Like it or not, over the next year or two it’s very likely you’ll end up owning some Bitcoin [BTC].

I’m talking everyone…even sceptics like my old mate Vern Gowdie!

How’s that possible, you ask?

Are millions of investors around the world about to have a crypto epiphany?

Are they going to become full on ‘crypto bros’ like me?

Probably not…

While I hope at least some people will see the benefit of an open, decentralised monetary system, sadly this is unlikely to be the case for most.

What’s going to happen is a little bit more mundane.

And dare I say it…fiat-like.

But price-wise, it’s likely to be explosive for all.

Because whether you’re philosophically aligned with the Bitcoin-ethos or not, there’s a huge investment opportunity about to kick off.

Billions of dollars are about to try and buy what — come April 2024 — is soon to be the world’s scarcest commodity.

And there’s a good chance it all kicks off in just 22 days.

You’ve probably heard me banging on about this before.

But let me repeat it once more…

All the signs are pointing to a Bitcoin spot ETF (exchange traded fund) being approved in the US sometime before 10 January 2024.

The latest clue came from SEC Chairman Gary Gensler appearing on CNBC last Friday.

He told the interviewer:

‘We had in the past denied a number of these applications, but the courts here in DC weighed in on that. So we’re taking a new look at this based upon those court rulings.’

If you’ve been following this story like me, you’ll know this is a subtle admission of defeat.

Gensler has been a long-time roadblock to an approved spot Bitcoin ETF.

But even he knows when he’s beat.

This time around you’ve got the likes of Blackrock and Fidelity actively pushing this process along.

This is something that’s never happened before. And it’s further proof Bitcoin is about to go mainstream.

Anyway, I could be wrong but personally I give the odds of an ETF approval by early 2024 at over 90% right now.

Which leads to the point of today’s piece…

What happens if a Bitcoin ETF is approved before the next major deadline (10 January 2024)?

What will a sudden inflow of money into Bitcoin ETFs mean for the price of Bitcoin?

I’ll go over some thoughts on this shortly.

But first, a little bit of history is in order…

The financialisation of crypto begins

There’s a long trend of assets being ‘financialised.’

This is the process by which various assets are packaged (usually into ETFs) to make them investable.

In a twist of fate, current Blackrock CEO Larry Fink, was one of the pioneers of this concept.

In 1983, Fink (at First Boston at the time) and Lew Rainieri (at Salomon Brothers) invented something called the Collateralised Mortgage Obligation (CMOs).

These were pools of mortgages that were packaged together and then sold.

These CMOs allowed debt markets to grow rapidly by attracting investor money eager to share in the returns from secure, diversified mortgage pools.

The new market (now called CDO’s as they included all sorts of debt, not just mortgages) grew at an exponential rate in the decades that followed:

|

|

|

Source: Celent |

This is the power of financialisation.

Another example…

In 1997, Sall Zell came up with a way to ‘financialise’ real estate.

Again, this was a way for investors to buy into an asset class, without having to own individual properties.

They could simply buy into a pool of properties.

Zell created the world’s most significant and important REIT (real estate investment trust) called Equity Office Properties.

He sold this empire to Blackstone (there’s that name again!) in 2007.

These days, REITs are now pretty common and there are several listed on the ASX.

Famous hedge fund manager Jim Rogers did the same in 1998 with commodities.

He launched the Rogers Total Return ETF which invested in a pool of different commodities like iron ore, copper, gold and all the rest.

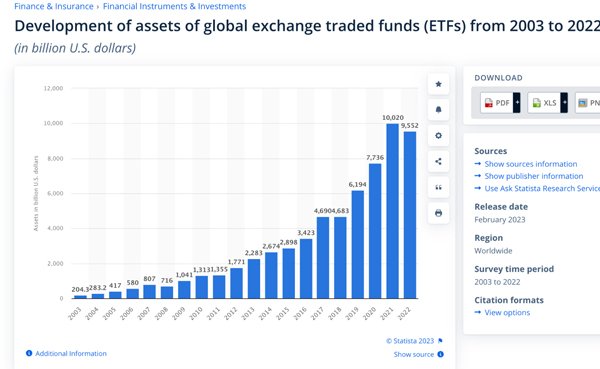

It’s amazing how successful the concept of ETFs — which is the concept of financialising assets — has been.

Check out the chart:

|

|

|

Source: Fred Krueger |

The market for ETFs is expected to grow from US$10 trillion to US$50 trillion by 2030.

