The real estate industry doesn’t get much time to kick back through the year, and as we approach the end of January, Australia Day signals the final weekend before the auction action starts again, and we’re thrown back into the thick of it.

And with that, there’s still plenty of market uncertainty.

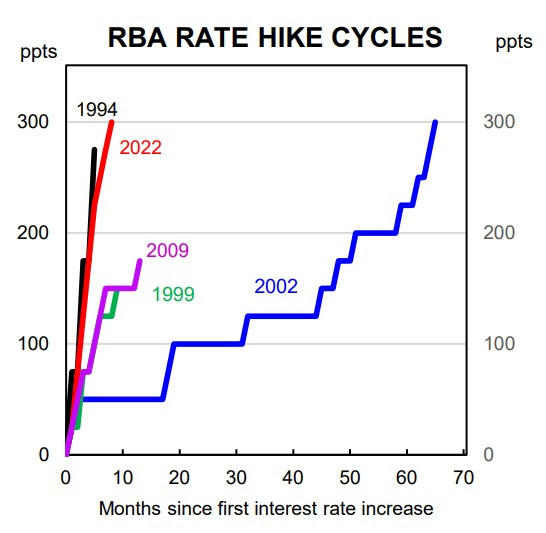

As my good friend, Pete Wargent pointed out in his daily blog this week — we’ve experienced the most dramatic interest rate hiking cycle in living memory, and everyone is questioning how much further the Reserve Bank will go before taking a breather…

|

|

| Source: CBA |

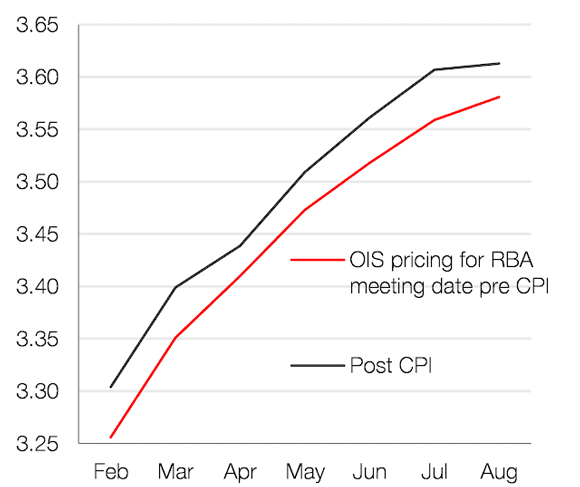

‘Before today’s inflation figures markets were fairly well split on whether there would be pause in two week’s time.

‘That no longer looks to be on the table, with a 25 basis points rate hike mostly priced in.

‘OIS pricing was nudged modestly higher immediately after today’s inflation print, suggesting that the cash rate target by the time of the July and August meetings could be 3.60 per cent (i.e. effectively two further interest rate hikes of 25 basis points each).’

|

|

| Source: Martin Whetton, CBA |

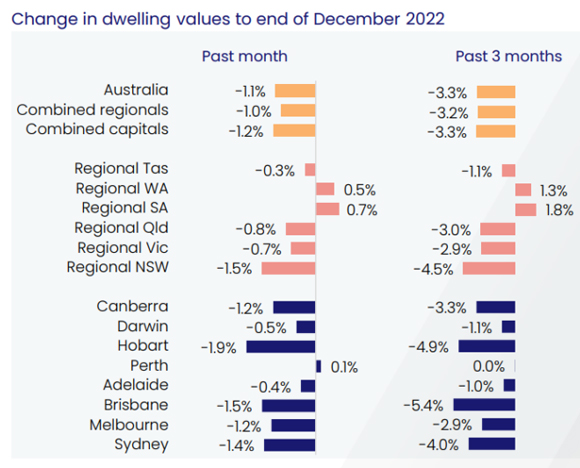

CoreLogic’s December dwelling value results show that monthly and quarterly home prices have fallen across every market in Australia — with the exception, that is, of Western Australia and regional South Australia:

|

|

| Source: CoreLogic |

In fact, after a decade of going nowhere in the first half of this cycle, Adelaide’s housing market is finally gifting rewards to its landowners.

According to Domain, Perth and Adelaide are the only capital city markets to end 2022 at a record high.

In Adelaide, prices have continued to rise since December 2021, with no downturn recorded.

|

|

| Source: Domain |

|

|

| Source: Domain |

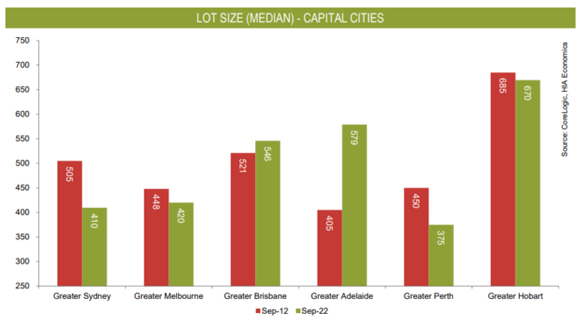

Despite the 2022 downturn and dramatic rate hikes, land has been a solid investment for Australians over the past 10 years.

