First some company news…

This is the last you’ll hear from me in Money Morning.

But fear not!

It’s only because as of this Wednesday, Money Morning is merging forces with the Daily Reckoning and Fat Tail Commodities under the one Fat Tail Daily newsletter.

The idea is that the combined forces of our three most popular daily newsletters will give you access to the full range of expertise here at Fat Tail Investment Research…and a little less clutter in your inbox!

So, you’ll still be hearing from me every Monday in Fat Tail Daily instead of Money Morning.

But the even better news is you’ll also hear regularly from the likes of James Cooper – our in-house geologist – on all things mining, from Greg Canavan, our value stock expert and from Brian Chu, our resident gold bug.

Plus you’ll still get your usual insights from the likes of small-cap aficionado Callum Newman and charting wizard Murray Dawes.

For the big picture stuff we’ll have regular contributions from our founder Bill Bonner and the well-travelled Nick Hubble.

Anyway, as I said, it all starts off this Wednesday and we think you’ll really enjoy the change.

Now, on with the show…

This made me laugh

This made me laugh yesterday:

|

|

| Source: Twitter |

It’s so true!

For example, I remember in late 2017 being invited to an acquaintance’s birthday.

It was his 40th and a sit-down dinner with only his ‘closest’ mates — which normally wouldn’t have included me as I didn’t really know him that well.

Except that particular year, through a mutual friend, I’d helped him and a bunch of his mates invest in crypto just before the 2017 bull market really started to rip.

From memory, with my guidance, they got into Bitcoin at $2,000, and by the time of the party it was fast approaching $20,000.

I remember entering the party and everyone looking at me in stunned silence.

I suppose as far as they were concerned, I was a ‘genius’ who had helped them 10x their money.

And everyone was keen to ‘grab a word’ with me on the latest goings on in crypto.

Then the 2018 bear market hit and the price of Bitcoin fell around 85% from the top of that cycle.

Funnily enough, I was never invited to another one of that bloke’s parties again!

My point is though…

Three predictions on the path to $1 million

I’m slowly moving from ‘idiot’ to ‘genius’ once again.

Bitcoin has been on a tear this year.

It’s up over 100% for 2023 and is the best performing asset by far.

And as I pointed out last week, amazingly (to the mainstream at least) it’s acting as a safe haven asset — it’s surging higher even while stock and bond markets plummet.

We’re not at the point where I’m getting calls from ‘long lost mates’ for advice on crypto. And I’ve not had any unexpected party invites…yet.

But it seems to me we’re getting closer to the stage where this kind of thing happens.

Bitcoin rips higher.

And when that happens it brings waves of new money and new interest. I’ve seen it happen time and time again over my 10 years in this space.

Here’s the thing though…

You don’t want to wait until it’s the topic of everyone’s conversation before you get involved.

The best investing moves are made when no one is interested — that applies to crypto or anywhere else for that matter.

With that in mind, I put out a presentation one year ago explaining how I thought Bitcoin could hit US$1 million by 2030.

I explained how 2023 would represent a crypto comeback (tick!), how bond markets would collapse (tick!) and how mainstream finance would pivot INTO crypto (again tick!).

So far, I’ve been on the money and you can watch a repeat of the presentation here to see what I think is coming next.

But let me tell you, no one was too interested in listening to me on this last year.

Bitcoin was trading under US$20,000 after a brutal fall.

Crypto companies left, right and centre were going bust.

And the media assured us — like they always do in these downturns — that this was ‘the end’ for Bitcoin.

It wasn’t and it never is.

Like I said, since that presentation went out in 2022, Bitcoin has soared higher and a number of my ‘strange’ predictions have come true.

But it’s still just the beginning.

I actually think this could be the last crypto bull market of magnitude we see in our lifetimes.

We won’t get the brutal ups and down of previous years.

Just one huge UP move as Bitcoin reaches a new equilibrium price level.

That’s why, despite the hefty gains this year, I say it’s still not too late to stake a sensible amount in Bitcoin as part of a well-diversified portfolio.

Get this…

Better than a ‘juiced up’ Buffett

I’ve always been of the opinion that NOT having some Bitcoin exposure is a bigger risk than having it.

This is a mindset that flies in the face of conventional wisdom and yet the facts have borne it to be true.

People like Warren Buffett have constantly attacked Bitcoin calling it ‘rat poison squared’ for instance.

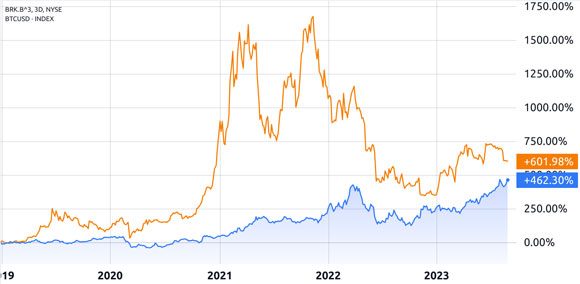

But consider this chart:

|

|

| Source: Trading View |

This compares the price of Bitcoin (orange) versus a leveraged position in Warren Buffett’s Berkshire Hathway.

Buffett is famously risk averse, so adding 3x leverage evens up the comparison.

And yet…

Even with that adjustment in place, you can see that by investing in Bitcoin — with no leverage needed — you would’ve made almost 50% more over the past four years, even if you got 3x the gains on money managed by the great Warren Buffett!

There are a host of other charts you can use to show how Bitcoin — as a non-correlated asset — improves almost every investor’s portfolio on a risk-adjusted basis.

But I won’t bore you with that today.

The only thing you have to realise is that, the longer Bitcoin survives, the more chance it has of getting a lot closer to my US$1 million price prediction.

And given that undeniable potential, even a small holding today could improve your portfolio’s overall returns in the years to come.

There’s still time to take an unbiased look at Bitcoin, and in turn make a rational allocation to it (i.e. 1–5% of your total portfolio).

But when my phone is ringing off the hook as it inevitably will be at some point again, you may have left it too late.

The window of opportunity is closing…

Good investing,

|

Ryan Dinse,

Editor, Money Morning