But probably the most important asset that has been financialised for the purposes of analysing the coming Bitcoin ETF, is gold.

Before 2004, owning gold was an onerous process.

You had to source an actual bar of gold if you wanted to have exposure to the gold price. This wasn’t always easy.

Not only that, you had to test it for purity, transport it, and store it safely somewhere.

Not many investors could be bothered with this headache.

So in 2004, a Gold ETF was launched.

This was a way to ‘own’ gold without having to touch the underlying assets. And investors loved it!

Look at what happened next to the price of gold:

|

|

|

Source: Trading View |

Gold basically went on a seven-year bull run after the launch of a regulated ETF.

The approval of a regulated Bitcoin ETF is likely — in my opinion — to have a similar effect.

Big financial institutions and high net worth individuals have largely shied away from buying Bitcoin, in large part due to the added complexity and risk of owning and storing Bitcoin safely.

Indeed, many super and investment fund mandates don’t allow investing in non-regulated investment vehicles.

So they couldn’t invest in Bitcoin, even if they wanted to.

With an approved Bitcoin ETF, now they can. And in time, in my opinion, they will.

Which, as I said at the start, likely means that — like it or not — you’ll end up owning some Bitcoin.

But that brings me to the big question…

What will the effect be on the price of Bitcoin if a spot Bitcoin ETF is approved early next year?

$500,000 in play

In short, it’ll all depend on demand.

How much money will be invested into these ETFs?

That’s the big question.

American hedge fund manager Mark Yusko is on record saying he thinks US$3 billion will flow into Bitcoin spot ETFs on DAY ONE!

That’s about half of Michael Saylor’s Microstrategy’s entire holdings, in just one day.

What would that do to Bitcoin’s price?

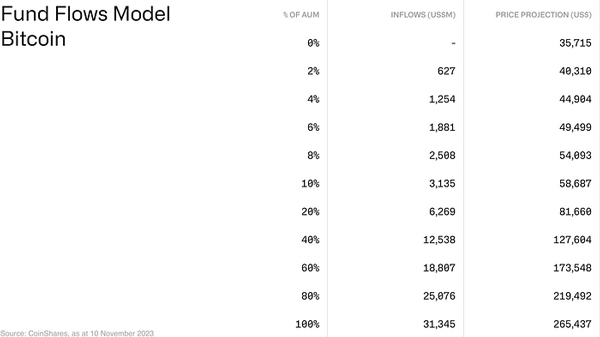

It’s a little complicated to work out, but Galaxy Digital did some modelling on how ETF inflows could affect the price.

The full report is here.

But the main conclusion was:

‘…we estimate $14bn of inflows into a Bitcoin ETF in the first year following an ETF launch, ramping up to $27bn by the second year and $39bn by the third-year post-launch.’

The assumptions they made for these figures were probably a bit conservative in my view.

They basically assumed only 10% of the target investment market (pension and investment funds) would add any Bitcoin exposure.

And of that 10%, the average allocation would be just 1%.

But even on those numbers the effect on price could be dramatic.

Check out this table:

|

|

|

Source: Coinshares |

If we take Galaxy’s US$14.4 billion of inflows in a year estimation as correct, that’d equate to a price of roughly US$141,000 per Bitcoin in year one.

Today, the price of Bitcoin is US$43,000 so you’re talking over 3x in 2024 alone.

By the time we get to year four or five, Wall Street analyst Fred Krueger has a projected price of US$500,000 per Bitcoin using a similar method.

The opportunity is clear…

Act now and ‘front run’ Wall Street

Of course, these are all just educated guesses.

No one knows what the actual inflows will be. Nor do they know at what price current holders will be tempted to start selling.

I’d wager the price will need to go a lot higher than some think.

But I’m probably biased.

The thing about these models though is that they’re coming from people who don’t necessarily believe in Bitcoin like I do.

Instead, these people simply understand the history of how financialisation drives demand.

And in turn, the price.

In many ways, buying Bitcoin now, is the equivalent to buying gold bars in early 2004.

Sure, it might come with some hassles, but the returns in the years that followed more than made up for it!

My Crypto Capital service is designed to help you enter this world before this financialisation process begins in earnest.

To invest…not just in Bitcoin, but also several core crypto assets that I think will underpin the new plumbing of a fast-evolving financial system.

It’s rare you get a chance to front run Wall Street. And it seems that window of opportunity is finally set to close.

But with potentially 22 days to go, it’s still not too late!

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital