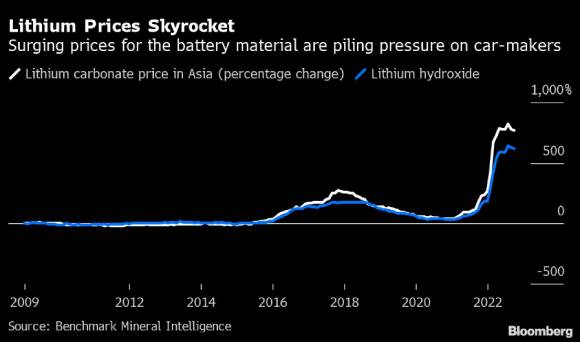

Over 2022, prices for raw lithium have made impressive gains.

The chart below shows the rapid accession for the two primary supplies of unrefined lithium material, lithium carbonate, and lithium hydroxide:

|

|

|

Source: Benchmark Mineral Intelligence |

Prices have accelerated on the back of anticipated demand coming from EV manufacturing.

Western Australia’s flagship lithium producer, Pilbara Minerals [ASX:PLS], has certainly benefitted from the momentum, surging more than 166% since the June 2022 lows…impressive, given the state of markets at the moment:

|

|

|

Source: ProRealTime Charts |

But should you invest in Lithium RIGHT NOW?

Most market commentators have stated future demand for EV batteries will continue to drive a boom in lithium prices.

But that’s the typical mainstream sentiment; I believe much of the excitement has already been priced in. In my opinion, I see much stronger opportunities presenting in other areas of the commodity sector.

You see, lithium does not have the same impending supply constraints that I see looming over other key metals.

Sure, demand for lithium is set to grow on the back of a large transition into renewables, but there’s a strong pipeline of projects already underway, which will meet this future demand.

From Argentina to Australia to Canada, numerous suppliers are set to come online providing additional metal to the EV market over the coming years.

It’s the stream of projects popping up across mature mining districts that will alleviate future supply pressures. This will moderate future lithium prices.

Importantly, these suppliers offer an alternative to China, which currently provides much of the world’s CURRENT refined lithium to market, an important consideration, which I’ll explain in detail below.

Which brings me to the commodities you SHOULD be focusing on…

Copper: A metal set to play an enormous role in the future energy transition.

Its superior conductive properties ensure it remains the only option for building vast infrastructure for the delivery of renewable energy to consumers.

But according to S&P Global Market Intelligence, new copper discoveries have fallen by at least 80% since 2010.

Similarly, companies with exposure to cobalt, zinc, aluminum, nickel, battery grade graphite, and rare earths will benefit not only from future demand but extreme lack of supply. An issue I just don’t see in the lithium market given the number of new projects coming into production.

What’s even starker is that many of these critical metals are not a ‘one-hit wonder’ like lithium. Instead, they’re used across numerous tech-heavy industries related to green energy technologies, defence, manufacturing, construction, medicine, as well as EV batteries.

You might say, ‘sure, but the amount of, say, cobalt needed in a single EV battery is far less than what’s needed for lithium’.

But what you NEED to understand is this: How abundant is this metal compared to lithium?

You see, virtually all the world’s cobalt resources are locked up in just ONE country, the highly volatile Democratic Republic of the Congo (DRC).

This, to me, makes cobalt a stand-out contender in the race to find alternative, stable supplies of critical metals.

Furthermore, DRC ore is shipped directly to China for refining, excluding Western economies from the cobalt supply chain.

Let’s take another example of a critical metal I believe will garner major investor interest in the future, far beyond what we’re currently seeing in lithium…battery grade graphite.

You see, a little-known fact is that graphite is the most used raw material (by weight) in an EV battery.

And it’s not just any type of graphite that can be used as a cathode in EV batteries, it’s a special flake type that allows processing into Purified Spherical Graphite (PSG).

Many investors have failed to recognise that we actually need more of this specialised graphite in an EV li-ion battery than we need lithium.

Who’s responsible for the ENTIRE global supply of battery grade graphite? China.

It’s simply staggering that US, European, Japanese, and Korean manufacturers have made themselves entirely reliant on a single supplier.

Even more astonishing is that the leaders of these countries are declaring a VERY REAL possibility of war with China, according to this recent ABC article.

But before proclaiming the possibility of a Third World War, perhaps these leaders should consider how they intend to build up their defence arsenal once China inevitably closes the door to critical metal supply.

After all, it’s Chinese supply of these critical metals that provides the raw materials to build highly sophisticated weaponry.

Which brings me to the all-important Rare Earth Elements, also known as ‘REEs’. A group of 17 metals used in specialised technologies.

They’re especially important in defence. Used in everything from Javelin missiles made famous by Ukraine soldiers and their defence against Russian tanks, to US F-35 fighter jets.

According to one military source, there are well over 3,000 items of US military equipment requiring rare earths including drones, satellites, nuclear weapons, missiles, surface warships and submarines, advanced radars, combat systems, and army vehicles such as tanks.

Yet China dominates more than 90% of supply!

The lack of long-term planning by the West as it drums up war rhetoric is simply astounding.

A military stoush between China and any US allies would almost certainly result in an embargo on numerous critical metals, which are exclusively provided by China.

The US is gradually waking up to its national security nightmare…but China knows it holds a valuable card in these geopolitical tensions; it’s prepared long and hard for this very situation.

Inadequate leadership is your opportunity to profit

The geopolitical heat unfolding between China and Russia against the West is just ONE of the selection criteria I’ve used in hand-picking an exclusive list of ASX-listed companies, which you can access VERY SOON.

Each company holds an extremely valuable critical metal deposit that falls OUTSIDE Chinese-dominated supply lines.

So, while the current boom in lithium gives us some insight into what might happen to critical metal prices more generally over the coming years, scarcity and demand will drive prices far higher for a select number of critical metals that I’ve identified as (currently) having exclusive control by China.

The companies that own these valuable Australian-based assets are set to gain an enormous premium as global tech manufacturers from energy, transport, and defence scramble to find alternative pathways when geopolitical tensions inevitably heat up between China and the West.

I’m currently zeroing in on several contenders. These could well be the showcase ASX stocks to own in 2023, no matter what the wider market does. We’ll be releasing a ‘motherlode’ of info on this topic here in The Daily Reckoning Australia later on this week. Stay tuned…

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia