‘You can’t handle the truth.’

Jack Nicholson’s character in A Few Good Men

This week, I was going to share with you some more truth on our research into gold and silver.

However, the collapse of Sam Bankman-Fried’s (SBF to his friends) pyramid scheme, FTX and Alameda Research, warrant inclusion in a series on knowing the TRUTH to make informed decisions.

Crypto is/was a classic pyramid scheme.

Sceptics of this make-believe, find-a-bigger-fool financial system, always knew the truth. However, during the everything bubble, those drinking the crypto Kool-Aid vehemently defended this new-age Ponzi scheme.

‘It’s different this time.’

‘It’s not a bubble.’

‘You don’t get it.’

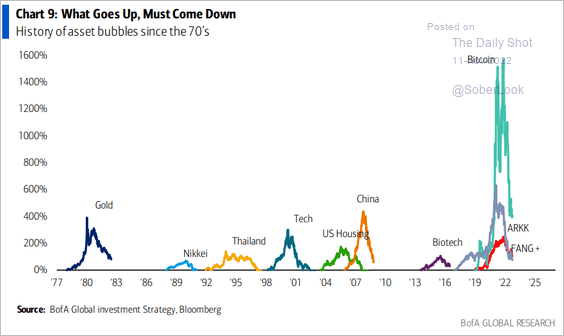

This graphic, published by The Daily Shot on 12 November 2022, puts the Bitcoin [BTC] bubble into historical perspective…as you can clearly see, there was NO bubble…nothing at all…yeah, right:

|

|

| Source: The Daily Shot |

For more than a decade, promises on the commercial value of the blockchain have been long, but delivery has been very, very short…just ask the good citizens of El Salvador.

Over the years, my views on crypto have been expressed in various Fat Tail Investment Research publications: Markets & Money, The Daily Reckoning Australia, The Gowdie Letter, The Gowdie Advisory.

While bigger fools, in bigger numbers, could be deceived into believing what was worthless, was priceless, the scheme popularised by Charles Ponzi remained active.

Up until a few months ago, the now bankrupt FTX unashamedly used celebrity endorsements from the likes of NFL legend Tom Brady to lure in more suckers (sorry, investors) to its fraudulent exchange, so it could use the funds to prop up the loss-laden Alameda Research:

|

|

| Source: Twitter |

Considering FTX went up in flames in a matter of days, you have to applaud the Market Gods’ sense of humour.

Can you imagine Warren Buffett paying anyone to pull this sort of stunt to promote Berkshire Hathaway?

Me either. But then again, as cult members often scoffed, Buffett is so old-school…he just doesn’t get it.

Amid a boom, when brains turn to mush and BS triumphs over common sense, this sort of boorish behaviour passes as an acceptable medium for a financial product endorsement.

Where was the due diligence?

And if you think investing in this rubbish was just for the financially illiterate, then you’re wrong.

In January 2022, came this headline from CNBC:

|

|

| Source: CNBC |

As reported at the time:

‘The Bahamas-based company said Monday that it raised $400 million in a Series C financing round — its third fundraise in the last nine months.’

Who invested US$400 million into what was an obvious scam (and that’s not me being wise with hindsight, my views on this toxic rubbish are well documented)?

Here’s the walk of institutional shame…which includes some pretty powerful and supposedly sophisticated investment houses…

BlackRock, SoftBank, Tiger Global, ICONIQ Capital, Thoma Bravo, Third Point Ventures, Altimeter Capital Management, Lux Capital, Mayfield, NEA, IVP, Insight Partners, Sequoia Capital, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings.

Those charged with doing due diligence obviously weren’t quite as thorough in the discovery process as they should’ve been.

Why?

They were either ‘wet behind the ears’, blinded by SBF’s self-promoted brilliance, baffled by his BS, or all of the above.

On 4 July 2022 (the day before Brady took flamethrower in hand), The Gowdie Letter warned:

‘The crypto pyramid is collapsing

‘Previous bouts of crypto price volatility occurred within the bubble inflation period. Low interest rates. Abundant liquidity. Rampant speculation. This trifecta of positives combined to take the Everything Bubble’s most speculative of assets, on a roller coaster ride to higher highs.

‘Bitcoin finally topped out in November 2021…hitting an all-time high of US$68k. HODLers believe US$68k is only a fraction of what bitcoin is really worth. I disagree. When the Everything Bubble finally bursts, the really worth of bitcoin is going to be a fraction of US$68k.

‘What the idealists fail to accept or realise, is that since the crypto boom and bust in 2017, the structure supporting this Pyramid Scheme has changed dramatically.

‘If we go back to the events of 2017, bitcoin started the year just under US$1k. On 18 December 2017, bitcoin hit an intraday high of US$19,783.

‘Was this extraordinary price action the work of a free market doing its thing?

‘Not according to research conducted by the University of Texas.

‘From Cointelegraph on 13 June 2018:

|

|

| Source: Cointelegraph |

‘To quote from the article…

“A paper released June 13 by John M. Griffin and Amin Shams of the University of Texas suggests that transaction patterns show Tether was ‘used to provide price support and manipulate cryptocurrency prices’.

“Half of the Bitcoin price rise in December 2017, when the cryptocurrency reached all-time highs around $20,000, was explicitly due to Tether and issuer Bitfinex, the researchers claim.”

‘In December 2017, Tether had a market capitalisation of US$1.1 billion.

‘By today’s standard, where Tether has a market cap of US$66 billion, it was a relative minnow back then.

‘But, in 2017, that US$1.1 billion was enough to…provide support and manipulate cryptocurrencies prices.

|

|

| Source: CoinGecko |

‘The crypto faithful point to the 2017 boom and bust and subsequent price revival, as a sign of the resilience of the crypto dream.

‘WRONG!

‘Prior to 2017, the crypto movement had gathered a solid following of believers. People who genuinely wanted an alternative financial system.

‘The fraudsters and swindlers recognised that naivety on this scale was simply too good of an opportunity NOT to exploit.

‘Spin the narrative of “be part of the revolution brother”.

‘Establish the infrastructure to enable people to participate more easily in the dream (every Ponzi scheme need a flow of fresh funds).

‘Develop a complex network between like-minded charlatans to shuffle money around. Creating the illusion of genuine trading activity to draw in greedy non-believers with dollar signs in their eyes.

‘In reality, 2017 was test run for a much bigger con.

‘After 2017, the puppet masters went to work building an elaborate web of digital asset lenders, stablecoins and exchanges.

‘At its peak, Tether had a market cap of US$80 billion.

‘If you could manipulate prices with US$1.1 billion, what would a war chest of US$80 billion enable you to do?

‘If you want a glimpse at the interconnectivity of crypto entities, read this excellent blog from David Gerard.

‘A Twitter feed from “Ape Digest” on 25 June 2022 provided a spreadsheet on the crypto contagion…

‘Terra and Luna should also be on this list.

|

|

‘These fallen cryptos are part of a much larger web of deceit.

‘As the foundations crumble and the scammers start scamming each other, the “name and shame” spreadsheet is destined to be expanded.

‘The collapse in the pyramid’s infrastructure (with the price manipulators and narrative makers going out of business) is one reason why there will be no repeat of the post-2017 crypto price action. But there are other reasons…

- ‘Due to the amounts lost and levels of fraud exposed, the developed world regulators will unite as one and come down on this stuff like a tonne of bricks. The wild west is over.

- ‘The trifecta of positives — low interest rates; abundant liquidity; speculative fervour — are turning negative.

‘The absence of new money has always been the death knell for pyramid schemes. Without buyers willing to part with (the once loathed) fiat money for crypto coins, those holding this stuff will be trapped in a world that’s far removed from the dream they were sold…a little like how subprime borrowers felt in 2008/09.’

The scammers have turned on each other.

US regulators are coming.

The con is collapsing.

Devout crypto cult members can’t handle this truth.

Perhaps, one day, something of value might be salvaged from the crypto ashes.

But here’s a word of advice…if it’s a token named Phoenix…run a mile.

Oh, by the way, what happened to the price of real gold as this digital (fool’s) gold was collapsing?

Yep…it went up.

The truth wins out in the end.

For an in-depth look into the value of real resources, with real economic demand and real supply limitations…which provides them with real investment potential…be sure to register for ‘The Age of Scarcity’ presentation, which goes live tomorrow.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia