The Zip Co Ltd [ASX:Z1P] has completed the acquisition of central European BNPL provider Twisto.

Zip says acquiring Twisto is an entry point to one of the world’s largest eCommerce markets, with access to all 27 member states of the European Union (EU).

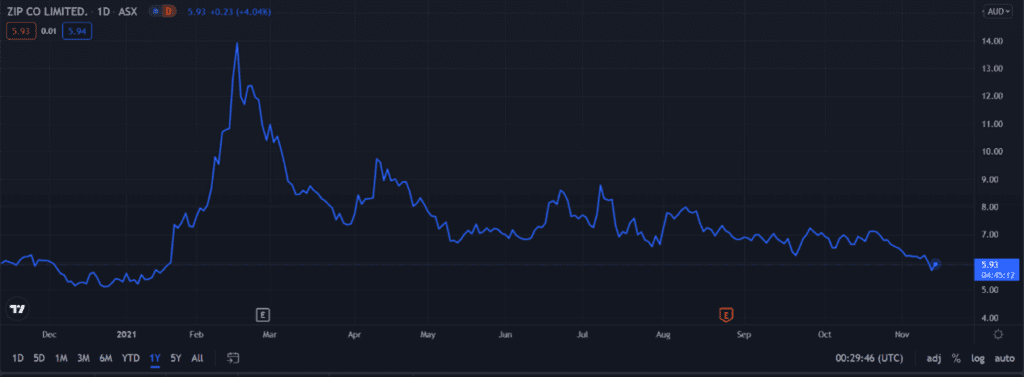

Zip Co Ltd [ASX:Z1P] share price is currently up 4%:

Zip completes Twisto acquisition

Under the terms of the Twisto acquisition, Z1P issued 17,454,987 new shares Twisto security holders today.

Zip said these shares are upfront consideration shares, approved by Z1P shareholders at the recent annual general meeting.

The upfront purchase price paid by Zip to acquire Twisto is about $115.8 million.

For reference, Zip ended the FY21 with $330.2 million in cash and cash equivalents, up from $32.7 million in FY20.

The upfront consideration shares were issued at a price of $6.61, based on a 30-day VWAP.

Zip will also issue up to 4,550,000 new shares to Twisto security holders as holdback consideration shares over the next four years.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Gateway to one of the world’s largest e-commerce markets

Zip said acquiring Twisto will serve as a gateway to ‘one of the world’s largest e-commerce markets and access to all 27 members states of the European Union.’

Zip described Twisto as a leading BNPL platform in Central Europe, serving almost one million customers across 22,000 merchants.

Twisto was the first to offer BNPL in the Czech Republic.

Some of Twisto’s biggest merchants include KFC, Pizza Hut, Secret Escapes, Gap, New Balance, Delivery Hero, Takeaway, Yves Rocher, and Under Armour.

Z1P outlook — BNPL fatigue?

At risk of succumbing to Betteridge’s law of headlines, which states any headline that ends in a question mark can be answered by the word no, I nonetheless ask — is the ASX suffering BNPL fatigue?

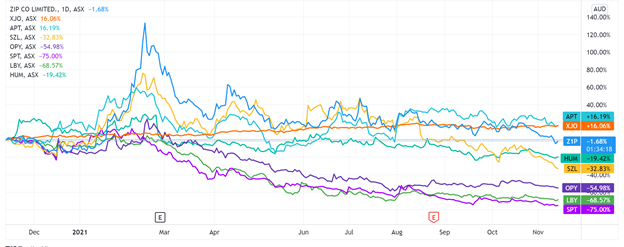

Consider the 12-month performance of the major ASX BNPL stocks.

Out of the seven BNPL stocks represented in the chart above, only Afterpay Ltd [ASX:APT] is outperforming — barely — the ASX 200.

Some, like Splitit Ltd [ASX:SPT], Laybuy Group Holdings [ASX:LBY], and Openpay Group [ASX:OPY] are down over 50% in the last 12 months.

And APT’s share price is being supported by an exogenous factor — Jack Dorsey-led Square’s all-scrip takeover bid for Afterpay shares.

The current BNPL landscape is a far cry from when the Australian Financial Review ran this headline in July 2020: ‘Afterpay-led buy now, pay later sector booms as more money pours in’.

While Twisto’s acquisition gives Zip the chance to grow its presence even more across different markets, its share price is still down from its peak of over $14.

Is customer growth no longer a key point of contention for investors? Are they now more focused on the health of BNPL stocks’ bottom line?

Zip’s total net loss for FY21 was a whopping $653 million. Granted, this was massively impacted by the acquisition cost of QuadPay, but even in FY20, Zip registered a net loss of $20 million in FY20.

There’s also banks like CBA and Suncorp launching their own BNPL offerings for Zip to contend with.

Now if you’re interested in fintech stocks, check out our report on three new small-cap fintechs with exciting growth potential.

Regards,

Kiryll Prakapenka

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here