Oil and gas giant Woodside Energy Group [ASX:WDS] shares are up by 1% today, trading at $37.62 per share as commodity prices continue to rise.

LNG and oil are up today, with Brent crude and WTI oil above the 52-week moving average price. Signs of tighter supplies and pledges from China’s leaders are the primary drivers as oil continues its fourth week of gains.

The timing could not be better for Woodside, who faced downward pressure last week after releasing its second-quarter report, which showed production and revenue were down from Q123.

Despite bumps in Q2 performance, Woodside’s share price is still up by 22.46% in the past 12 months as more investors move into the supply-constrained sector and realise the limitations of the promised energy transition.

Source: TradingView

Woodside’s quarterly update

Woodside shares are up 1% today, reversing any losses in share price after a shaky second-quarter report released last week.

Despite delivering fairly reliable production and sales volume, both experienced declines compared to the previous quarter due to planned turnaround and maintenance activities.

The company delivered quarterly production of 44.5 MMboe (489 Mboe/day), down by 5% from Q123.

As a result, revenues decreased by 29% from the first quarter — with an average of $63/boe.

Woodside CEO Med O’Neil commented on the Q2 update, saying:

‘Strong underlying operational performance in the second quarter was impacted by planned turnaround and maintenance activities, particularly at the onshore Pluto LNG facility and associated offshore facilities in WA.’

Full-year production guidance remains unchanged at 180–190 MMboe as maintenance will be offset by the early production at the new Argos platform ramps up.

The Argos platform began production in April this year and is part of Mad Dog Phase 2, located in the Green Canyon area in the Gulf of Mexico.

The project is a southern extension of the existing BP-operated Mad Dog offshore oil and gas field, which was discovered in 1998 and began production in 2005.

The Mad Dog field is estimated to hold more than 5 million barrels of oil.

Woodside also announced in its Q2 report that it has progressed on projects Scarborough, which is 38% complete, and Sangomar, now at 88% complete.

Approval for final investment decisions was also made for Trion and Julimar-Brunello Phase 3 projects which Woodside has an approximate 60% interest in the resources.

Both of these projects now await regulatory approval of the field development plan (FDP), which is expected in the fourth quarter of this year.

Outlook for Woodside

Despite the global focus on renewable energy and emissions reduction, the future of the oil and gas sector remains strong.

In recent news, OPEC+ supply cuts have kept prices pushing up while signals from Chinese leaders may open the door for increased demand from China as manufacturing there tries to find its feet.

This medium-term supply shortfall may continue to push prices higher, but there is also the risk of falling demand as government policies fund energy transition, and consumers switch habits.

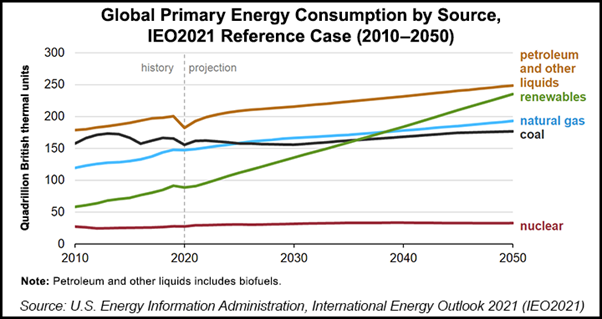

While there is increasing interest in electric vehicles (EVs) and renewable energy, oil and gas will likely play a crucial role in the energy transition for decades, not just years.

A good example can be seen in Norway, which has seen 80% of new car sales being EVs — now more than a fifth of the country’s fleet.

Despite this, total oil consumption has only fallen about 10% over the past decade.

The relatively small drop highlights the enduring demand for oil in various industries beyond transportation.

Source: US Energy Information Administration, International Energy Outlook 2021 (IEO2021)

The International Energy Agency forecasts continued oil demand growth until at least 2028, driven by the central role of oil in everyday life, particularly in the manufacture of numerous products such as solar panels, plastics, clothing, and medicine.

The underinvestment in oil exploration since 2014, compounded by the impact of COVID-19, has constrained supply and supported elevated oil prices.

Environmental, social, and governance (ESG) considerations have limited the sector’s growth but created an upside for shareholders.

Banks’ reduced lending has led to a more disciplined capital allocation by oil companies, resulting in higher dividends for shareholders.

Woodside Energy stands out as an attractive option due to its low production cost and minimal exposure to Australia’s uncertain east coast market — which has been subject to regulatory swings.

Woodside offers a 7% fully franked dividend that could be attractive to defensive investors.

Overall, the oil and gas sector will likely remain relevant, and investors stand to benefit from the potential dividends this sector offers.

If you are unsure about investing in oil and gas, or purely dividend income stocks, then there are other options.

Finding dividends that are worth your time

The market has been confusing for stock investors in the past year.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the best balance.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you may want to consider a different strategy.

Click here to learn more about what that looks like.

Regards,

Charles Ormond,

For The Daily Reckoning Australia