The DroneShield Ltd [ASX:DRO] share price rose today after the company posted record quarterly customer receipts of $7.4 million in 2Q21.

DRO shares were up as much as 9% in early trade.

At the time of writing, the DroneShield share price was up 3%.

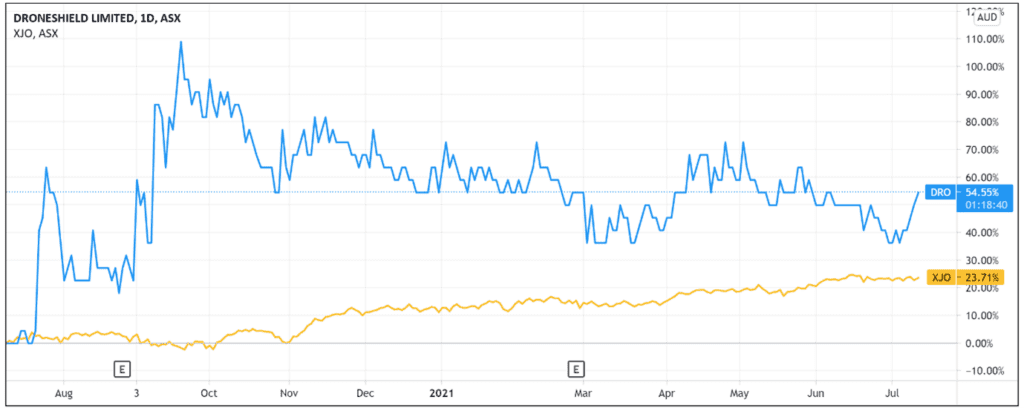

DroneShield — specialising in detection systems technology — has treaded water year to date but the stock is still up 50% over the last 12 months.

DroneShield 2Q21 quarterly results

Here are the key highlights from DroneShield’s latest results for the three months ended 30 June 2021.

- ‘2Q21 quarterly customer receipts of $7.4 million, an all-time record, despite COVID slowdown.

- 1H21 cash receipts of $9.1 million, a 600% growth over 1H20 cash receipts.

- $3.8 million contract with Australian Department of Defence in Electronic Warfare/Signals Intelligence arena, including the first $1.9 million initial payment received in June 2021.

- Active engagement on the US$50 million Middle Eastern contract continues.

- Diversity in the quarterly cash receipts, including substantial Australian, US and Middle Eastern payments, across multiple product lines, as well as R&D work.

- Positive cashflow quarter, bank balance as at 30 June 2021 increased to $14.2 million.

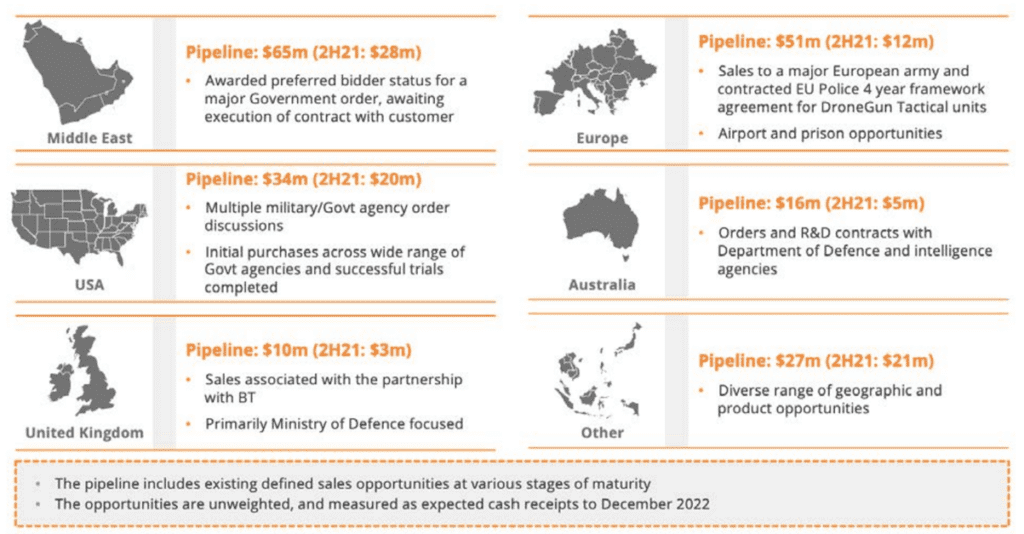

- $200 million global sales pipeline, across number of key markets and products, in a $6bn total addressable market.

- $10 million of inventory by sale value on hand to meet near term pipeline requirements.’

Despite the record customer receipts for the quarter, year to date (six months) the company posted a net cash loss from operating activities of $1.69 million.

That said, DRO did record a positive net cash position from operating activities totalling $726,986 for the June quarter.

This compares to a net cash loss from operating activities in the preceding March quarter of $2.41 million.

The biggest difference between the two quarters was receipts from customers.

DroneShield received $1.68 million from customers in the March quarter, compared to $7.44 million in the June quarter.

DRO Share Price ASX outlook

Today’s quarterly result is a positive one, evidenced by the lift in the DRO share price today.

DroneShield grew its customer receipts from the previous quarter, and in the process it also posted a gain from operating activities in the June quarter.

Zooming out, the company’s 1H21 cash receipts jumped 600% from 1H20, totalling $9.1 million.

And DRO was able to grow its cash balance to $14.25 million.

Investors will likely still be wondering, however, about the consistency of DroneShield’s customer receipts.

Will the June quarter form the new standard, or will quarterly customer receipts oscillate?

What could contribute to a strong September quarter is the US$50 million Middle Eastern contract mentioned in today’s results release.

On that front, the company only divulged that ‘active engagement…on the Middle Eastern contract continues.’

If you’re interested in DroneShield as an investment idea, you should check out our deep dive into the world of AI stocks.

It is a sector that is gaining traction on the ASX, which is why we’ve put together a list of five AI stocks that could potentially follow in the footsteps of BrainChip’s meteoric 3,133% price spike.

Check out the full report right here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here