In a paradigm war, your greatest endorsement isn’t from a loyal supporter but from someone who is normally your detractor giving you their support.

Why is that?

Your supporter is already on your side. You’re preaching to the converted. Your detractor, however, is one that could take down your case or, at least, level criticism. It means much more when they’re standing with you.

Let’s look at the paradigm war on what defines money.

How many nations have fought between themselves over money and the control of who decides what constitutes money?

For better or worse, society has evolved over time because of money.

And we’re now living at the edge of monumental change.

Some have seen a major transition from when US President Richard Nixon took the world off the last vestiges of the gold standard.

And over the last three decades, we’ve also seen how coins and notes gave way to pieces of plastic that we call credit cards. Then there was the advent of online banking as everything started moving into the digital world. Your wealth could be at your fingertips at the touch of a button.

What’s coming next is a fork in the road.

On one side is a decentralised financial system where individuals and institutions can trade in an open and transparent network…

On the other is a fully centralised system controlled by a bunch of unelected bureaucrats who want everything monitored and tracked.

The choice is yours.

You might be wondering if I’ve abandoned gold and precious metals and joining the blockchain bandwagon because of what’s happened in the markets over the last two years.

Not at all.

But I’ll show you how a gold enthusiast like me can have a few good words to say about our future with cryptos.

Let’s start with one key rule in warfare.

To win a war, pick your allies and foes carefully

The subheading says it clearly.

Whoever you choose to fight a war with and against can determine your outcome.

So I’ve got to work out who is fighting against me, and who I want alongside me.

I’m sworn against dishonest money first and foremost. So I’m naturally against the fiat currency system that is run by central bankers, Wall Street, and their associates.

How about cryptos?

You’re all aware that there’s been a long-standing war of words between gold and crypto enthusiasts. And those in the crypto camp appeared to have the upper hand for the last five years. There was a strong case for them, given they were reaping astronomical gains.

That changed a few months ago.

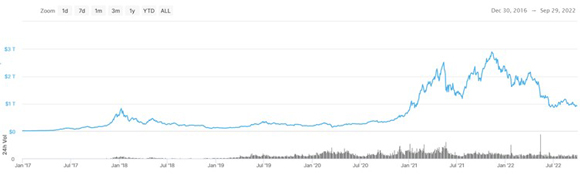

Here’s an image showing how the crypto market’s total worth has fluctuated since 2017:

|

|

| Source: CoinMarketCap |

The crypto market has had both a meteoric rise and demise. At its height, it was worth almost US$3 trillion (~AU$4.5 trillion), around 50% more than the total assets in superannuation in Australia. Today, it’s worth around US$940 billion (~AU$1.4 billion).

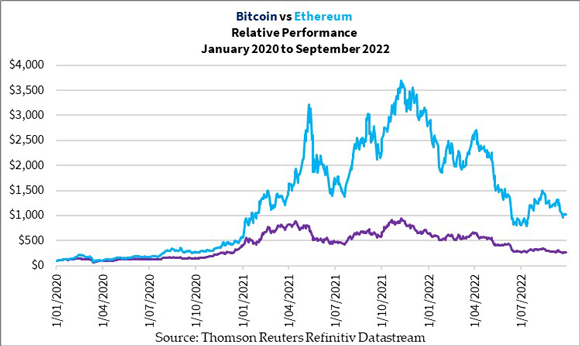

Check out the graph below to see how much US$100 invested in Bitcoin [BTC] and Ethereum [ETH] in 2020 would be worth today:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

It hasn’t been the easiest ride, to say the least.

Those who got in early would be still grinning from ear to ear. After all, bitcoin is still more than 170% higher if you bought at the start of 2020, while Ethereum is 900% higher. And if you bought five years ago, you’re up more than 300% on both.

But I believe many started jumping onto the crypto bandwagon last year when the market went gangbusters off the crazy stimulus programs governments rolled out during lockdowns.

Just when people thought this was the easy ticket to becoming wealthy, the crypto market peaked last November and began to grind down before collapsing in spectacular fashion.

There were some notable collapses in the crypto market, with Celsius [CEL] and Terra [LUNA] being two high-profile failures. Many lost their life savings, and some even their lives.

Now, I’m not writing to dance on the demise of cryptos. I don’t feel any smugness over how many crypto investors — who may have mocked gold in the past — had their proverbial backsides handed to them.

I actually believe the crypto nuclear winter we’re seeing is a fertile ground.

Your journey to massive returns could start now

I see a parallel in this current crypto market as I do with gold and gold stocks.

And if I’m seeing this right, that could mean now is a great time to take a dip into the crypto market if you can stomach the risk. The rewards could be substantial.

I can speak for myself on this going back in time. The 2013–14 bear market in gold stocks took even Newcrest Mining [ASX:NCM] down from $42 in late 2011 to as low as $7 in late 2014. And the smaller gold producers fell even more. But those who had the guts and skill to jump in at the right time and hang on tight enjoyed exceptional rewards in the subsequent bull market of 2015–16. Several mid-tier gold producers enjoyed a 10-fold recovery within the space of 18 months.

And that was for gold stocks. With cryptos, the returns could be multiples of what you could get investing in gold stocks.

It sounds good, doesn’t it?

But there’s a catch to it…

You don’t want to enter this market without guidance. The crypto market is unregulated, just like the Wild West back in the day.

You need to learn about how this market works, what is a crypto wallet, and ways to avoid scams and sh!tcoins.

And there’s someone who can make it much easier for you.

His name is Dinse…Ryan Dinse. Our crypto veteran who lives and breathes cryptos.

This guy’s made a packet trading bitcoin and other tokens long before cryptos went mainstream. He also managed to help his readers dodge several scams in this market, including Terra, which took many people down with it.

To say that you’re in good hands with him is an understatement.

But don’t take my word for it.

Keep an eye out in your inbox for a special presentation sometime next week, where Ryan makes the case for how bitcoin could reach US$1 million by 2030.

You’ll get a chance to start your journey to the future of money, away from the collapsing fiat currency system and the dystopic digital currencies the central bankers want to railroad people into.

You want liberty and prosperity? Well, you’ll have to fight hard for it.

Do so with a veteran leading you.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia