At time of writing, the share price of 9 Spokes International Ltd [ASX:9SP] is up 5.71%, trading at 3.7 cents.

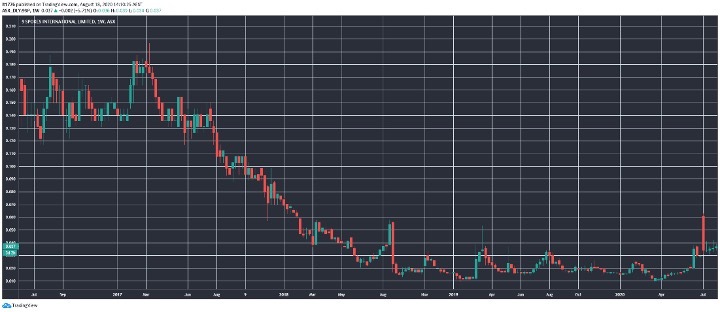

It’s been a long road since their listing in 2016, with a few false dawns for the 9SP share price over the course of the last four years:

Source: tradingview.com

The small business-centred fintech announced a partnership with a US-based fintech, Fundation, today.

9SP share price moving higher after a long slide

You can see that high hopes for the 9SP share price faded over the course of the last four years.

But green shoots are appearing for the company, with the most recent deal moving the 9SP share price higher.

Increasingly, fintech is collaborating with banks, helping them modernise their practices.

Everyone knows banks need data-driven solutions to remain relevant and this deal is no different.

Under the terms of the agreement, 9 Spokes will work with Fundation to enter the US market, collaborating on new features.

Previously in July, 9 Spokes came out of a trading suspension announcing a deal with Visa for dashboarding for their small business clients, in a five-year deal.

Outlook for 9SP share price

After high hopes on their listing, the 9SP share price slid.

It’s an interesting chart, which could be misleading.

With breakthrough technology, or at least technology that offers an incremental improvement in efficiencies, development can take time.

9 Spokes is intriguing in this regard — their data-driven approach to small business strikes me as a useful addition to a SMB’s operating practices.

Many small businesses operate on back of the envelope calculations and rough assumptions.

A more granular approach to the various data points encountered in these businesses is surely a good thing.

As such, the 9SP share price could break out of the doldrums should it continue its penetration into the US market with more deals.

Fintechs don’t just completely compete with big banks but can offer their services — complementing the big banks services and features as well.

With one eye on its cash balance as of the most recent quarterly — it has a cash balance of NZ$4.247 million.

It went through NZ$838,000 in operating activities.

Meaning a capital raise is on the cards in the coming quarters should it not accelerate towards operating cash flow breakeven.

Still, an exciting product in a growing industry.

Regards,

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown mega-trends. Click here to learn more.

Comments