Will the XRO share price hit $100? It already has.

Xero, another of the big winners to come out of the COVID-19 pandemic, recently announced the acquisition of Waddle.

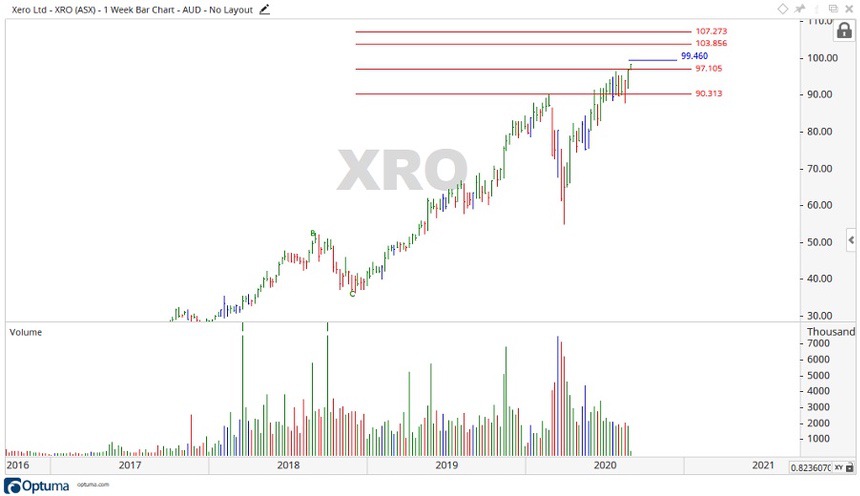

This new acquisition combined with the business conditions in the current climate are pushing Xero Ltd [ASX:XRO] ever closer to having a $100 share price, trading at $97.56 at the time of writing.

In today’s trading it initially broke the $100 mark, but the XRO share price then sold off on this potentially psychologically important level.

Source: Optuma

What’s happening at Xero?

Back in the days before COVID-19, Xero had been moving up in price consistently.

From February 2020, Xero’s stock price plunged over 39% into the March low.

The company recovered quickly, breaking the previous all-time high set in February.

This quick recovery allowed Xero to make the acquisition of Waddle.

Waddle is a modern invoice finance provider designed to help Australian businesses improve cash flow.

Waddle is designed to connect with Xero, MYOB, and QuickBooks.

With an upfront cash payment of AU$31 million and subsequent earnout payments based on product development and revenue milestones, of up to AU$49 million, the total potential consideration for the purchase of 100% of Waddle is AU$80 million.

With Waddle already designed to connect with Xero, it makes sense for the one to take hold of the other.

Xero CEO Steve Vamos commented:

‘The acquisition of Waddle is an important step in our strategy to help small businesses better manage cash flow and gain access to working capital.’

Where to from here for XRO shares?

The acquisition of Waddle could be a shot in the arm for Xero, who are already running on a high.

It will position Xero to partner with lenders globally, to better serve small businesses’ working capital and other financial needs.

Source: Optuma

Manage your books — and help you fix them up with financing.

They call this vertical integration.

The XRO share price is sitting on $97.56 at the time of writing, very close to the $100 mark.

This could prove a tough nut to crack, if it does then the levels of $103 and $107 may become the focus in the future.

Should the price start to fall back, then the levels of $97 and $90 may provide support to a decline.

Worth noting that the level of $90 was the all-time high set back in February, and could prove to be very strong.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown mega-trends. Download now.

Comments