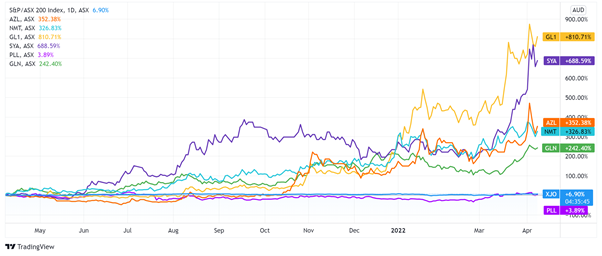

Investment bank UBS has upgraded its lithium price forecast as supply remains tight, with ASX lithium stocks rising on Friday.

Source: Tradingview.com

At midday trade on Friday:

- Arizona Lithium [ASX:AZL] was up 10%

- Neometals [ASX:NMT]was up 8.5%

- Global Lithium Resources [ASX:GL1] was up 7.5%

- Sayona Mining [ASX:SYA] was up 6.5%

- Piedmont Lithium [ASX:PLL]was up 5%, and

- Galan Lithium [ASX:GLN]was up 3%.

UBS upgrades lithium outlook

The Australian Financial Review reported that investment giant UBS has upped its lithium price forecast for 2022.

The strong market conditions have even forced UBS to rethink its long-term assumptions about future lithium spot prices.

Lithium prices have exceeded the broker’s expectations, with UBS thinking the market is not about to ease up yet.

This mirrors what lithium producers themselves have been reporting lately.

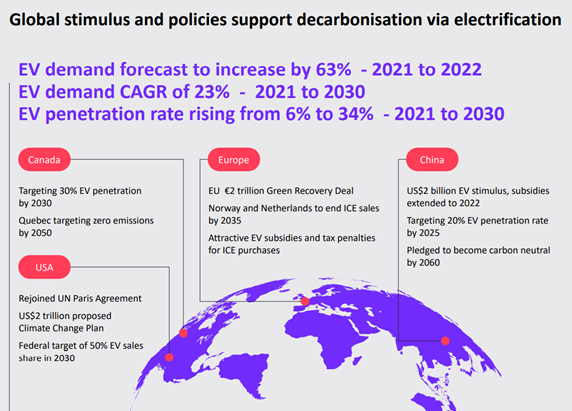

This week, Allkem [ASX:AKE] said it expects the lithium market to be in a supply deficit for the remainder of the decade, with global EV penetration to rise from 6% in 2021 to 34% by 2030.

Source: Allkem

Lithium part of a wider commodities boom

2022 has been a great year for lithium stocks.

Consider these year-to-date numbers:

- Lake Resources [ASX:LKE] shares are up 90%

- Core Lithium Ltd [ASX:CXO] shares are up 105%, and

- Sayona shares are up 120%.

All the while the All Ords is down 1.8% in the same time period.

But 2022 has been a great year for commodities in general.

And as Ryan Clarkson-Ledward pointed out in today’s editorial, commodities may remain hot for a while yet.

Why?

As JPMorgan strategists noted this week:

‘In the current juncture, where the need for inflation hedges is more elevated, it is conceivable to see longer-term commodity allocations eventually rising above 1% of total financial assets globally, surpassing the previous heights.’

And just today it was reported that inventories of base metals at the London Metal Exchange fell to ‘critically low levels’.

According to Bloomberg, LME’s stockpiles of copper, aluminium, zinc, lead, tin, and nickel fell to the lowest level on record based on data stretching back to 1997.

Three overlooked ASX lithium stocks to consider

The likes of UBS upgrading their lithium price forecasts suggests the demand for lithium is still outpacing the current supply.

So who stands to benefit?

The currently elevated prices cannot stay elevated forever. An equilibrium will be reached as high prices incentivise more supply.

So are there stocks capable of shipping lithium right now and benefiting from strong market conditions?

Money Morning identified three such stocks in a research report you can download and read today.

Consensus analyst forecasts have the first stock making $1.16 billion in revenue in FY22 and $1.88 billion in FY23.

Consensus analyst forecasts have the second stock raising its FY22 revenue from $784 million to $1.52 billion in FY24.

And the final stock was dubbed by investment bank JPMorgan as a ‘one-stop stock for EV raw material.’

Access the free research report here.

Regards,

Kiryll Prakapenka,

For Money Morning