‘Do you know who the greatest propagator of disinformation in the history of the world is? The US government.’

US Senator Rand Paul

So, it appears the big balloon floating across the US last week might be a $12 balloon sent up by a local hobby club.

As reported in Aviation Week:

‘A small, globe-trotting balloon declared “missing in action” by an Illinois-based hobbyist club on Feb. 15 has emerged as a candidate to explain one of the three mystery objects shot down by four heat-seeking missiles launched by U.S. Air Force fighters since Feb. 10.’

Nope, not UFOs, not the Chinese…just one big nothingburger. And by the way, each of those missiles costs US$400,000 a pop.

Whether it turns out to be hobby balloon or not, the bigger question is why no one would give a straight answer.

I mean, why all the mystery and fuss?

As famous whistle-blower Edward Snowden tweeted, this is why:

|

|

| Source: Twitter |

As per usual, the mainstream press did its job of distracting everyone from the real stories of the day.

At least they gave us a break from Harry and Meghan, I suppose…

But as Snowden alludes to, there was a whopper of a breaking story — a real news story — that went mostly under the radar in all the balloon intrigue.

You see, earlier this month, award-winning investigative journalist Seymour Hersh released a stunning expose.

In it, he claims it was the CIA, under directions from President Biden, that blew up the Nord Stream 2 gas pipeline last September.

Now, Seymour Hersh is no conspiracy nut.

The 85-year-old first gained recognition in 1969 for exposing the My Lai massacre in Vietnam and its subsequent cover-up.

He also uncovered the torture of Iraqi prisoners at Abu Ghraib prison in 2004.

Both revelations were true.

And I believe this Nordstream story probably is too. It was the only explanation that made sense anyway.

But either way, the destruction of the Nordstream pipeline — which cut Germany off from Russian gas — has big consequences for global energy policy in 2023.

And it should make us all rethink our own energy transition going forward…

Germany turns back the clock on energy

Germany had been the poster child of the green energy transition.

From way back in 2000 through to 2019, renewables grew from supplying 6.6% of their energy grid to 41.1%.

But some prominent Germans were recently warning the gap between supply and demand was narrowing dangerously because of too much reliance on intermittent renewables.

In 2021 — well before the Ukraine crisis — Harald Schwarz, professor of power distribution at the University of Cottbus, said:

|

|

| Source: World News |

The long-term solution to this is batteries.

You store excess energy in good times to cover the shortfall later.

But this isn’t feasible yet. So, the short-term solution for Germany was to be Russian gas. Still a fossil fuel, but cleaner than coal.

Then the Russia-Ukraine war scuppered that plan…as did — allegedly — the CIA!

Germany now needs to somehow transition from Russian gas, which made up 55% of their total gas imports in 2021.

Not an easy task.

And if they can’t do it fast or cheaply enough, their huge manufacturing base is under threat.

A number of German companies are already looking offshore due to energy concerns.

As reported:

‘As manufacturers in Germany face energy bills of up to 10 times more than what they paid two years ago, one in five engineering firms saw the risk of relocating at least some of their business overseas, a survey by German union IG Metall showed last month.’

If that happens, their economy is toast.

So, what’s the rescue plan?

First, they want to replace gas with LNG.

They have agreements with Qatar, Australia, and the US already. They’re also in talks with Canada now too.

Secondly, they’re moving back to coal…temporarily, at least.

Germany just passed a new law bringing back coal- and oil-fired powered plants into the energy mix.

The deal runs until 31 March 2024, but could run longer depending on the energy situation.

Thirdly, Germany is looking to keep their existing nuclear plants running for longer.

This only accounts for 6% of the existing energy mix, but right now, every watt counts, especially from a source as reliable as nuclear.

And lastly…

Energy rations.

Yep, it sounds amazing to think that Europe’s top economy could be left in a situation where consumers and businesses are being asked to reduce their gas consumption.

If they can’t reduce it by 20% voluntarily, then compulsory rationing will kick in.

The fact is, green energy sources like solar and wind simply aren’t in the position of being able to make up Germany’s energy shortfall.

