My son, Cyrus, will start school today.

He just turned four and a half years old a few days ago.

He’s taking his first small steps into the big world.

It’s made me think about how much the world has changed since I was in his shoes over 30 years ago.

What will the world become when he’s my age? And what can I do to help him best prepare for the days ahead?

I thought I’d share these thoughts on my mind with you today.

The 1980s: A rough start that gave way to an era of growing prosperity and hope

I was born in the early 1980s in Hong Kong at a time when the global economy was reeling from the ravages of the oil crisis, runaway inflation, and armed conflicts in the Middle East, Vietnam and Afghanistan.

The decade began with the US Federal Chair Paul Volcker making the historically significant rate hike that took the Federal Funds Rate to nearly 20%. He meant to help reset the US dollar and halt the runaway inflation rate from the excesses and blunders of the last decade. The bitter pill was to pave the way for better days ahead.

Many households and businesses were stifled by a sudden spike in the interest rate. A global recession took hold in 1980–82.

Those who were 20–25 years old in 1980 certainly went through the baptism of fire moment. They came into the workforce during one of the toughest economic periods.

Meanwhile, my father had a secure well-paying job as an electrical engineer which allowed my mother to stay at home to take care of my brother and I.

It was only when I was in my 20s that my parents told me how they’d shouldered for a short time the burden of a double-digit interest rate. Fortunately for them, their career progressed so they were on the up and up.

It was for this reason that they valued good education, which they ingrained into us. They believed it helped them avoid the hardship that many in their generation endured.

But even then, the pain would pass. Prosperity returned soon after the recession and many now look upon the 1980s with much fondness and longing.

Looking closer, we’ll see why the hard start to the 1980s didn’t result in a disaster, but instead sowed the seeds of growing prosperity and restored hope to many.

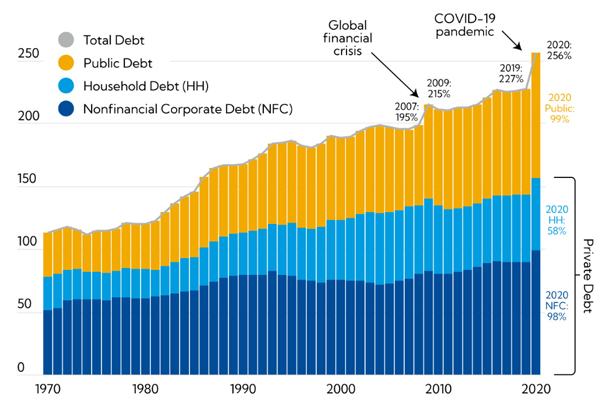

For one, global debt was at a manageable level at the start of the decade, as you can see below:

|

Source: International Monetary Fund |

Global borrowings as a proportion of global productivity was 100–110% in 1980. A major recession and high interest rates held credit growth at bay for the first half of the decade. Global productivity bounced back in 1983–85 and the economy began a period of rapid growth.

The interest rate fell into the second half of the decade, boosting global growth.

Not everything went smoothly during this decade. Government debt as a proportion of the world’s productivity accelerated quickly. It ended the decade at over 170% of global productivity. Part of this arose from the US government bailing out many financial institutions during the Savings & Loans Crisis.

Furthermore, the 1987 Black Monday market crash was a major warning sign of the excesses in the financial markets. We’d see such financial disasters repeat itself more frequently and with greater consequences in the coming decades.

But to the ordinary household, the financial market booms and busts were headline stories in the newspapers or on the nightly news channels.

Stocks and bonds were the playthings of the few and the well-heeled. So the pain was limited. Most households concentrated their wealth in their own home. They were more interested in paying off their mortgage. Many could do so in 10 years as they enjoyed promotions while interest rate cuts acted as tailwinds. Housing affordability throughout the decade maintained stable during the quarter, being around 3–5 years of the average annual income.

2024: A world of contrasts

How things have changed! We now live in a time of stark contrasts.

Firstly, global wealth has grown significantly. But so has the wealth gap.

There’s no denying that manufacturing, the global supply chain and technology have grown rapidly. This has allowed more people to improve their living standards. The biggest beneficiaries are China and India with their rapidly growing middle class.

