In 2018, MMT was all the rage among monetary and fiscal policy wonks. It seemed to offer the best of all possible worlds — unlimited spending with no concerns about debt, deficits, or inflation.

Politicians loved MMT, even if they didn’t understand it or hadn’t even heard the term. That’s understandable. One would be hard-pressed to find a politician who didn’t love a policy that allowed you to spend unlimited amounts of money without consequences.

Still, the MMT buzz did not last long.

In 2018, the Federal Reserve was raising rates aggressively (sound familiar?). As usual, they overdid it. From mid-September to Christmas Eve 2018, the major stock indices fell by almost 20% — the definition of a bear market. The Fed kept raising rates anyway, including a 0.25% rate hike on 19 December 2018, increasing the fed funds target rate to 2.5%.

That was the last nail in the market’s coffin. On 24 December 2018, the market staged the Christmas Eve Massacre. On that one day, the Dow Jones Index fell 414 points or 1.8%, the S&P 500 Index fell 2.1%, and the Nasdaq Composite Index fell a full 3%. A bear market was staring investors in the face.

The Fed got the message. By early January 2019, Fed Chair Jerome Powell said he would be ‘patient’ on further rate hikes. ‘Patient’ is code for ‘no more rate hikes without fair warning’.

On 31 July 2019, the Fed actually started to cut rates. These rate cuts continued until March 2020, at which point the COVID lockdown overwhelmed the economy, and the Fed cut rates to 0%, where they remained until the new rate hike cycle began in March 2022.

We followed these developments closely, yet no one was talking about MMT (except us). The course of 2019 was mostly about rate cuts to save the stock market. Republicans controlled the White House under Trump. They also controlled the Senate, so there was no serious possibility that MMT would be put into practise.

Everyone gets a cheque!

The pandemic of 2020 changed everything. MMT was still not a topic of discussion. It didn’t matter because MMT was being practised, even if by stealth. COVID relief and economic ‘stimulus’ was Job One.

Trump pushed through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) on 25 March 2020. It provided US$2.7 trillion in new spending, including US$1,400 cheques sent to every US citizen.

Then, on 21 December 2020, Trump signed another US$900 billion relief package, providing an additional US$600 cheque to every US citizen.

Not to be outdone, the new Biden Administration passed the American Rescue Plan Act of 2021 (ARPA), which provided another US$1.9 trillion of deficit spending and sent another US$1,400 cheque to every US citizen.

Bear in mind that in fiscal years 2020 and 2021, the US was already running a US$1 trillion baseline budget deficit. When you pile the Trump and Biden relief packages totalling US$5.5 trillion on top of the US$2 trillion baseline deficit, the total deficit in 2020 and 2021 came to an astounding US$7.5 trillion of new debt in just two years.

The runaway spending didn’t end there. On 15 November 2021, Joe Biden signed the US$1 trillion Infrastructure Investment and Jobs Act. This was followed by US$737 billion in new deficit spending for the Green New Deal in the misnamed Inflation Reduction Act of 2022 (IRA) signed by Biden on 16 August 2022. (The IRA claims some deficit reduction features, but these are smoke and mirrors. Savings were projected from interest rate reductions. In fact, the yield to maturity on a 10-year Treasury note has risen from 2.8% the day the law was signed to 3.9% today. So much for interest rate savings.)

The Infrastructure Act and the IRA added US$1.74 trillion to the deficit in stages over the coming years. Meanwhile, the US$1 trillion baseline budget deficits continue as if nothing happened. With fiscal 2022 added to the mix and these new deficit spending bills included, the total addition to the deficit over three fiscal years is more than US$10 trillion.

The entire national debt from George Washington in 1789 to Donald Trump in 2019 amounted to US$23 trillion. After Trump and Biden’s pandemic relief in 2022–23, today’s national debt is more than US$33 trillion. That’s a 43% increase in the national debt in just three years.

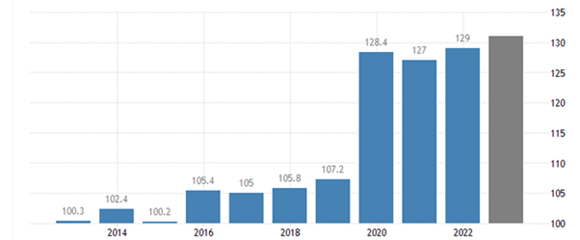

United States Gross Federal Debt to GDP

|

|

| Source: Trading Economics |

The US debt-to-GDP ratio has risen from a dangerously high 106% at the start of the Trump Administration to an astronomical 131% today — the highest in US history. For perspective, the other countries with a debt-to-GDP ratio of 130% or more include Lebanon, Greece, and Italy. The US is now a full-fledged member of the deadbeat debtors club.

MMT — hiding in plain sight

Does this debt and deficit debacle mean that MMT has achieved its goals and is now the guiding light for fiscal and monetary policy? The answer is: yes and no.

The ‘yes’ answer is easy to explain. MMT says that spending doesn’t matter, and deficits don’t matter. The US can issue as much debt as it wants and spend as much money as it wants. As long as the debt is denominated in US dollars and the Fed has a US dollar printing press, we can always monetise the debt with new money. Problem solved.

With US$10 trillion of new debt in three years and a 131% debt-to-GDP ratio, the US is certainly acting as if debt and deficits don’t matter. This is the essence of MMT.

The ‘no’ answer is more nuanced and political. It’s true that we are acting in accordance with MMT, but the MMT advocates are keeping their heads down. Why shouldn’t they? They are getting exactly what they want, and the Republicans have gone along with it.

Trump increased the deficit by US$4.6 trillion in his last year in office, almost half the US$10 trillion total increase under Trump and Biden together since 2020. There’s no need to push MMT or even discuss it if Republicans and Democrats are acting in accordance with it.

So, the US is implementing MMT without acknowledging or even understanding it. It now exists in practice, but it has not passed a political litmus test. The future of MMT hangs in the balance starting now.

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia