Shares in Althea Group Holdings Ltd [ASX:AGH] have rebounded today upon the release of updated revenue guidance.

Pot stocks have been on a steady decline since coming off their peak in late 2018, although they now appear to be making a resurgence.

Source: Tradingview.com

AGH’s share price rocketed in early September thanks to proposed regulatory changes in relation to the status of cannabidiol.

However, those gains have largely been given back.

At the time of writing, the AGH share price is up 9.20%, or 4 cents, to trade at 47.5 cents per share.

New agreement to lift revenue

Today AGH announced its wholly-owned subsidiary Peak Processing Solutions has entered into two contracts with Canadian brands Earth Kisses Sky and Electric Brands.

AGH estimates a total forecasted revenue of up to CA$4.65 million over the next 12 months.

The licence agreement with Earth Sky Kisses is for the manufacture of two topical products — with an order of 150,000 units expected to be purchased in year one.

While the manufacture and distribution for Electric Brands — a company founded by ex-Coca Cola Canada and Canopy Growth executives — is in relation to 50,000 units of cannabis-infused beverages.

Althea CEO, Joshua Fegan, commented on the Peak update:

‘Since Peak received its Standard Processing Licence from Health Canada a couple of months ago, we have been busy ramping up commercial operations at the facility, and are in the process of expediting the product launch dates for both new and existing customers.

Peak has received an influx of enquiries for its industry leading Cannabis 2.0 product development, manufacturing, and distribution services, and has already signed contracts representing forecasted revenue of up to CAD$4.65m over the next 12 months.’

Are pot stocks poised for a comeback?

Below shows the indexed value of North American pot stocks over the past three years.

Source: Marijuana Index

We can see a steep decline through 2019 as hype was surpassed by regulatory restrictions.

However, the index over the past 12 months hints at a return.

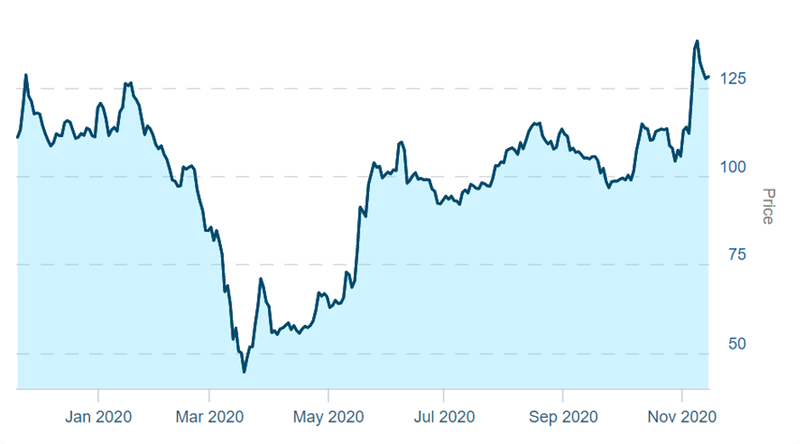

Source: Marijuana Index

We can see a strong recovery after the market crash in March, with the index now showing some good upward momentum.

Also notice a sharp jump in early November — right after the US election.

If speculators are right, a Biden presidency could see further relaxation of marijuana laws in the US.

If you plan on following the resurgence in pot stocks and want to stay updated with important news and analysis, make sure you subscribe to Money Morning. We believe these rapid-fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then make sure you’re subscribed — the best part is it’s free! Click here to find out more.

Regards,

Lachlann Tierney,

For Money Morning

Comments