Not yet, anyway…

As I’ve written previously, many projections on the green energy transition simply refuse to acknowledge that it’ll take a lot longer than a decade to dig up the battery metals we need.

Those targets for 2030 aren’t going to happen.

To be clear, I’m not against renewables in any way.

I actually love the idea of decentralising electricity production — things like rooftop solar — away from big, dirty power plants.

But not at any cost…

Rationing energy might be uncomfortable for the citizens of Germany, but it’s downright fatal for people in developing countries.

Today, 2.3 billion humans have to rely on cow dung for heating and cooking fuel. And three million people die annually because they can’t afford cleaner fuel.

Let’s be clear on this…

These will be the people that suffer the most if we try to move to renewables too fast and without a proper plan.

Germany has been the canary in the coalmine on this front.

But if you believe CO2 emissions are an imminent existential threat and we have no choice but to act now, what then?

Well, the only sensible answer is this…

Clean, green, and a world of abundance

No single variable probably explains the rise in standards of living as energy.

You can see it very clearly here:

|

|

| Source: World Bank |

Long story short, we’re going to need more and more energy or condemn billions of people to poverty.

For example, for India to have the same standard of living a China, their energy consumption has to increase more than 400%.

And the only way we can do that in a fast enough timeline and in a ‘green’ way is nuclear.

Now, I’ve heard a lot of pushback saying nuclear is too expensive, too dangerous, and takes too long.

However, when you actually look at the data, you find the opposite is true.

Let’s start with safety…

It’s not a popular viewpoint, but the facts say that nuclear is actually one of the safest sources of energy there is:

|

|

| Source: Markandya and Wilkinson |

‘But they take too long to build’, is another common argument against nuclear. If we are indeed in a race against time, this would be a valid criticism.

But again, not true.

The French managed to build out their nuclear power plants from the 1960s through to 1985, with most plants taking less than five years to build.

|

|

| Source: Jack Devanney |

The Japanese nuclear expansion was even faster.

In ‘Nuclear is too slow’, Jack Devanney writes:

‘It is the Japanese that really put the lie to the claim that nuclear has to be slow. They built 60 plants between 1970 and 2009, Figure 5. The median build time was 3.8 years, which is about the time it takes to build a big coal plant.’

And that’s old nuclear technology.

New tech, such as small nuclear reactors (as I wrote about a couple of weeks back), promise to be even faster to construct.

What about cost?

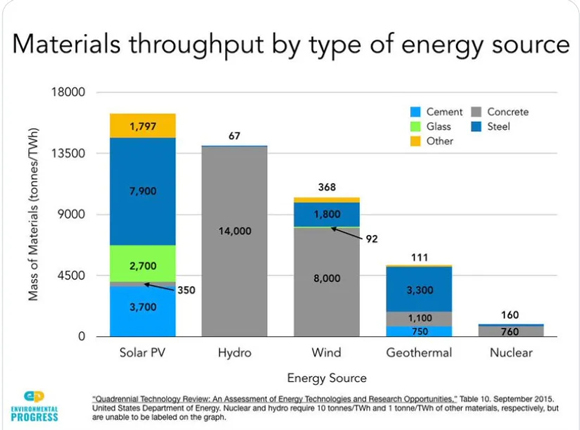

Well, nuclear power plants actually require a lot less material than alternative sources of energy:

|

|

| Source: Environmental Progress |

That means a lot less mining too, unlike with battery metals and renewables.

Let’s put it altogether…

If the world starts building today, then within four or five years, we’d have emission-free, stable power.

It’d literally take billions of people out of poverty and meet our climate change goals at the same time.

So why such hatred of nuclear?

I can only put it down to misinformation, vested interests, and general ignorance.

There’s a whole heap of lobby groups, all the way from big miners to left-wing environmentalists, against nuclear for their own specific reasons.

But it seems to me to be the only way to make this huge energy transition without severe pain for many.

Unless, of course, addressing climate change isn’t the real goal here?

I’m not trying to be controversial in saying that.

But in this age of extreme misinformation, it’s worth questioning everything before you make your mind up on important topics.

Especially on energy policy…

Good investing,

|

Ryan Dinse,

Editor, Money Morning