Gold enthusiasts have every reason to feel hopeful as 2022 draws to a close.

After what transpired over the last two years, such as the stomach-churning false rallies that left many disappointed, it seems like we might see a much brighter 2023.

It’d certainly be a welcomed relief, given that the last six months were particularly brutal if you owned precious metal mining stocks.

Given what occurred during the year — armed conflict between countries, trade sanctions, rampant inflation, economic recession, and irresponsible government spending — you’d expect that gold would be soaring.

Well, it did for a few short weeks, as you can see in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

When armed conflict broke out between Russia and Ukraine in late February, gold spiked as other assets retreated. This brought back the notion that in times of real trouble, gold is like no other asset, as I wrote at the time.

I believe that gold is the safe-haven asset, something that the US dollar tries to imitate but fails when a real crisis hits.

‘Transitory’ inflation, rate rises, and the fizzling gold rally

Things turned downwards for gold as the US Federal Reserve began raising rates in April. The Federal Reserve finally followed through on its rhetoric from the second half of 2021. Previously they were vigorously ignoring inflation and downplaying its intensity, calling it ‘transitory’.

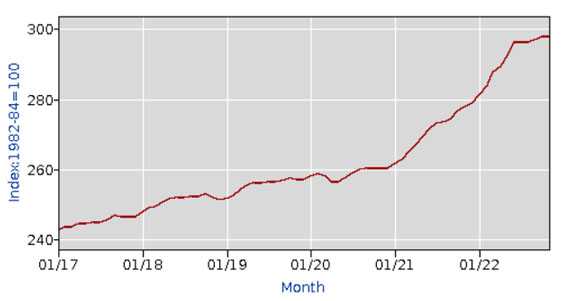

How transitory was it? Let’s check out the CPI in the US since 2017:

|

|

| Source: US Bureau of Labor Statistics |

Talk about inflation sticking around like a bad smell in the elevator!

So ‘transitory’ is inflation that Treasury Secretary Janet Yellen has recently said that it’ll likely remain till the end of next year.

Keep in mind that this is the same Janet Yellen who ‘did not expect to see a financial crisis in our lifetime’ back in mid-2017 when she was the chair of the Fed. Also, this same person didn’t see a property bubble before the subprime crisis.

Let me say this about Janet Yellen: Never let her seemingly ‘warm and harmless grandmother’ countenance deceive you for what she really is…an incompetent crank, at best, or a seasoned liar.

Either way, the financial system is in a dreadful mess and the people we trusted to fix the problem for us turn out to fan the flames further.

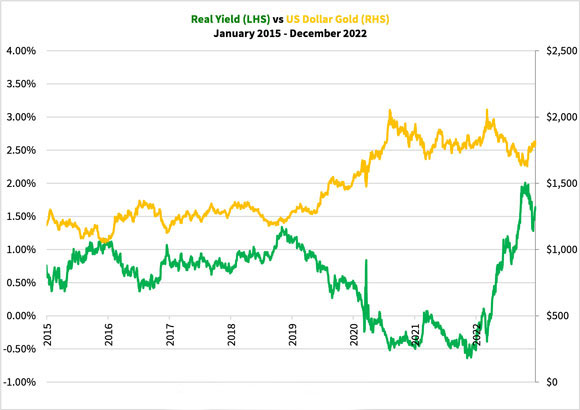

The rate rises from the Fed came hard and fast since April. To date, the Federal Funds Rate has risen 4.25% and sits at around 4.4%. Such a rapid increase has caused the long-term real yield to rise to a positive level, making the US dollar increasingly attractive as its purchasing power improved.

You can see below how gold fared as the long-term US Treasury bond yield climbed:

|

|

| Source: Fed Reserve, St Louis |

Like Cinderella’s wicked stepmother and her ugly sisters, the Fed rate rises dressed up the US dollar in a nice gown, slapped on some lipstick, and sent them to the ball.

Sadly, market investors courted it, leaving gold at the door.

The Bank of Japan blinks — signs of an unravelling

The interesting thing about central banks all raising rates at the same time is that, eventually, they get in each other’s way.

What do I mean by that? After all, haven’t their rate rises caused a slowdown in economic activity, more burden on borrowers, and savers finally enjoying a meaningful return on their bank deposits?

