In today’s Money Morning…meet the Kardashev scale…energy use is good (so is nuclear)…the future is small scale…and more…

Apparently, the centre of our galaxy smells like raspberries and tastes like rum!

As reported in IFLScience:

‘As improbable as this sounds, the discovery was made when astronomers from the Max Plank Institute used the IRAM radio telescope in Spain to study Sagittarius B2, a dust cloud near the center of the galaxy…

‘…among the chemicals for which signals were found was ethyl formate (C3H6O2), the dominant flavor in raspberries, as well as an important one in rum.’

The fact we can even know this kind of stuff blows my mind. Science is simply amazing.

But I’ve noticed an increasing amount of ‘anti-science sentiment’ creeping into society of late.

Usually from people who think they’re smarter than they are. But, funnily enough, not smart enough to become actual scientists!

Anyway, I bring this topic up today because the science of energy is firmly on my mind.

As you know, energy is a big topic in the world. We’re moving from a largely fossil fuel-based economy to something less carbon intensive.

However, as we’re also finding out, such transitions aren’t easy in the real world.

The conflict in Ukraine is showing Europe how important oil and gas still is. And I can’t believe how strategically naïve EU ministers have been in giving Putin such a strategic hold over them.

A lesson (if we needed one) that politicians, bureaucrats, and regulators are probably the worst people to be deciding humanity’s future.

But changes in energy markets are coming one way or the other.

I love times of flux like this as an investor because they present massive opportunities.

And in one particular energy niche, there are signs of a 180-degree shift in sentiment that could be a precursor to an almighty rally in a select few stocks.

Let me explain more…

Meet the Kardashev scale

First, let’s take a step back and look at the big picture on energy.

As reported in Futurism magazine, we’re at a major turning point:

‘We have reached a turning point in society. According to renowned theoretical physicist Michio Kaku, the next 100 years of science will determine whether we perish or thrive. Will we remain a Type 0 civilization, or will we advance and make our way into the stars?’

What’s a ‘Type 0’ civilisation, you ask?

It’s a term coined by Russian astrophysicist Nikolai Kardashev in 1964.

He was looking for signs of alien life in cosmic signals and came up with an idea of how intergalactic civilisations could evolve.

His theory was that a species advancement is directly correlated with its energy use.

He came up with a scale — now called the Kardashev scale — that lists advanced civilisations by three types.

A Type 1 civilisation is one that can harness and use all the energy emanating from their neighbouring star (the Sun in our case).

We would have to use 100,000-times more energy than we do now to reach this status. And if we did, we’d probably have complete control over our planet — the weather, volcanic activity, earthquakes even.

A Type 2 civilisation is a big jump higher. This type of advance would allow a species to harness the power of their entire star (not just transform the sunlight into energy but controlling the power within the star itself).

Futurism magazine notes an important point on this:

‘…if fusion power (the mechanism that powers stars) had been mastered by the race, a reactor on a truly immense scale could be used to satisfy their needs. Nearby gas giants can be utilized for their hydrogen, slowly drained of life by an orbiting reactor.’

Having control of this much energy would enable us to do some crazy things.

Like moving Earth out of the way of an incoming asteroid, or the capacity to terraform any planet to make it habitable.

Then there’s Type 3…

This type of civilisation would be able to control energy on an intergalactic scale. So not just the Sun but every star within reach.

If we ever controlled this amount of energy, we would essentially be able to control enough energy to make our species immune from extinction. We probably wouldn’t be human at this point — at least not as we are now.

Maybe we’d be cyborgs, or perhaps we’d exist in entirely different dimensions!

But don’t worry too much about all this now, we’re not even on the scale yet (hence Type 0)!

The point I’m trying to make is this…

Energy use is good (so is nuclear)

There’s another creeping notion in society today that using more energy is ‘bad’ per se.

But as Kardashev showed, it’s literally the driving force for humanity and our ability to survive as a species over the long term.

I think our current era of Malthusian politics — an era where energy (or even meat as I pointed out here) is to be rationed — is the exact opposite of the world of abundance we should be aiming for.

Interestingly, nuclear energy is probably the key technology to get us entry into the Kardashev scale.

And on the investment front, we’re starting to see a lot of capital move into this space.

For example, late last week Paladin Energy [ASX:PDN] announced a $215 million capital raise to restart their Langer Heinrich mine in Namibia.

Perhaps uranium miners are worth a punt?

Demand certainly seems to be ramping back up for their product.

In Europe, the French government is backing new rules to classify nuclear plants as ‘green’ energy. And they’ve got a number of new-generation nuclear plants due to come online in 2023.

France already generates 70% of its electricity from 56 nuclear reactors, and with the current Russia situation regarding gas imports, I expect many EU countries, including Germany, to backflip in this direction.

Indeed, World-Energy reported last month that:

‘Economy Minister Robert Habeck told German broadcaster ARD that Germany is considering whether to extend the life-span of its remaining nuclear power plants which are currently planned to be closed by the end of 2022. “It is part of my ministry’s tasks to answer this question … I would not reject it on ideological grounds,” he said.’

I’ve never understood the argument against nuclear. It’s as green as you can get, replicating a process done by Ra (the Sun god) himself!

But it’s the future of nuclear technology that really excites me…

The future is small scale

The holy grail of nuclear power is nuclear fusion.

This is different than the fission process that takes place in current nuclear power plants.

Fission involves splitting an atom, whereas fusion involves fusing two hydrogen atoms together.

Fusion is the process that takes place in the Sun to generate solar energy.

But fusion is a lot harder to do. The old joke on nuclear fusion is that it is 30 years away from becoming a reality…and will always be 30 years away.

However, in 2020 some brave early-stage private investors poured more than US$300 million into nuclear fusion start-ups. And if it becomes a reality, it changes the game for energy markets.

In the shorter term, though, the future of nuclear is smaller fission plants.

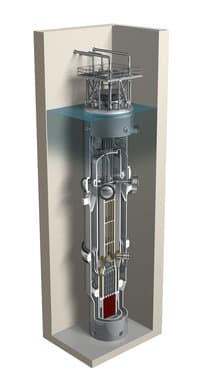

Last year we saw a company in the US, NuScale, raise a whopping US$221 million in private funds with plans to raise another US$200 million through an IPO this year.

The company makes small-scale nuclear reactors that have cost and safety benefits over large-scale plants.

|

|

| Source: NuScale |

As Futurism reported:

‘Of course, “miniature” in this case is relative to the sprawling complex that is typical of nuclear power plants. But considering NuScale Power is reducing hectares into a structure that can fit on a flat-bed truck (roughly nine-stories tall) the design is a feat unto itself.’

The company claims these could be in operation by 2026 and they could usher in a new era of nuclear energy around the world.

And with it, perhaps we’ll move closer to becoming a Type 1 civilisation on the Kardashev scale!

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.