The Lake Resources NL [ASX:LKE] share price fell slightly today on a financing update regarding the Kachi Lithium Project.

LKE shares were down 1.7% at the time of writing.

After trading largely sideways for most of the year, the LKE share price is experiencing some volatility of late.

For instance, while up 5% this week, it is still down 10% this month.

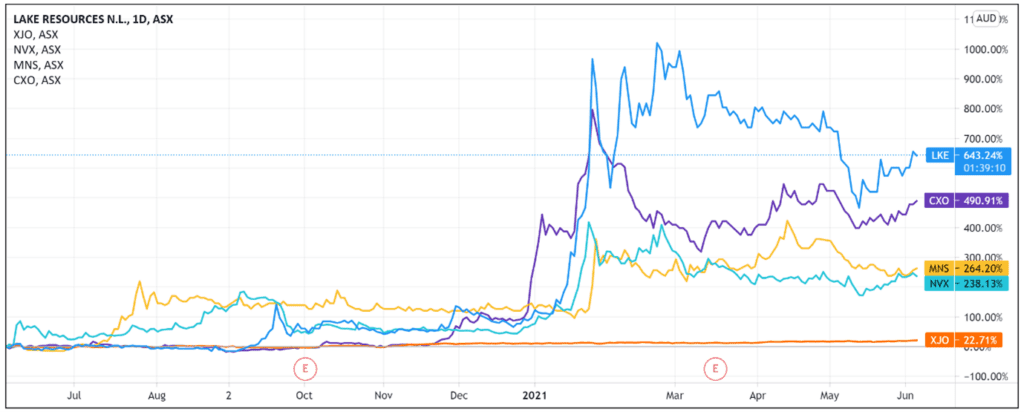

Nonetheless, the boom in the ASX lithium sector saw LKE shares surge 650% over the last 12 months.

Lake Resources financing news

In the latest LKE ASX news, the lithium producer updated the market about financing its flagship Kachi Lithium Project within the lithium triangle in Argentina.

Lake Resources notified that it has advanced debt funding options for Kachi, with ‘over half a dozen major international banks to participate in ECA-led project debt finance.’

Back in March, LKE appointed SD Capital Advisory and GKB Ventures as financial advisors to help with financing the project by focusing on Export Credit Agencies (ECAs).

ECAs provide government-backed finance to help businesses grow their exports.

For instance, Export Finance Australia is the Australian government’s own ECA, which provides financial solutions to ‘drive sustainable growth that benefits Australia and our partners.’

Elaborating on the advanced debt funding options, LKE reported that its advisors conducted an in-depth analysis of Kachi’s pre-feasibility study and its funding opportunities.

LKE flagged the possibility of ‘significantly lower’ cost of capital if it secures longer-dated, lower-cast ECA-backed debt.

Providing further detail, the lithium producer said that the targeted level of financing support would be about 70% of the total funding required.

Additionally, ECA debt repayments usually take between 5–8 years post-construction and build-out.

According to Lake, this implies a total debt finance duration of up to 10 years.

What is the state of LKE’s finances currently?

In its latest quarterly, Lake Resources posted a net-cash loss from operating activities of $1.68 million for the nine months to 31 March 2021.

As a junior explorer, it of course did not report any receipts from customers.

Administration and corporate costs formed the bulk of Lake’s operating outflows.

For the nine months to 31 March 2021, LKE also spent $2.43 million on exploration and evaluation as part of its investing activities.

Thanks to the issuing of securities in the March quarter — worth $23.63 million — Lake Resources ended the reporting period with $24.68 million in cash and cash equivalents.

Lake ended the March quarter with $1.91 million of total cash outgoings, giving it about 18 quarters of funding available.

Part of the available funding comes from $10 million worth of an unused finance facility.

LKE’s latest half-year ended 31 December financial account also reported no outstanding loans.

LKE Share Price ASX outlook

In its financial statements for the half year ended 31 December 2020, released in March 2021, Lake Resources stated that its directors have ‘prepared cash forecasts which indicate that current funds are sufficient to meet the current year’s program of work…and the required hydrological, environmental and technical studies planned for the forthcoming 12-month period.’

Regarding the debt financing, Lake Resources stated today that the potential size and duration of the debt funding will be provided ‘in the coming months’, after receiving expressions of interest from potential export credit agencies.

In the meantime, the lithium producer reiterated that it is ‘well-funded through to the final investment decision on construction finance for Kachi, anticipated in mid-2022.’

Lithium stocks like Lake Resources are riding a strong wave of interest recently.

Governments are eyeing off a greener future while enterprises are eyeing off profitable ways to accelerate this future.

Lithium is at the core of this as the white metal is a key part in the global EV supply chain.

Therefore, if you want more information on a sector enjoying a resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.