Well, there’s a bit more to it.

The role of monetary policy is essentially to try and create harmony in domestic productivity, inflation control, and foreign trade. The drivers of the domestic economy are GDP (Gross Domestic Productivity) growth, inflation, and interest rates. The international markets are driven by differentials of these domestic economic drivers and reflected by the exchange rates between different currencies.

Central banks try to manage their own economies through controlling two of the following — interest rates, inflation, or foreign exchange. It’s impossible to do all three, with the US dollar being the exception — I’ll explain very soon.

This leads to fluctuations either in the country’s inflation or foreign exchange rates.

In the case of the US, the dollar being the reserve currency gives them a slight advantage. It can kind of do all three. Other countries may peg their currency to the US dollar, or the US can issue more currency and have countries use the US dollar and absorb the impact on inflation.

This system works if central banks coordinate their monetary policy to accommodate the US dollar and give assurance to the debt and derivatives market. However, one wrong move could undo this increasingly fragile system, especially given the volume of debt and derivatives exposure globally.

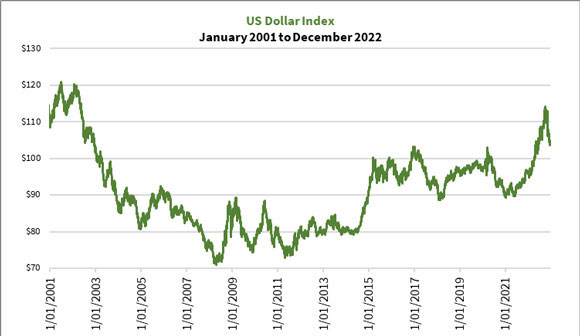

The US reserve currency status served its purpose well for much of this year, as you can see how the US Dollar Index rose to levels last seen 20 years ago:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

However, we’re starting to see cracks appear in this system and it’s about to get worse.

Earlier this week, the Bank of Japan shifted its monetary position and announced it’d adopt ‘yield curve control’. In other words, it’s adjusting its short and long-dated bond positions in the money markets to cushion the impact of greater volatility in the global markets on the Japanese economy. This is a pivotal signal to show that even the Bank of Japan may finally join in on raising interest rates, which have been in negative territory since 2016.

This move is significant because it could further weaken the US dollar, in turn threatening the US-denominated debt and derivative markets.

And that could roil the global markets.

Gold stirs and rises for a stellar 2023

The markets noticed the Bank of Japan’s move by selling down the US dollar, buying gold and the Japanese yen.

The broader asset markets are in a bit of a dilemma, as we’ve seen with the initial retreat followed by a strong recovery on Wednesday night trading.

On the one hand, prices rose due to the easing US dollar. But on the other, fears are rising due to expectations of greater uncertainty ahead as a weakening US dollar could threaten the already fragile debt and derivatives markets.

Most people don’t expect a crash to come. They’ve heard it so many times on the news about it, much like Peter crying ‘Wolf’.

But I believe that it’s more like Banquo’s ghost. It’s an ominous portent to wake people up and snap them of their complacency.

Gold is a good signal in this respect. It’s one of the few assets trading higher than at the start of the year.

Silver is also making a run for it too, gaining more than 30% since its bottom in early September.

Having bullion on hand could give you peace of mind should the financial system hit the rocks in the future.

Those who have the guts to speculate on the boon for precious metals should consider buying mining stocks. They’ve had a tough year this year, with the ASX Gold Index [ASX:XGD] falling 10% and many producers falling 30% or more.

Speculative gold explorers had it much worse, many shaving more than 50% during the year.

When things have been that bad, you’d be right to expect it can’t get that much worse. Should it recover, and history shows it does, you’re talking seriously good returns!

If that’s something you’re up for, consider my Gold Stock Pro service.

And with that, may you and your family have a Merry Christmas! See you in 2023!

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

PS: Due to the festive season, The Daily Reckoning Australia will have a modified publishing schedule next week. Expect to see special editions of Daily Reckoning Australia on Monday, Wednesday, and Friday next week — where you will get a glimpse at what our editors have been telling their paying subscribers recently on how to best navigate these sensitive market conditions. We will return to our usual daily publishing schedule on Tuesday, 3 January.