And the Albanese Government’s ‘Big Australia’ policy ramping immigration to record levels gives a good indication that it will continue.

It’s these types of policies that have gone some way to ensuring a median lot price across Australia’s two largest cities, Sydney and Melbourne, have more than doubled in the decade to September 2022.

That’s despite shrinking in size as developers maximise their profits by cutting lot sizes to a minimum and building to the boundary.

From macrobusiness.com.au:

‘The HIA-CoreLogic Residential Land Report has been released, which shows how Australian residential lot prices have soared over the past decade on the back of cheap credit, extreme immigration, and supply constraints…

|

|

| Source: CoreLogic |

‘This surge in median lot values came despite the median lot size shrinking across both markets:

|

|

| Source: CoreLogic |

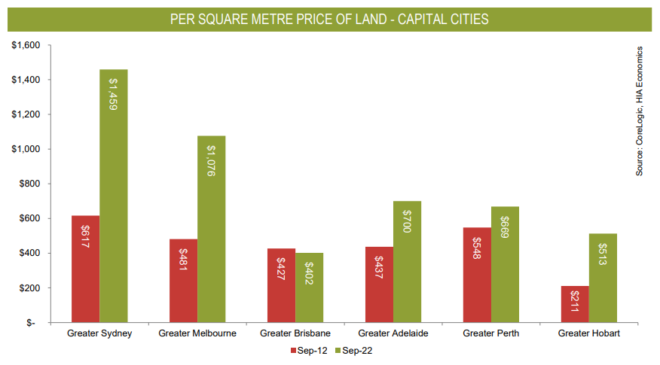

‘Accordingly, the land price per square metre rose even more aggressively across Sydney and Melbourne in the decade to September 2022:

|

|

| Source: CoreLogic |

‘The price per square metre has also risen across the other capital cities with the exception of Brisbane; albeit by far less than Sydney and Melbourne.

‘Sadly, Australia is transforming into a nation where housing choice is becoming limited to an expensive shoebox apartment or an expensive tiny lot on the fringe far away from amenities.’

Indeed — which is perhaps why one land-banking family in The Ponds near Quakers Hill, have steadfastly refused to sell their land to developers despite the big cheques that have been waved in their face.

The two-hectare site is surrounded by a new estate of grey houses on handkerchief blocks of land giving a bizarre view of a property that’s now worth no less than estimated $50 million!

From Pete Wargent:

|

|

| Source: news.com.au |

‘A local real estate agent has praised the Zammit family for staying put, despite the big cheques they have likely been offered.

‘Depending on how far you push the development plan, you’d be able to push anywhere from 40 to 50 properties on something like this, and when subdivided, a 300 square metre block would get a million dollars.’

The bottom line here is, there’s always a way to win in the market, if you know what, where, and when to buy.

Still, it really doesn’t matter how good you are at finding great properties.

If you don’t have the knowledge to negotiate them effectively, you’ll come unstuck.

Negotiation is all about mastering the art of communication.

Whether verbal, written, body language, or simply knowing when to talk and when to stay silent.

So today, to commemorate Australia day (on which I write this), I’d like to share an interview I recorded for my podcast Cashmore’s Real Estate with one great Australian in our midst.

Steve’s skills in behavioural analysis are bar none.

In 1996, van Aperen was a police detective who had worked on many high-profile cases, including the disappearance of Azaria Chamberlain.

He was interested in psychological profiling:

‘I wanted to know what made serial killers and serial sex offenders tick.’

He wanted to know why some detectives, including himself, weren’t very good at spotting a liar.

He went to the FBI academy in Quantico, Virginia, for some training and subsequently became the first Victorian police officer to become a qualified polygraph examiner.

However, even while doing his polygraph training, he thought it would be much more effective to have the skills to determine when someone is lying without using a polygraph!

‘From that date on it became a full-time career’, he explained.

Steve has spoken at more than 600 conferences and seminars throughout the world attended by thousands of delegates.

He delivers training programs and one-on-one training to CEOs, government departments, executives, fund managers, analysts, recruiters, sales teams, managers, investigators, the finance sector, media…and many others.

He’s known as Australia’s human lie detector, but his techniques cover much more than this.

In the interview, we discuss how to develop the ability and skill sets to read people like a book during the sales process, meetings, interviews, and how to detect deception.

We discuss the importance of controlling your emotions prior to any negotiation and how to use these skills to build resilience in everything you do.

I hope you enjoy the chat as much as I did!

I think you’ll find the information extremely valuable.

Click here to listen now.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments