Wholesale prices fell in June 2023 by 0.2% month-over-month. This was the third straight monthly drop following May’s larger 1.1% decline. On a year-over-year basis, wholesale prices fell 2.9%, the most since June 2020.

Germany’s price declines are part of much broader deflationary trends there. The biggest source of German deflation comes from trade and business prices. This appears not only in internal wholesale prices but in export and import prices as well.

The global goods economy is being buffeted by declines in demand and dangerous overcapacity. And there are no indications the deflationary downside is steadying. There will be more demand destruction and deflation before the process bottoms out.

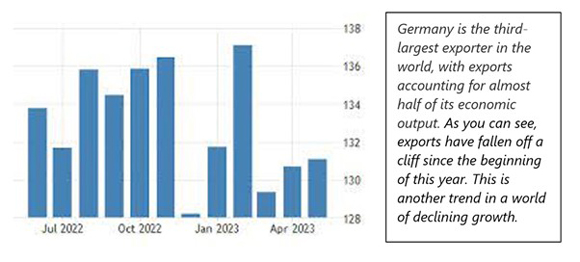

The value (in euros) of German exports in May 2023 was 3.5% less than May 2022. Adjusted for inflation, export volumes fell 7.9% year-over-year. Imports also dropped 10.2% in euros. Exports to the US fell 7.2% in May (on a year-over-year basis), the first decline by value since February 2021.

These trade figures must be put in the context that Germany’s net trade surplus as a percentage of GDP is higher than any major economy in the world. German growth is driven by exports. Since volumes have been falling longer than dollar or euro values, it’s important to look at levels in comparison with previous years.

German export volumes:

|

|

Germany’s import and export volumes today equal what was shipped during each of the prior two economic recessions in 2012 and 2009, both notably weak years.

Until recently, this trade weakness had been hidden by the 2021–22 supply chain disruptions that kept nominal values solid, even as real activity fell dramatically. But as deflation hits trade, nominal margins shrink and turn negative. Business owners will have to equalise volumes, not values. There’s no resiliency here, just adaptation to a world of declining growth.

Germany has its hands full with declining output, declining exports, deflation, a looming energy crisis, and the consequences of its decision to follow Joe Biden into the quagmire of Ukraine. Its Nord Stream natural gas pipelines to Russia are off-line perhaps for years to come, and they have disabled their nuclear power plants and dismantled their coal-fired plants. Germany is also hindered by the slowdown in China, a prime export market.

Germany will not be rescuing the global economy. It can barely help itself.

Regards,

|

Jim Rickards,

For The Daily Reckoning Australia Weekend