The Commonwealth Bank of Australia [ASX:CBA] will become Australia’s first bank to offer its 6.5 million users the ability to buy, sell, and hold crypto assets via the CommBank app.

The landmark decision sees crypto go mainstream with Australia’s largest bank now set to offer its users access to crypto assets.

While the market’s reaction was muted, CBA’s foray into crypto will likely be seen by many as a milestone for the sector.

CommBank to offer crypto services in industry shake-up

The future is here.

CBA — Australia’s largest listed company — announced today that it will become Australia’s first bank to offer customers crypto services via its CommBank app.

The app will include a new tailored feature assisted by partnerships with crypto exchange Gemini and blockchain analysis firm Chainalysis.

CommBank will provide customers with access to up to 10 crypto assets, including Bitcoin [BTC], Ethereum [ETH], Bitcoin Cash [BCH], and Litecoin [LTC].

A crypto pilot program will start in the coming weeks, with CBA intending to progressively rollout more features in 2022.

CBA CEO Matt Comyn said:

‘We believe we can play an important role in crypto to address what’s clearly a growing customer need and provide capability, security and confidence in a crypto trading platform.

‘Customers have expressed concern regarding some of the crypto services in market today, including the friction of using third party exchanges, the risk of fraud, and the lack of trust in some new providers. This is why we see this as an opportunity to bring a trusted and secure experience for our customers.’

Caroline Bowler, CEO of Australian-owed crypto exchange BTC Markets, said CBA’s move was exciting but inevitable.

‘With regulation in the offing and the largest bank in the country allowing it, the floodgates are now open for more appetite from traditional finance and smart money to move into cryptocurrencies.’

Now, not later: CBA’s BNPL and crypto moves

First, it was buy now, pay later (BNPL). Now, it’s crypto.

It seems CBA is trying to move with the times, lest it be left behind.

In August, CommBank launched StepPay, its own BNPL offering to rival Afterpay Ltd [ASX:APT] and Zip Co Ltd [ASX: Z1P].

It was the first of the Big Four to do so.

While StepPay launched without much fanfare, no doubt some readers will have recently noticed ads for StepPay as CBA ramps up marketing.

CBA launched the marketing campaign in late September via M&C Saatchi.

StepPay’s launch follows CBA’s partnering with BNPL giant Klarna in January 2020, with the bank investing US$300 million and bringing its shareholding in Klarna group to 5.5%.

The partnership will also see CBA and Klarna jointly fund and have 50:50 ownership rights to Klarna’s Australian and New Zealand business.

The Klarna partnership shows CBA was monitoring BNPL’s pulse for a while, entering the deal with Klarna when APT shares were trading for $35.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Demographics and CBA’s rationale

Now, CommBank is the first to offer its customers access to the thriving crypto world. Is this significant? Why does CBA deem these moves worthwhile?

Demographics offers a clue.

What BNPL and crypto have in common is a younger user base, one that traditional banks don’t want to lose to upstart fintechs.

In a March 2021 bulletin on the BNPL sector, the Reserve Bank of Australia reported that BNPL services are ‘used more intensively by younger consumers’.

More than 55% of users were aged under 40.

How does this impact traditional banks?

A good place to look is an August dispatch from Afterpay on BNPL use.

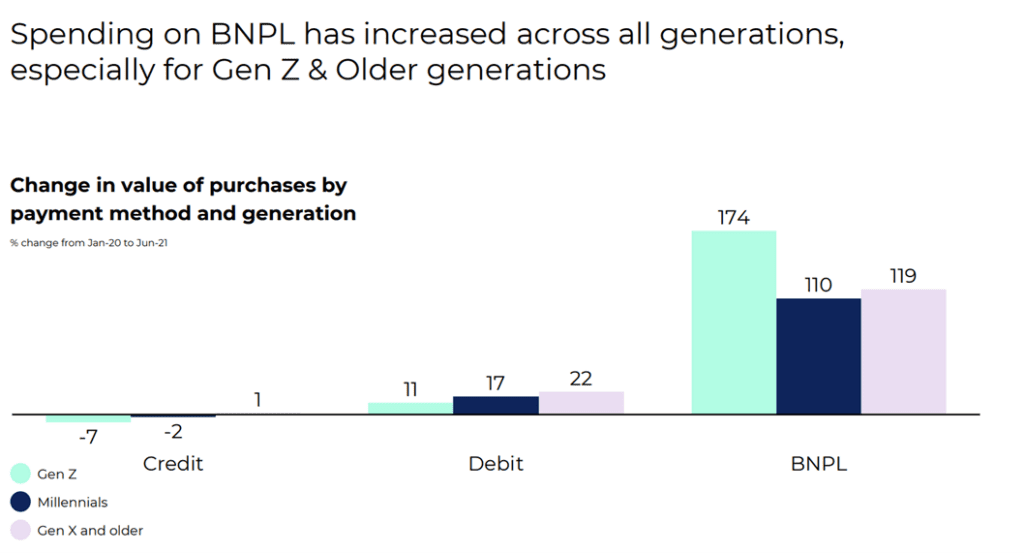

What the diagram above shows is the rising popularity of BNPL as a payment option…to the detriment of credit cards, especially for younger people.

StepPay and investments in Klarna look like sound strategies to win over a demographic turning away from traditional institutions.

It’s a similar story with crypto.

A recent survey from fund manager Vanguard Australia revealed millennials are the biggest demographic group owning crypto assets.

But cryptocurrencies are also attracting users across the age range.

Earlier this year, Caroline Bowler of BTC Markets told the Sydney Morning Herald that only a year ago, major investors tended to be males in their mid-twenties.

But the sector’s wider exposure led to shift in demographics, with the sector now attracting more early retirees, high-net-worth individuals and institutional investors.

In coincidental timing, just a day before CommBank announced its crypto plans, the New York Times ran the following story: ‘Banks tried to kill crypto and failed, now they’re embracing it’.

As the article noted:

‘Digital currencies, which let individuals bypass banks in money transfers, sales and business collections by connecting people instantly without an intermediary, are threatening to take away that central role banks play.’

One way banks can respond is to appropriate the technology threatening to sideline them — integrate it in the very system it seeks to bypass.

For instance, last year, Bank of America filed the biggest number of patent applications in its history, including ‘hundreds involving digital payments technologies’.

Questions to ponder

CBA’s historic move poses large questions the financial community will no doubt ponder over the next weeks and months ahead.

Here are some I think are pertinent.

- Will CBA’s announcement move bitcoin’s price? Can we construe CommBank’s foray as the validation of crypto?

- Will other major banks follow? Were they caught off guard or are the rest of the Big Four already considering something similar?

- Is crypto now officially mainstream? And what does this mean for the industry?

- And here’s a blunt question: will users care?

CBA said it plans to offer access ‘up to ten crypto assets, including Bitcoin, Ethereum, Bitcoin Cash, and Litecoin’.

Will this be enough for crypto enthusiasts, especially considering the recent buying frenzy surrounding Shiba Inu [SHIB]?

How many users will ditch their current exchanges to hold their crypto assets with CommBank? And how many new users will be persuaded to enter the crypto market that wouldn’t of if CommBank had not offered crypto services?

In business, evolution and adaptation is key.

CBA won’t remain a top bank if it does not detect and act on tech changes altering the financial landscape.

For more analysis, cutting-edge commentary, and thoughts at the frontline of the financial revolution, I highly recommend checking out New Money Investor.

It’s a research service run by our Editorial Director Greg Canavan and editor Ryan Dinse.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here