Japan

Japan is the world’s third-largest economy after the US and China, although close in size to Germany, the world’s fourth largest. The country is a technology, manufacturing, and export powerhouse but one characterised by weak growth. Japan has suffered nine technical recessions since 1989, the most recent of which was from late 2018 to late 2020, when the economy declined by more than 4.4%.

It’s more accurate to say Japan has been in a prolonged depression since 1989, punctuated with periodic recessions. Even when Japan is growing, the growth is barely more than 2%. Japan is a thin reed on which to lean if you’re looking to prop up a global economy.

Recent growth in Japan has been no source of comfort. Measured on a year-over-year annualised basis, Japan’s growth was 1.6% in Q3 2022, 0.4% in Q4 2022, and 1.3% in Q1 2023. Second quarter GDP will be released in the coming days. It is expected to show weak growth with some strength in the services sector but contraction in the manufacturing sector.

It’s fair to say Japan is not in a technical recession, but the economy is hanging by a thread. Japan’s economy is so heavily integrated with China’s that the weak China story can’t help but translate into a weak Japan story.

Nominal spending for Japanese households fell steeply in May 2023, down 1% from April. When you adjust the nominal figures for inflation, real household spending dropped a huge 1.1%.

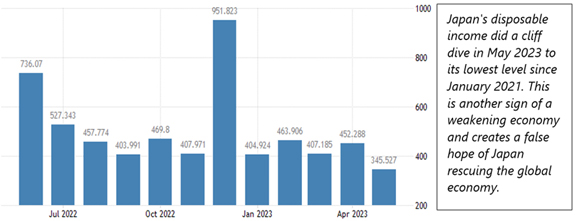

Japan’s disposable income:

|

|

The cause of the spending drop is that disposable income did a cliff dive in May, falling 6.3% in nominal terms, the lowest level since January 2021. Again, when you adjust the nominal crash for inflation, real disposable household income dipped 6.3% to the lowest level since March 2018.

Optimism about Japan’s ability to stimulate the global economy was based on a strong stock market performance as in the US. Bubbles do not make for real growth; they’re just bubbles or a kind of asset inflation.

Given the situation in the US and China, Japan was being held out as the ‘last hope’ for the global economy. The last hope is a false hope. Japan is weak at best and may soon be in recession at worst.

These spending statistics are not the only negative data coming out of Japan. Real (inflation-adjusted) trade is contracting by amount and volume. Some nominal figures are holding up (barely), but that just means the Japanese are paying more for less.

Japan will not lead the world up; it will follow the world down. There is no ray of hope in the Land of the Rising Sun.

All the best,

|

Jim Rickards,

For The Daily Reckoning Australia

Weekend