You might’ve caught JP Morgan boss, Jamie Dimon’s remarks on crypto last week.

The famous Wall Street banker told a US House Committee headed by far-left Democrat Elizabeth Warren that:

‘If I was the federal government, I would shut down crypto and Bitcoin.’

He continued:

‘The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance.’

These remarks were pretty hilarious for a number of reasons.

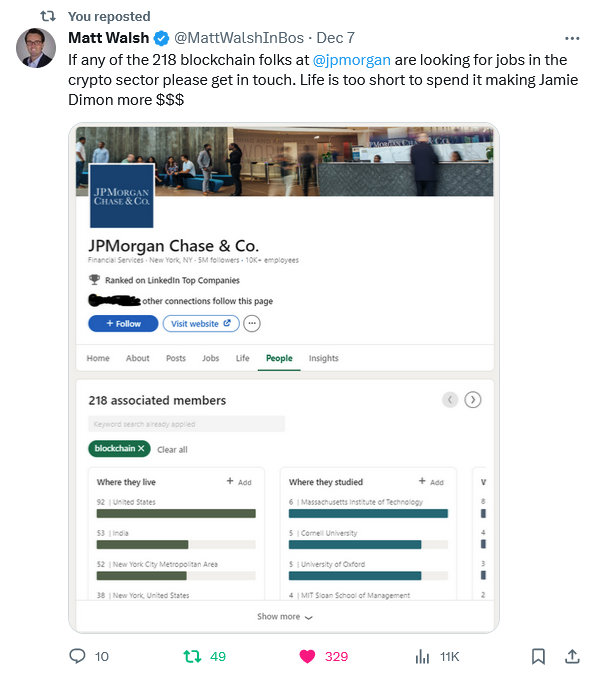

For a start, has anyone told the 218 employees (yes, 218!) working on blockchain projects at JP Morgan, they’re helping criminals and drug dealers?

| |

| Source: x.com |

JP Morgan have actually been a big investor in the Ethereum eco-system for years and even have their own live blockchain called Onyx:

| |

| Source: JP Morgan |

They offer crypto investing services too — but only for high net wealth customers. I mean why should the plebs be allowed to make money?

But the second point is probably more absurd…

In a classic case of the pot calling the kettle black, JP Morgan is one of the biggest facilitators of illicit financing activities in the banking space.

The preferred financier of such luminaries as Jeffrey Epstein and Bernie Madoff has been fined a whopping US$38 billion by regulators since 2,000.

Things like this happened all the time:

| |

| Source: Bloomberg |

And even more amazingly, they got pinged for this one time too:

| |

| Source: x.com |

I’ll give Jamie Dimon this.

When it comes to shady dealings, he certainly knows what he’s talking about!

But while one of the biggest offenders, JP Morgan are far from alone in this.

In total, US banks have paid US$380 billion in fines since 2,000 for fraud, money laundering, and other misdeeds.

Globally, the picture is much the same.

And yet…

In the banking world, no one gets fired, rarely does anyone get put in jail, and the banks simply continue on their merry way, comfortable in the knowledge that they’re untouchable.

Even worse, they know that if anything really bad happens, taxpayers will bail them out. Just like they have consistently over the past two decades since the GFC.

In this context, comments like Dimon’s make complete sense.

Simply put, they’re terrified of crypto.

And they should be.

It’s a decentralised system which does away with ticket clipping middle men. It’s a system that makes meddling central bankers redundant. And it’s a system that levels the playing field for everyone all over the world.

And as usual, when it comes to mainstream coverage of crypto, reality is diametrically opposed to the narrative.

Twitter (or x.com as it’s now called) even publicly fact checked Jamie Dimon on his statement pointing out:

‘Less than 1% of the trillions transacted annually in crypto are illicit. The UN estimates that annually between 2% to 5% of global GDP (US$800 billion – US$ 2 trillion) is used for illicit activities and money laundering through the traditional banking system and cash.’

If we were really going by Dimon’s criteria, Elizabeth Warren should be shutting down the banks!

But that wasn’t the real agenda in play.

What brought these strange bedfellows together was really a shared hatred.

You had the far-left ‘bank busting’ senator Warren agreeing whole heartedly with the supposed capitalist titans of Wall Street.

This doesn’t make any sense until your realise their masks are slipping.

The truth is, Warren cares as much about social inclusion as Wall Street cares about capitalism.

What they both want are profits and control.

And this is the Faustian bargain they’ve made here.

The ‘anti-crypto’ campaigner Warren dreams of a world with a few big banks all under her tight control.

Then she can implement things like central bank digital currencies and decide who gets access to capital and banking and who doesn’t.

Money will become a weapon of control.

Sadly, the ‘capitalists’ at JP Morgan seem to be happy with that future as long as they’re cashing their cheques along the way.

For the rest of us, it’s an Orwellian nightmare…

Price shock incoming

The good news?

Unfortunately for these power-hungry shysters, the horse has already bolted.

Bitcoin is sufficiently global and widespread that you can’t shut it down.

Not that I think Dimon was even serious about that comment anyway.

Like I said, he has a big stake in crypto already.

My guess is he’s probably just stalling for time as his firm positions itself for the inevitable. Or perhaps trying to curry favour so that HIS blockchain gets favoured by regulators.

The real funny thing about Jamie Dimon’s comments was how little impact it had on the Bitcoin price.

Check out the chart:

| |

| Source: Coinigy |

It barely made a dent!

That’s the thing…

People holding Bitcoin today have done the work through the long bear market and know what they’re invested in.

And censorship resistant money that can’t be debased is a pretty valuable commodity in a world full of tyrants and profligate central bankers devaluing fiat at record speed.

75% of Bitcoin hasn’t moved in over a year.

No one is even close to cashing out.

Like me, they’ve heard this kind of crap for years. But these days no one is buying it. Because the evidence is very much to the contrary.

You’ve rumours like this swirling:

| |

| Source: x.com |

Then, you’ve more countries adopting Bitcoin too.

New Argentinian President Javier Millei has promised to get rid of the central bank and he’s a big believer in monetary competition, saying this on the campaign trail:

‘I propose the free competition of currencies, full reform of the financial system.’

But as I said before, the big catalyst everyone is watching is the imminent approval of a Bitcoin spot ETF.

Wall Street doesn’t want to stop crypto.

It wants to own it!

It now looks likely that an ETF will be approved sometime before 10 January. And we could potentially see trillions of dollars chase an asset only worth US$855 billion.

That’s only 1/20th the size of the gold market.

Then in April we have the Bitcoin halving — a moment when supply of new Bitcoin falls in half. At that moment, Bitcoin will become scarcer than gold on a stock to flow basis for the first time.

Put this altogether…

$500k in play

Super strong holders around the world.

Potential demand shock incoming.

Supply shock guaranteed.

What does this all add up to?

In my opinion, a massive price shock is coming in 2024. It’ll leave those left on the sidelines in the dust.

How high can it go?

If previous cycles are anything to go by, US$500,000 is in play:

| |

| Source: x.com |

One thing is clear to me.

Whether these predictions turn out to be right or not, the risk-return on offer remains immense for astute investors.

People who can see past the continual mainstream fear campaign and understand the value of decentralised money, and the underlying signals of adoption.

If I’m right, the window of opportunity to grab your stake in this future is closing fast…

Get your name down here to learn more.

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital

Comments