I woke up today at 6am, as I tend to do most mornings.

As usual, I’m not in my own bed.

A vague memory of someone shouting ‘Daddy!’ in the middle of the night explains my late-night bedroom transition.

It’s still dark outside, despite daylight savings kicking in over the weekend.

I reach for the sideboard and grab my phone to check the headlines.

I’m not sure the glow of the phone screen is good for my eyes in the dark, but I loathe to turn on the light and wake up the peacefully (and soon to be not so peaceful) sleeping four-year-old to my left.

The headlines are grim…

It’s wall-to-wall COVID-19 coverage.

‘British PM Boris Johnson in intensive care with virus’

‘US on brink of catastrophe’

‘Bodies “likely” to be buried in parks’

With some trepidation I scan the markets fully expecting the worst.

Yet much to my surprise I find this:

‘Dow leaps 7.7%, ASX to open higher’

The AFR article reads:

‘Australian shares are poised to extend their fast start to the week as overseas markets rallied on signs that the virus may have or may be near a peak in Italy and Spain, as well as in New York City.

‘ASX futures were up 121 points or 2.4% to 5397 at 6am AEST. The currency leapt 1.4% to 60.83 US cents.

‘The Dow ended the start of its week up 1628 points or 7.7%.

‘Shares closed up 5.8% in Germany, 4.6% higher in France and London’s FTSE 100 advanced 3.1%.

‘Shares opened sharply higher in New York and held those gains through the session. The Dow was more than 1300 points higher at about 3.40pm local time.’

Now, this is all very interesting for us stock market watchers.

A 7.7% one session rise is huge in any type of market.

But it was the divergence between media sentiment and market behaviour that really shook me out of bed.

My colleague over at The Rum Rebellion, Greg Canavan, often says that when you see markets rise on bad news, it’s a great sign the bottom is close.

What’s going on I wondered…

The inflection point that everyone’s watching out for

Behind the terrible headlines, there was a bit of good news which explains the overnight surge.

At least partially…

You see, there were indications that efforts to get the virus under control in New York, Spain, and Italy were starting to work.

As the New York Times reported, this was a big moment a lot of people were looking out for:

‘For days, officials in and around New York sought indications that the coronavirus was nearing a peak in the region — the U.S. epicentre of the pandemic — and might start levelling off.

‘And for days, the death toll climbed faster and faster. In New York State, for instance, it rose by more than 200, then more than 400, then 630 people in a single day.

‘But on Monday, for the second day in a row, officials found reasons for hope even as hundreds of people continued to die and thousands clung to life on ventilators.

‘On both Sunday and Monday, fewer than 600 deaths from the virus were reported in New York: 594 on Sunday, 599 on Monday, Gov. Andrew M. Cuomo said.’

It’s something I’ve been watching carefully, too.

As I’ve written about in the past, a key feature of this virus was that it was following an exponential growth pathway.

That was the scary thing about the rapid spread of the virus.

But in all exponential curves there’s a crucial point — an inflection point — where the growth rate of the spread starts to slow down.

The ‘J’ curve morphs into an ’S’ curve.

The thing about this inflection point is that times are still bad when it hits. People are still dying in numbers; infection rates are still soaring, and because of that the headlines are still grim.

This explains the divergence we see today between media headlines and the markets.

A lot of people get confused by this, but remember the stock market lives in the future, not the present.

And overnight it had a glimmer of hope that we’re at the beginning of the end for the virus…

Be cautious

But before you dive in headfirst, a quick word of warning…

The economic effects of this virus will be significant long after the virus is contained. And that’s even if it is. One day’s data does not make a convincing case for that.

I’d want to see a week’s worth of evidence before I get too excited.

This could just be your typical bear market rally, when a market bounces higher in the short term but is still going further down long term.

Some of the biggest rallies actually happen in bear markets.

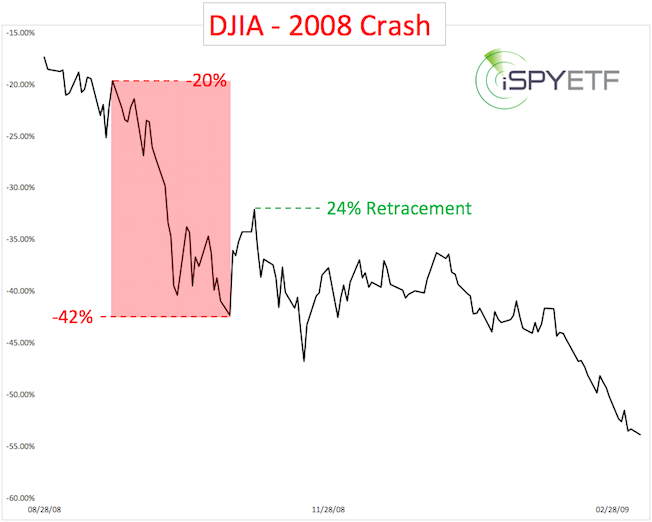

Check out the 24% retracement rally in the 2008 GFC market falls.

|

|

|

Source: Market Watch |

That wasn’t the end of the falls. Just a fake out before more pain ahead.

You can see similar bear market rallies in the big market crashes of 1929 and 1987 too.

I remain cautious about this overnight surge in the stock market.

Though being an optimist, I’m hoping that indeed it does mark the start of a turnaround.

Although my colleague Vern Gowdie is far from convinced on that.

He thinks that this is just the start of a bigger and deeper downturn. He was predicting 65% falls just three months ago. So far, we’re over halfway there.

Vern’s argument can sound a bit gloomy, but he’s been proven right so you should listen to what he has to say.

To get his special report on what investors should look for next, sign up to Money Morning for free today…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks. Click here to learn more.