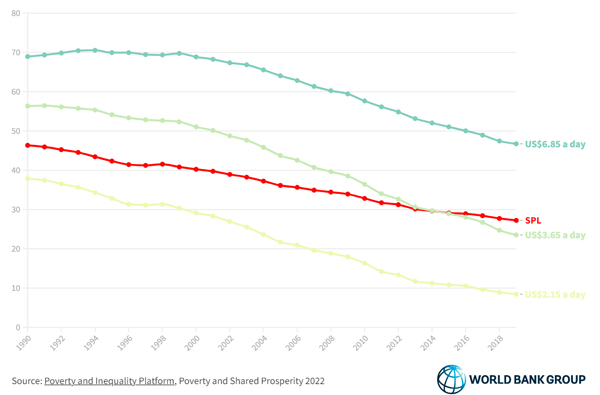

Over this period, a falling proportion of the world’s population live in poverty. Their plight comes from ongoing wars, civil unrest, corruption and crime. But there’s still a significant proportion of people living below the poverty line in certain continents, as shown below:

|

Source: Poverty and Inequality Platform, Poverty and Shared Prosperity 2022 |

Even though prosperity has improved, wealth inequality remains a major problem. It was made worse during the Wuhan virus outbreak that transferred trillions of dollars to the richest few, at the expense of the rest.

Undoing or reversing this is a tall order. The rich also hold much political power. Trying to lobby for change when those in power side with the elite is a tough task.

Secondly, the more society is connected through social media and globalisation, the more it’s divided people and created more conflict. Societal structure has shifted from traditional values, resulting in more relationship breakdowns and social malaise.

Fertility rate has fallen in most developed countries. Prosperity has led to the women in these countries opt to have less children so much that the fertility rate is below the replacement ratio. Some countries may see their population risk extinction in the next 100 years if the trends continue.

This has placed a strain on governments as they try to provide for the ageing population. As a result, tax rates increase on the working population to cover the deficits. Most western countries have also sought to increase immigration to reduce the strain.

No doubt, such policies result in cultural clash, higher crime and more internal unrest.

Thirdly, we’ve seen plummeting public trust in government, professions and other once-recognised authorities. This is despite the move towards globalisation and technocracy where leaders with expertise are appointed to inform collective decision-making.

Rather than politics seeking to improve society, those in power and influence weaponise ideology to subdue and divide the people. Meanwhile, media is used to amplify the party line rather than provide objective views and opinions. This has made it difficult for people to discern facts from truth, opinions from objective statements, and rationality from propaganda.

We’re now a society where people have increasingly lost trust on who or what to believe.

Will the world overcome the existing order and usher in better days ahead? And what is the process by which we get there?

Stepping into an uncertain but hopeful future

I hope I’m not sounding too bleak and despairing in this article. I believe you’d understand my mindset better if you’ve had children. It’s our parental instincts at play.

Emotions and instincts aside, I believe it’s our personal responsibility to equip ourselves to deal with what lies ahead.

In many ways, the world has gone too far down the path to turn around and return to the past. The system is too corrupt, indebted and infested with the wrong people steering it.

If you’ve read my past articles, you know I believe the existing system is on its last legs. An opposing force is working to expose and purge it out of existence. But there’ll be a period of chaos and uncertainty while it unfolds.

Having the right mindset is critical. It’s about knowing ‘how’ to think rather than letting those above tell you ‘what’ to think.

But to be able to develop your own independent mind requires determination and courage.

Plus, it’s hard to stand against the crowd if you’re dependent on the system, whether it’s the government, your employer or your lender.

In the last 10 years, I’ve staked my territory with gold and gold stocks. This is because gold owes nobody a favour. It’s neither a master nor a servant. It holds its own very well.

I may’ve joined the game a little. Gold had risen from US$250 an ounce in the early 2000s to US$1,200–1,300 by 2013. But I’m glad to have ridden it up to above US$2,000.

And you’ve read my reasoning about why it could continue to rise this year and how to best play this by signing up to my precious metals investment newsletter, The Australian Gold Report.

As for Cyrus, my hope is he will stand upon others’ shoulders and build himself a strong foundation in his knowledge and discernment.

As King Solomon once said, ‘How much better it is to get wisdom than gold! And to get understanding is to be chosen above silver.’ (Proverbs 16:16, Amplified Bible).

Fellow parents, I believe you’d agree with me.

As I sign off, please join me in wishing all our children a fruitful year at school.

God bless,

|

Brian Chu,

Editor, The Australian Gold Report and Gold Stock Pro

Comments