Yancoal Australia [ASX:YAL] finds itself at a crossroads as it grapples with falling profits and an ambitious growth strategy.

The Chinese-controlled thermal and soft coking coal miner and exporter has reported a significant drop in first-half earnings, with after-tax profit plummeting 57% to $420 million, down from $973 million in the same period last year.

This stark decline was not the major factor hitting the share price today. The company also announced it would not be paying a dividend for the half, as it eyes potential acquisitions.

Yancoal’s share price took a severe hit after the news, plunging more than 17% to $5.77 by noon. The price has recovered slightly to $5.99, which puts the company’s 12-month return at 18.9%.

Despite this, Yancoal appears to be playing the long game. The company is actively building a war chest for potential acquisitions, particularly eyeing metallurgical coal assets to balance its portfolio.

With global coal prices in a slump and investor sentiment cooling, is Yancoal’s strategy a masterstroke or a misstep?

Source: TradingView

Profit Slump and Dividend Suspension

Yancoal’s financial results paint a challenging picture for the first half of 2024.

Revenue slid 37% to $3.14 billion, while the average received coal price dropped 37% to $176 per tonne.

While prices were lower, the company increased its total saleable coal production by 18% to 17.0 million tonnes.

The company also reported a total run-of-mine (ROM) coal production on a 100% basis of 27.9 million tonnes, up slightly from the first half of 2023.

The higher production saw their cash operating costs fall by 7%, and the company said it expects this to fall further in the second half as ‘production is expected to be significantly skewed towards the second half of this year’.

These silver linings weren’t enough to sway investors, as the shock decision to suspend dividend payments saw heavy selling occur before noon.

CEO David Moult emphasised that this move is part of a broader strategy to position the company for future growth opportunities:

‘We want to be in a strong position. We want to be in a position where we can respond, and we want to be in a position where we can respond in a way where we can acquire, if they become available, assets that will add further value to shareholders.’

But where exactly are they looking? And is the drop an opportunity for investors looking long-term?

Acquisition Strategy Unveiled

Yancoal’s leadership has made it clear that they’re on the hunt for acquisition opportunities, with a particular focus on metallurgical coal assets.

The company is rumoured to be in the mix for Anglo-American’s Australian metallurgical coal mines, with offers due by 9 September.

Moult stated today:

‘We’ve made it quite clear over recent times that our preference would be for metallurgical assets if they became available. We do look at other thermal assets, but at the end of the day, we’ve got, in my opinion, the three best thermal coal mines in Australia.’

This strategy seems to be a play to replicate the success of their 2017 acquisition of Coal & Allied from Rio Tinto for US$2.45 billion, which brought the Hunter Valley Operations and Mt Thorley Warkworth into the business.

Yancoal Outlook: Balancing Act in a Volatile Market

While Yancoal’s strategy to build a war chest for acquisitions could position it for long-term growth, it comes with significant short-term risks.

The suspension of dividends has clearly rattled investors, who sold heavily today as they hunt for more secure income stocks.

For this decision to pay off, Yancoal will need to manage shareholder expectations and clearly communicate its long-term vision.

That’s difficult in a market that is largely discounting the future of coal.

The global coal market remains unpredictable. While Yancoal is betting on future opportunities, continued price slumps would further erode profitability.

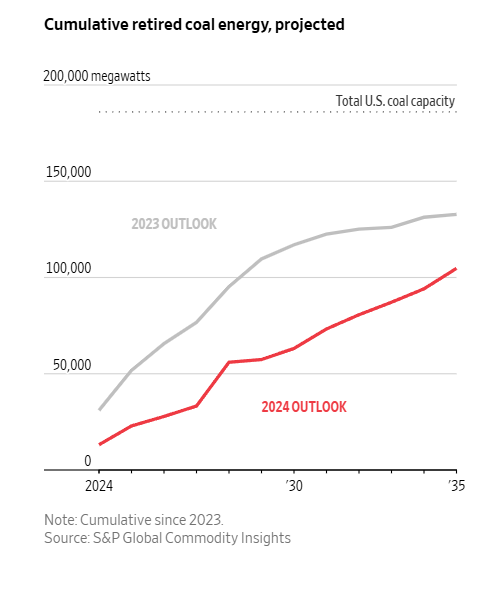

To be fair to Yancoal, politicians, analysts, and markets have overestimated the reduction of coal these past few years.

In the US, similar coal power phase-out plans have been pushed back as coal generator extensions doubled from 2021 to 2022 and beyond.

Source: S&P Global — WSJ

There could be a chance similar shifts are seen in Australia as we come to terms with our own power generation needs in the world of power-hungry AI.

Even if that happens, it’s still clear coal is in a 20-year decline. It struggles to compete with cheaper natural gas and renewable energy projects, and climate goals will see it shunned politically.

But a shorter-term need for power could still give it a second wind.

Yancoal’s focus on metallurgical coal could be seen as a strategic pivot. Metallurgical coal, used in steel production, is likely to face less immediate pressure than thermal coal used for power generation.

Even with the lower coal prices, Yancoal has managed to increase production volumes, which could help offset some of the impact of lower prices.

The company expects its cost per tonne to reduce to $89–97 in the year’s second half.

Investors will be closely watching Yancoal’s moves in the coming months. The success of this strategy could determine whether the company emerges as a stronger, more diversified player in the global coal market, or if it has overplayed its hand in a challenging environment.

It’s next acquisition could be the make or break.

Takeover Season Here

Yancoal is not the only company currently out there looking to acquire big targets.

Takeover season is here and investors should be on the lookout for junior miners who hold incredible assets and could see amazing share price gains.

With the upcoming commodity supercycle ahead, Geologist James Cooper has been on the lookout for world-class mines held by smaller companies.

Just take REX Minerals back in July. The tiny company got an offer which saw their stock jump 63% in minutes.

But that isn’t the only one.

If you want to find out how you can access James’ handpicked targets, which he thinks could be next big winner.

CLICK HERE to read more and see how you can find the next Rex.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments