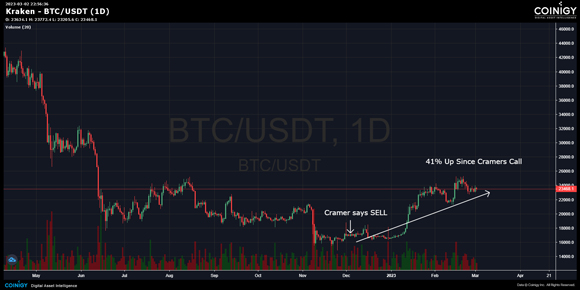

On 5 December 2022, CNBC’s Jim Cramer urged his viewers to exit crypto.

He said:

‘It’s never too late to sell an awful position, and that’s what you have if you own these so-called digital assets.’

How’s that call going so far?

Check out the chart:

|

|

| Source: Coinigy |

Three months after Cramer’s call, Bitcoin [BTC] is up an almighty 41%.

Some altcoins are up by triple digits.

This fact might surprise you.

Especially if you only follow the mainstream news on crypto.

They’ve spent the last year (the last decade, if truth be told) saying how crypto was a ‘useless’ asset, a scammy industry, or worse.

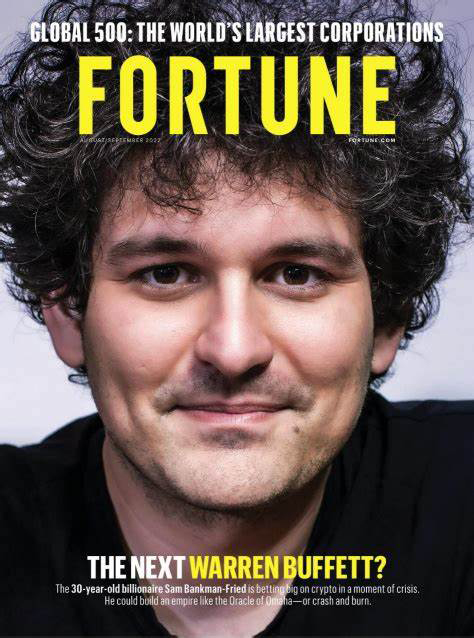

Though, funnily enough, the one entrepreneur in the space they all seemed to get behind was this guy:

|

|

| Source: Fortune |

I mean kudos to them, I suppose.

They actually managed to back the biggest scammer in the entire crypto industry!

Like Cramer, these people are useful for their consistency in getting it wrong.

The cold hard truth is that the mainstream has never had its facts right about bitcoin or crypto.

And from what I’ve seen and read this past year, they’re not going to change any time soon…at least until it’s far too late for you to do anything about it.

For example, they’re not telling you any of this…

Big brands quietly make their moves

Nike, Adobe, Starbucks, Disney, Adidas, DraftKings, Mercedes, Meta, Reddit, and hundreds of other big-name companies are all actively developing blockchain-based products for their customers.

Disney’s CEO said:

‘We forget, in our generation, that things don’t have to be physical. They can be digital, and they have meaning to people. And as long as that meaning can be essentially substantiated in a blockchain, I think you’re going to see an explosion of things being created, traded, collected in NFTs.’

Elsewhere…

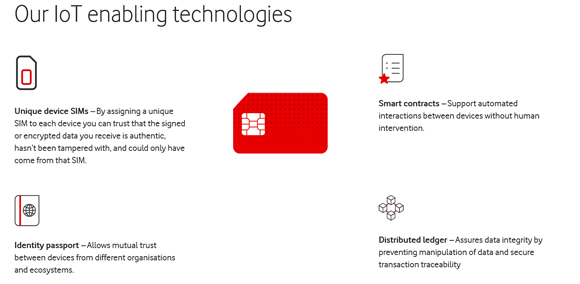

Vodafone, the seventh-biggest telecommunications company in the world, has plans to create a platform to connect the world’s devices — the so-called ‘internet of things’.

According to the company, it’s a US$12.6 trillion opportunity to radically change supply chains, point-of-sale financing, energy markets, and transport solutions.

And it’s also using blockchain technology, as you can see in this diagram:

|

|

| Source: Vodafone |

And even in finance itself, the big banks don’t want to be left out, no matter what they say in public.

For example, a few months back, JPMorgan — a company with a CEO that’s been a very vocal critic of crypto since 2017 — quietly patented its own ‘crypto wallet’.

As reported:

‘In November, the U.S. Patent and Trademark Office approved the bank’s trademark application for the “JP Morgan Wallet,” which is designed to transfer and exchange virtual currencies, facilitate crypto payment processing, and support virtual checking accounts and financial services in general.’

As the old saying goes, ‘look at what people are doing, not what they’re saying’.

And you can bet your bottom dollar, as soon as they’re all set, they’ll change their tune on crypto quick smart.

With a compliant media cheering them on, of course.

The clock is ticking on your chance to claim a stake in this inevitable future. And if history repeats a fifth time, you have less than 12 months to get in.

Let me explain why…

A look under the hood

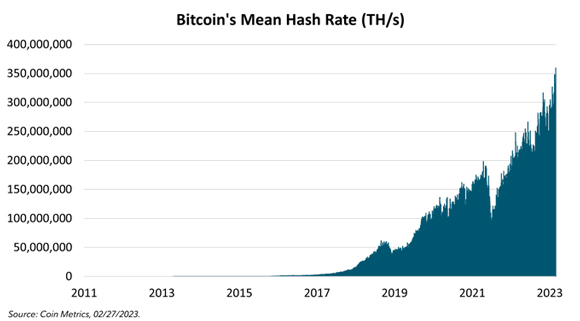

If you ignored the price action and just looked at the raw data, you’d see that bitcoin has never looked stronger.

You can do this quite easily with bitcoin because everything is on a public blockchain.

The good news?

The on-chain data is showing some very bullish signals, even while the ‘Cramers’ of the world continue to stir up panic.

First up…

The security of the world’s premier decentralised network has never been stronger:

|

|

| Source: Coin Metrics |

I won’t go into the complexities of this. But the gist is, the higher the hash rate, the more secure it is.

It also means, despite the pessimism, bitcoin miners are happy to spend money to get the ‘mining’ reward of newly issued bitcoin.

This is a strong show of confidence in the future price.

Secondly…

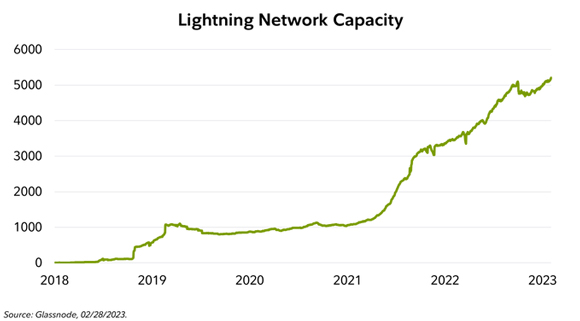

The Lightning Network — a layer two built on top of Bitcoin that helps it scale — continues to gather pace:

|

|

| Source: Glassnode |

Jack Dorsey’s fintech company, Block, announced last Friday they’d be supporting the Lightning Network by deploying part of their bitcoin holdings onto it.

The goal is to help with the reliability of the emerging payments network, which is still a work in progress.

But there are two interesting consequences to the growth of the Lightning Network.

First, it ‘locks in’ more bitcoin, meaning more supply available for sale is taken off the market.

Secondly, Lightning allows bitcoin holders to generate yield on their holdings as they share in any transaction fees they help pass on.

When institutional investors realise this — that unlike gold, you can earn yield on bitcoin — the investing equation radically changes.

And lastly…

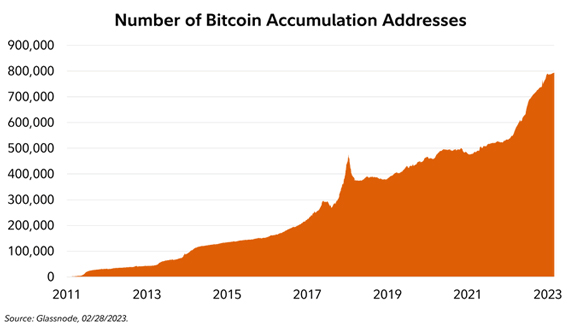

The diehards, the so-called ‘hodlers’, are soaking up every last bit of bitcoin they can.

An astonishing 67% of existing bitcoin hasn’t moved in the past 365 days:

In other words, these are the people who have taken everything last year could dish out and yet continue to hold.

Let me tell you, they’re not the type of people to sell into a ‘small’ 41% price pump either!

In fact, they’re still accumulating, as this chart shows:

|

|

| Source: Glassnode |

How can these people be so confident, you might be asking yourself.

Well, we’ve been here before…

60,969 blocks to go

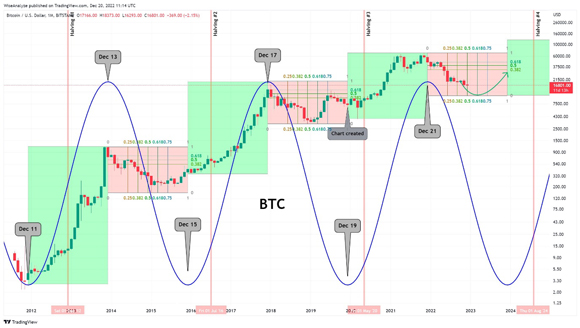

Here’s another chart for you:

|

|

| Source: Coin Metrics |

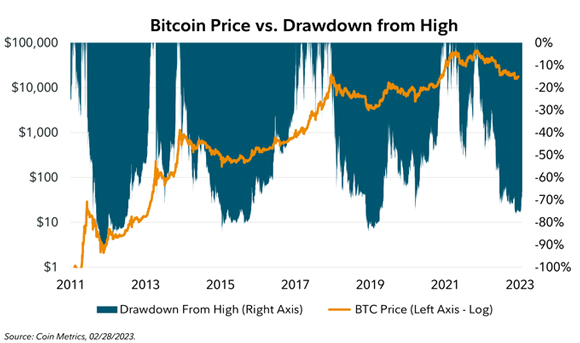

As you can see, bitcoin has had four price drawdowns of more than 70% prior to 2022’s price collapse.

And each time, it’s recovered to new all-time highs (that’s north of US$69,000 today).

These repeatable price cycles closely follow Bitcoin’s halving schedule.

This is when the reward paid to miners — the people that secure the network by dedicating computing power — is cut in half.

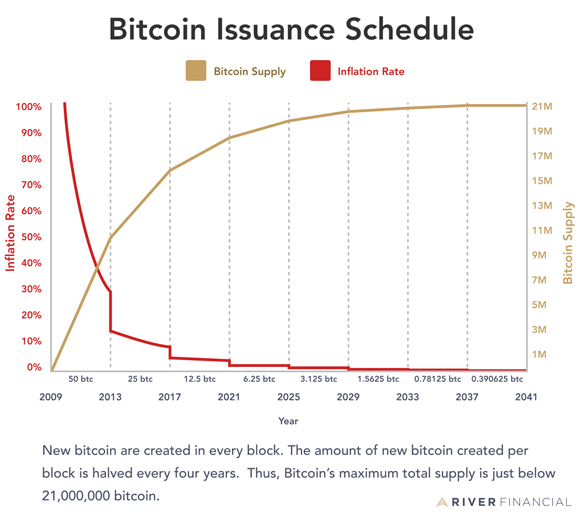

You can see the schedule here:

|

|

| Source: River |

Over time, less and less new bitcoin is created as we approach the 21 million hard cap.

Historically, bitcoin has tended to rise in value as we approach each halving.

Check out this chart:

|

|

| Source: Binance |

It’s pretty easy to see the pattern here.

So what drives this predictable price cycle?

Well, each halving re-highlights the in-built scarcity of bitcoin.

It’s a stark contrast to fiat currencies, which have no ceiling on how much can be created.

As I type, there are 60,969 blocks (a block is added to the blockchain every 10-minute containing valid transaction on the network) until the next halving.

But in my experience, the price tends to lead well in advance.

Beyond the price dynamics, though, now is the perfect time to actually try and understand what crypto and bitcoin really are.

I’ve been in this space since 2013 when bitcoin was sitting at US$600.

And I can guarantee you, if you’re getting your information on this from the likes of Cramer, you’re missing 99% of the picture.

This is a risky industry to get involved in and it takes time to understand it properly.

That’s why downcycles in the price are the perfect time to do it.

You get in at a cheap price, and you have the time to understand properly what you’re actually invested in.

The alternative — waiting for the next crypto frenzy — usually ends in tears, unfortunately. Bull markets are full of noise and scammers looking to take advantage of the unwary.

You don’t want to fall into that trap.

That’s why now is the time to get interested.

The clock is ticking…

Good investing,

|

Ryan Dinse,

Editor, Money Morning