2024 is days away.

And as the new year approaches, it encourages reflection on the current year.

For markets, that usually means assessing performance.

Who were the winners? Who were the losers?

Today, we’ll look at 2023’s duds and their lessons.

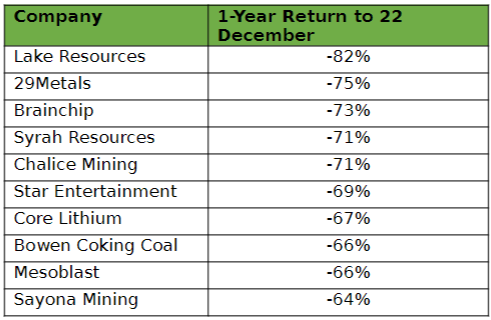

10 worst performing ASX stocks of 2023

Here are 2023’s worst performing stocks on the All Ords. The All Ords is a good barometer, made up of the 500 largest ASX stocks.

Below, the duds.

| |

| Source: Fat Tail |

Lithium stocks take a beating

Three lithium stocks feature on the list. One — Lake Resources [ASX:LKE] — tops it.

Lake is down over 80% this year.

It gets worse.

Lake, who hopes to develop the Kachi project in Argentina, is down ~95% since April 2022.

Joining Lake in ignominy are Core Lithium [ASX:CXO] and Sayona Mining [ASX:SYA].

Both have fallen sharply since their all-time peaks.

Core is down 80% since November 2022. Sayona is down 80% since April 2022.

The fall is fascinating.

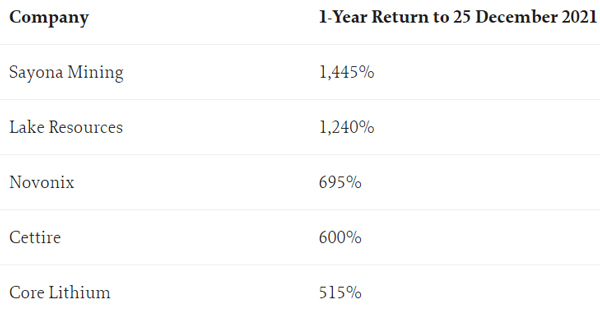

Lithium stocks were thehottest thing a few years back. When I wrote about the best performing stocks on the All Ords in 2021, guess who was top?

Sayona Mining, Lake Resources, and Core Lithium.

| |

| Source: Fat Tail |

In fact, eight of the top 10 performing stocks on the All Ords were lithium stocks in 2021.

The lithium hype was real.

Importantly, the hype centred on lithium juniors. Explorers years away from production, poking around their deposits, thinking big, talking up EV adoption.

Lake’s 2021 annual report was rife with the optimism of the time:

‘The company has seen global growth in the demand for lithium rise to levels of magnitude that are multiples of the amount produced in recent years. At the time of writing there are 247 battery manufacturing facilities being developed to meet 2030 demand whilst in 2015 there were three! 151 of these factories will be consuming raw materials by the end of 2021, we are now entering a period of supply deficit that analysts are suggesting will last a decade or longer before supply catches up.’

But valuations ran ahead of reality. And reality never caught up.

At one stage, Lake, Core Lithium, and Sayona were multi-billion dollar companies. Airy expectations bloated the valuations.

Then general market euphoria died down and rates rose. And lofty expectations embedded in the price became a burden. A burden these stocks could not bare.

In markets, high expectations make for high ledges.

Take Brainchip [ASX:BRN].

Brainchip captured the market’s imagination developing ‘edge AI technology’. Expectations were high, but Brainchip failed to execute.

Its actual business could not catch up to the market’s vision of it. The vision adjusted, and so did the price.

But let’s focus on Lake Resources here.

It surged in 2021/22 on claims its direct lithium extraction (DLE) approach will usher in an era of environmentally friendly and efficient lithium mining.

Lake talked up the size of its Kachi resource in the ‘lithium triangle’ and the inventiveness of its DLE technology partner, Lilac Solutions.

All this led to sky-high expectations.

But expectations demand to be met. And Lake faltered.

Lake pushed out full production to 2030 after a strategy overhaul, with first production slated for 2027.

And this week, LKE finally released the long-delayed DFS.

With a market cap now below $200 million, Lake expects its capex to be US$1.4 billion for the first phase of production.

How will it raise the money? From whom?

I think Lake’s rocky 2023 will spill over into 2024.

In mining, execution is everything. And when you struggle to execute on high expectations, you suffer.

And yet…

The two top performing stock on the All Ords this year are Wildcat Resources [ASX:WC8] and Azure Minerals [ASX:AZS]. Wildcat is up nearly 3,000% this year. Azure is up 1,500%.

Both are lithium stocks. Azure also owns a nickel-copper-cobalt project.

Lithium hype hasn’t really died down, then.

But you could say it’s become more discerning. Wildcat and Azure benefit from owning lithium assets in Western Australia, a premier mining jurisdiction.

Most importantly, both Wildcat and Azure are also under heavy takeover interest.

Mineral Resources is eyeing Wildcat. Gina Rinehart’s Hancock Prospecting and SQM are eying Azure.

What happens if neither get acquired? Will their share price mirror that of Core Lithium, Lake, and Sayona?

Let’s see next year.

Critical materials not feeling the love

If we look at the 10 worst performing stocks, we’ll see a wider pattern beyond lithium.

Stocks involved in critical materials underperformed badly.

Syrah Resources [ASX:SYR] produces graphite.

29Metals [ASX:29M] mines copper.

Chalice Mining focuses on nickel and copper.

So six of this year’s worst performing stocks are involved in critical materials.

The electrification of the world will require more copper, more graphite, more nickel, more lithium, more cobalt.

That’s all true.

But the sextet’s performance shows the story is not enough.

The market absorbs information and discounts the future.

By now, information about the need for more critical metals is abundant. And valuations have that information baked in.

It doesn’t help, either, that world economies are growing below-trend due to high interest rates.

Is Star Entertainment road kill?

Michael Burry, of The Big Short fame, said his strategy isn’t ‘very complex’.

Burry tries to ‘buy shares of unpopular companies when they look like road kill, and sell them when they’ve been polished up a bit’.

Few stocks are as unpopular right now as Star Entertainment [ASX:SGR].

Down nearly 70%, the casino operator suffered from bad press, scandals, and discounted capital raisings in 2023.

If any stock could resemble road kill, it would be Star Entertainment.

But is the worst priced in?

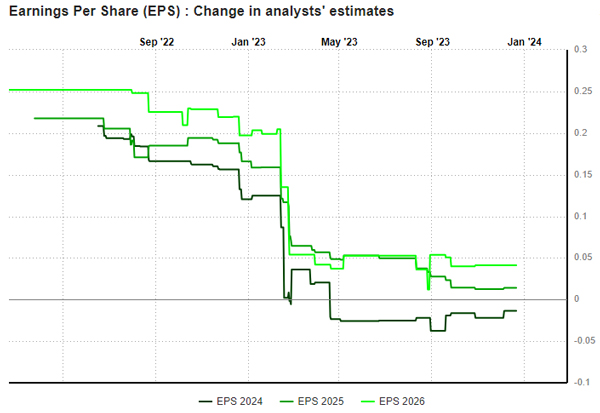

Consensus earnings revisions have stabilised.

| |

| Source: MarketScreener |

But, honestly, Star could fall further.

The stench is still strong. Neither does the valuation make sense.

Let’s quickly run the numbers based on FY25 consensus estimates. Using an 8% discount rate, we get a fair value estimate of …16.5 cents.

Star Entertainment last traded at 52 cents…

But that’s the estimate you get when consensus FY25 estimates for ROE are 3.5%.

Last I checked, the Aussie 10-Year bond yield sat at 4.06%.

No wonder the stock trades at a heavy discount to book.

At the very least, I don’t expect value hounds to lick their chops at Star just yet.

Sometimes road kill is just …road kill.

Thank you for reading our articles this year. I hope you find them insightful and engaging. Have a great break and Happy New Year!

Regards,

|

Kiryll Prakapenka,

Analyst and host of What’s Not Priced In

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In where he and a new guest week figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!

Comments