Last week the US stock market hit record highs…

Why?

Well, despite the noisy politics in Washington, recent third quarter company earnings were actually pretty good across the board.

Very good actually.

According to FactSet, 80% of companies reported better than expected earnings. Profits were around 4% above expectations, and sales figures were 1% better.

Importantly, the big names were the big winners.

Facebook, Apple, Paypal, Bank of America and Intel all boosted profits.

When companies that big start moving higher, they tend to drag the entire index with them.

The much-maligned Tesla was another big winner, reporting a huge surprise profit figure that caught everyone on the hop. Shares surged 20% higher on the good news.

But my favourite result was from sandal manufacturer Crocs, Inc [NASDAQ:CROX], benefitting from an apparent ‘ugly shoe’ trend.

Their third quarter numbers ‘sailed past even the highest Wall Street estimates’, according to one amazed analyst.

Proving that it’s not just in the flavour of the month industries like tech and banking where investors can make money in the stock market.

Now, all of this good news might be a bit of a surprise to you.

After all, it certainly surprised those in the industry. The Financial Times ran this headline on Saturday:

‘US stock market’s new high baffles investors’

Almost all of the pundits these days are predicting lean times ahead. If not total Armageddon. A strong earnings season wasn’t what this narrative was expecting.

And neither is a rising market through 2020.

Well, that’s part of the reason this bull could be set to run harder than ever next year.

Let me explain…

One of the most important charts you should watch

It’s an investing cliché, but only because it’s true.

You really should buy when no one wants to and sell when everyone wants to buy.

Logically, you probably understand this.

If you buy when no one else wants to, you get a good deal. But if everyone wants to buy, the price will likely work out in the seller’s favour.

However, understanding this in theory and doing it in practice are two different things.

It takes major psychological strength to ignore the herd when it comes to investing. No one wants to look stupid.

It’s why the recent earnings results are still viewed with suspicion.

Bank of America strategist Jared Woodard explained how ingrained this negativity is right now. He told ft.com:

‘Investors we speak to are incredibly cautious. They see the market rally but they don’t trust it.’

And these investors are putting their money where their feelings lie.

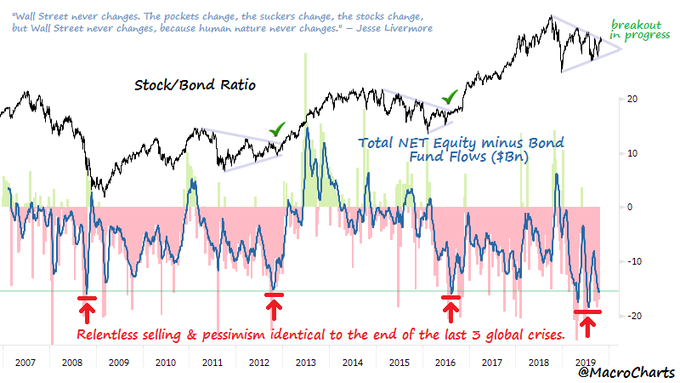

Check out this chart:

|

|

| Source: Macro Charts |

This chart is one of the most important ones you can follow.

It’s called the stock/bond ratio and measures the relative performance of the S&P 500 versus the 20 Year Bond ETF.

If the stock market is outperforming the long-term bond market, then the black line rises. And vice versa.

Now at the bottom of the chart you can see a blue line that measures fund flow between stocks and bonds.

Pay attention because this is very important…

This is showing that most of the money is flowing into bonds right now, rather than stocks. Nervous-Nellie investors are moving into the safety of bonds at record levels.

Even though bonds are paying a pittance.

At the same time, the stock-bond price ratio could be about to breakout to new highs.

It has done exactly the same on two previous occasions (indicated by the red arrows) with spectacular rises in the share market straight after.

[openx slug=inpost]

Get in early

This is how stock market rallies begin…

They break out with few believers, until one by one, and over time, bears become bulls as the market rises.

All that bond money is actually dry fire power, ready to come into the stock market once investor sentiment turns.

If it does, 2020 could be explosive.

I think the rampant third quarter earnings season could prod some investors back into stocks soon. And then the domino effect will start to kick in.

It’s just the way the markets always work.

As the famous trader of the 1920s Jesse Livermore said:

‘Wall Street never changes. The pockets change, the suckers change, the stocks change, but Wall Street never changes because human nature never changes.’

2020 could be a huge year for stock market investors.

Good investing,

Ryan Dinse,

Editor, Money Morning

Free report: Four standout Aussie stocks to stick in your portfolio ASAP. Click here to download your free report.

Comments