In case you’re unaware, a major recession is gripping the world.

You’d have to live off the grid or secluded from society not to realise it. You’d need to suppress your conscience or be blind to reality to deny its existence. That or you’re gullible enough to believe unscrupulous politicians, economists and mainstream financial pundits using the official economic and market data to spruik a bright outlook.

The fact is, even if you believe the data, you should feel something is seriously wrong.

Apart from equity indices trading at or near all-time highs, asset prices and economic indicators point to the smart money heading for safety. Meanwhile, ordinary folks (not the top 10%) face rising living costs, job losses, slow wage growth and shrinking wealth.

The global markets slumping early last month after the Bank of Japan raised the interest rate was meant to sound a warning. However, the quick recovery that followed showed many didn’t heed it.

They could pay dearly for it. Few assets are immune to a major correction should one occur.

Let me explore today the indicators and how you could position yourself to weather a potential storm.

To be clear, I’m not writing today to shout gloom and doom or to tell you to sell everything and head for the hills. Instead, I want to remind you to check your financial position and exposures. Those who do could exploit the massive opportunities beyond the potential carnage.

Spot the odd one out

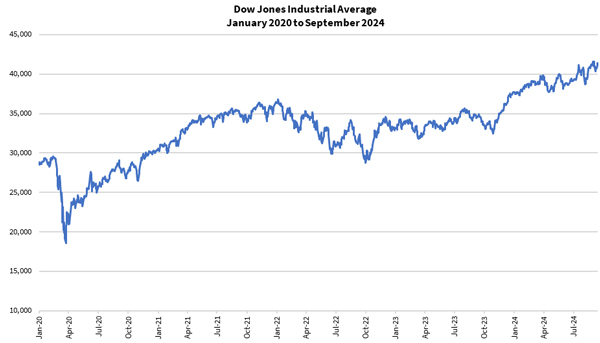

For the past four years, market indices have ground higher, turning market bears into a laughing stock.

Have a look at the Dow Jones Index [DJIA]:

| |

| Source: Refinitiv Eikon |

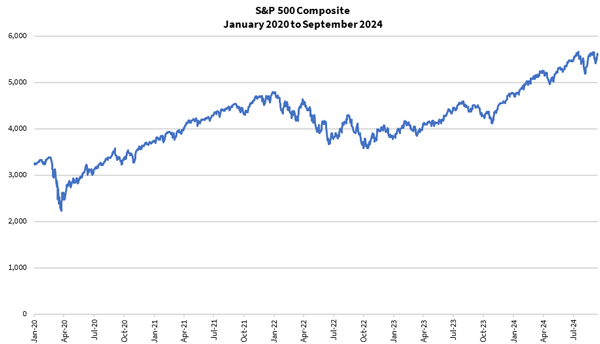

The S&P 500 [SPY]:

| |

| Source: Refinitiv Eikon |

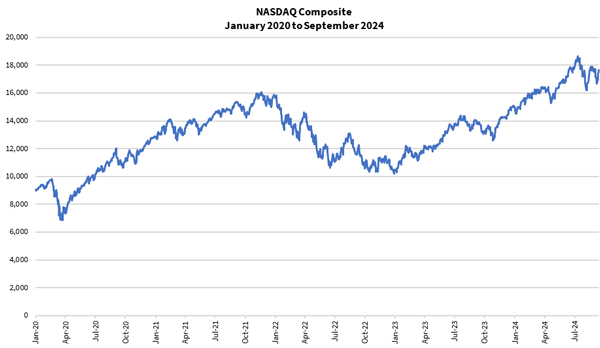

The NASDAQ Composite [NASQ]:

| |

| Source: Refinitiv Eikon |

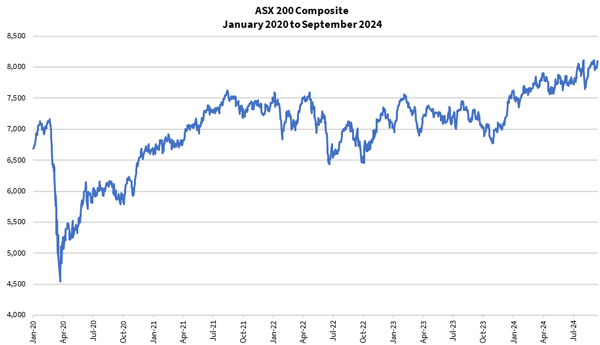

And our own ASX 200 Composite Index [ASX:XJO]:

| |

| Source: Refinitiv Eikon |

I’ll call this is as good as it gets. The market indices are trading as if stocks are rallying forever.

