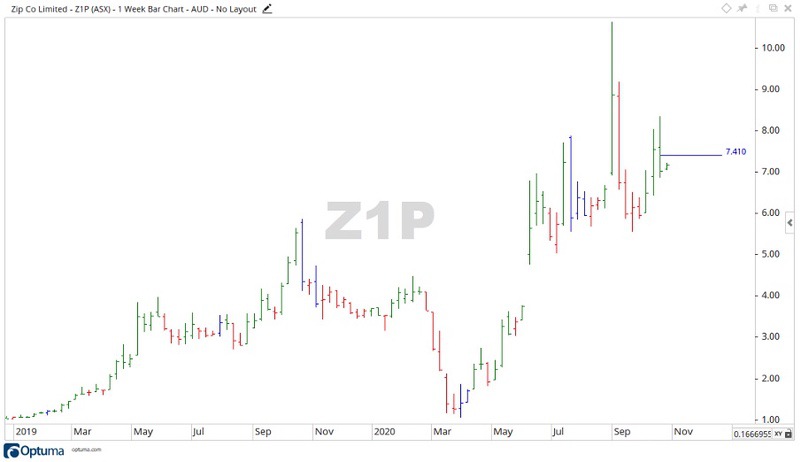

After a big run-up and a subsequent retracement, we take a another look at how the Zip Co Ltd [ASX:Z1P] share price is tracking.

The ‘buy now, pay later’ (BNPL) provider is making it easier for consumers to use their platform.

They announced they are partnering with Visa to make BNPL services more accessible for everyday use.

The announcement saw their share price rise 3.35%, to trade at $7.41 at the time of writing.

Source: Optuma

What’s happening at Zip Co?

This year saw an explosion in the usage of BNPL providers.

The COVID-19 pandemic forced people all over the country to stay at home a lot more than usual.

The popularity of Zip Co along with the likes of Afterpay Ltd [ASX:APT] and Openpay Group Ltd [ASX:OPY] gave the whole sector massive rises in their respective stock prices, and a lot of hype in general.

But the hype masked the reality of the usage rates.

Only 13% of stores in Australia presently use BNPL providers.

Zip Co recently announced a new product to get these usage rates up and make it more accessible for everyone.

Tap & Zip, it’s called.

The announcement noted that:

‘Zip has been granted a Principal Issuer license with Visa and will leverage Marqeta’s leading open-API card-issuing platform, which together enables users to create Zip-branded virtual cards in real-time. This virtual card allows users to shop at any instore or online retailer where Visa is accepted.’

Where to from here for the Z1P share price?

Being included in the Visa system should open huge possibilities for Zip Co.

With Visa now being in business for 62 years, its integration across all walks of business is extensive.

Source: Optuma

On the chart, the price is continuing to move sideways.

With Christmas around the corner, the usage of Zip Co may spike and push the share price higher. Should it move to the upside, then the levels of $7.89 and $8.36 may provide future resistance.

On the downside if the broader instability in the economy gets a hold of the direction and pulls the price back, then the levels of $6.96 and $5.57 may come into play.

Regards,

Carl Wittkopp,

For Money Morning

PS: Looking for more fintechs? Get the names and profiles of three small-cap fintechs in this brand-new report on the topic. Download your free report now.

Comments