But those who aren’t holding the largest stocks know it’s a mirage. Those investing in commodities stocks have experienced pain. Even those who chased the Mag7 tech stocks are now feeling the force of gravity.

Meanwhile, many mid-caps lagged the blue chips. Small-cap companies took a battering, especially biotech and commodity stocks.

You won’t see that in the indices because the largest constituents drag everything higher, until they don’t.

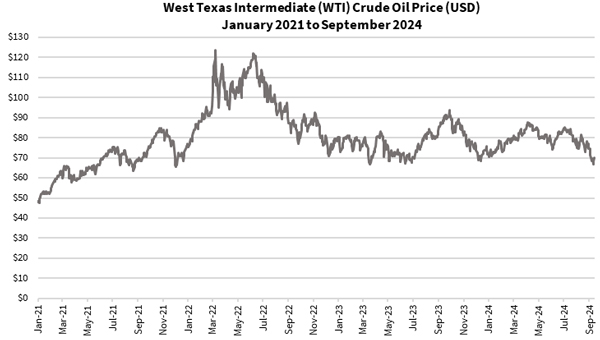

Moving onto oil, it’s fallen by more than 30% from its highs this year in April:

| |

| Source: Refinitiv Eikon |

Moreover, it’s down almost 50% from its 2022 highs. Oil is in another bear market now.

Some may argue that this slump is driven by the world shifting away from fossil fuels to clean energy.

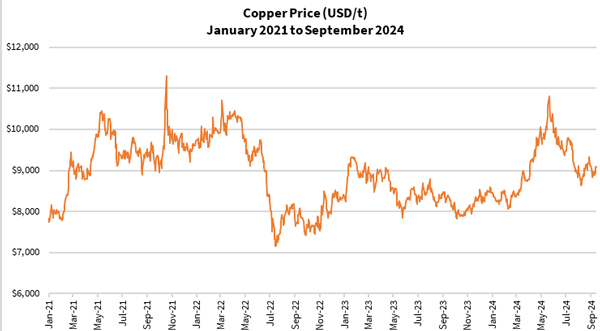

But let’s look at copper, a critical metal used for transmitting electricity:

| |

| Source: Refinitiv Eikon |

It’s trading almost 20% below its recent highs. We can safely put to rest that narrative.

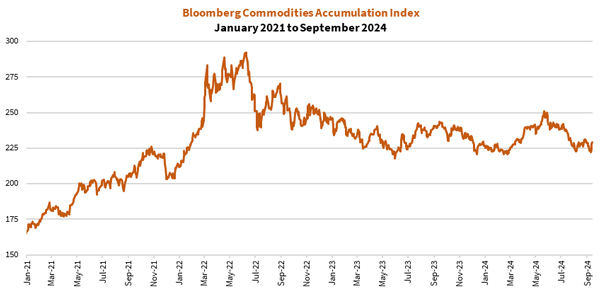

Meanwhile, the broader commodities came off their highs despite governments worldwide pursuing critical minerals development:

| |

| Source: Refinitiv Eikon |

Apart from a major rally in early-2022, the commodities space has delivered a tepid performance. Different commodities turned bullish over the last two and a half year: lithium, nickel, oil, rare earths, uranium, copper, gold and silver. However, most commodities have given back their gains. In the case of lithium and rare earths, they’re in deep bear territory.

Debt carnage ahead!

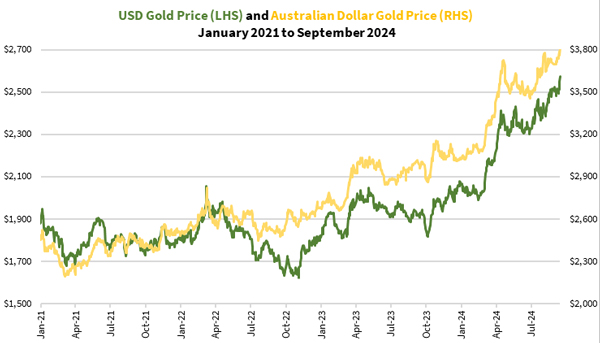

Finally let’s look at gold:

| |

| Source: Refinitiv Eikon |

I’ve saved this for last to make a point.

There’s been a gold bull market these three and a half years thanks to unprecedented central bank currency creation. It paused for several months in 2022-23 before it went parabolic from mid-March this year.

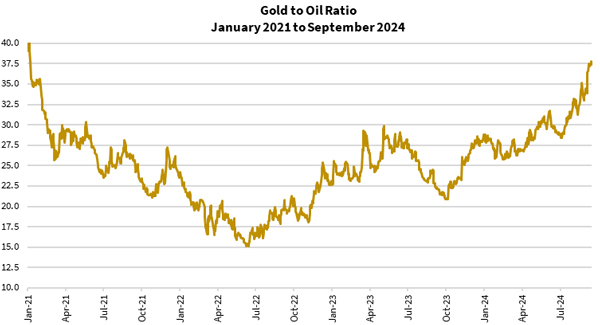

And looking at the gold-oil ratio, it’s the highest we’ve seen since early 2021:

| |

| Source: GoldHub Australia |

During this period, central banks and governments bought gold at record levels, giving more fuel to the gold bull market. They know something bad is brewing.

Why’s that?

Lockdowns and the global supply chain collapse gutted the private sector. Governments tried to fill the void, bloating the public sector. This is the key reason for rising inflation, which central banks vainly tried to control in 2022-23 by raising interest rates at a record pace.

They caused major problems during the Wuhan virus outbreak and the ensuing debacle in rolling out healthcare measures. It’s like rolling a boulder up a mountain, growing it as it did.

The US Federal Reserve meets this week. On Thursday morning, we’ll find out if it’ll cut the Federal Funds Rate by 0.25% or 0.5%.

The financial pundits have primed people to want interest rate cuts. Investors have moved ahead to buy stocks and bonds, anticipating another rally.

However, could this time be different?

Looking at the various asset markets above should give you reasons to act cautiously.

The signs point overwhelmingly to a weak economy. Stock prices are at record highs because excess liquidity is directed there. The largest stocks are dragging the market indices higher. Meanwhile, commodity prices have slumped. This points to weakening global demand as business activity and consumer confidence plummet. Governments have largely fired their ammunition from the orgy of stimulus they pumped into the global economy, with the private sector yet to or unable to fill the void.

Central banks cutting interest rates now could push the market over this time. It’d be them conceding defeat, which could cause the debt boulder to roll down and crush the markets.

Speculate wildly from a position of safety

How do you position yourself in this predicament, should my outlook play out?

Your first priority is to move your portfolio to safety. Are there any stocks or assets that have enjoyed a good run?

It’s easier to prepare yourself for the potentially messy situation when you’re in a relatively safe position. Those who are engaged in FOMO and chasing momentum will likely lose their shirts and dump good assets in an untimely manner.

Don’t dump everything you have now. But have enough dry powder to jump on deeply discounted assets.

I’ve left you plenty of clues about where the bargains are… commodities.

Better yet, you can pick one or both paths to play it.

If you want to prepare for the next commodity supercycle, I’d recommend you watch the latest video from my colleague, James Cooper, editor of Diggers and Drillers, and Mining: Phase One. He has a couple of commodities stock opportunities.

Or if you want to know more about the gold bull market, you should check out this video from me and sign up to The Australian Gold Report.

As the old saying goes, ‘buy when there’s blood in the streets’. I’d say speculate wildly from a safe position.

That’s it from me: enjoy the week ahead and get your financial house in order!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments