In today’s Money Morning…the devil is in the detail…a turning point for Australia’s future…all we can do is hope that they choose the right course of action…and more…

Dear Reader,

Well, well, well…

The federal government has thrown us all a curveball.

Josh Frydenberg has confirmed that digital payments and cryptocurrencies are set for a local overhaul, aiming to legitimise and regulate a new era of financial services for everyday Aussies.

As Frydenberg himself notes, it is likely to be the biggest shakeup to payments in a quarter of a century, pushing Australia to become a ‘world leader’ in the next frontier of money and commerce.

A bold move for any government, and a rather surprising one given the upcoming election.

Clearly, the coalition believes it can use this decision as a cornerstone policy — one that may win over not only the business sector, but also forward-thinking investors and crypto enthusiasts.

But let’s not get too ahead of ourselves yet…

After all, this announcement is merely the prelude to any actual reform. Which is why you should stay aware of it, but not necessarily get your hopes up.

The devil is in the detail

According to Frydenberg, we’re going to have to wait at least a year for any firm details.

The government has earmarked the end of 2022 to finalise any consulting and reporting. This information will then give them a framework to decide on which reforms to enact and how.

That’s certainly not a bad decision, as this isn’t something you’d want to rush.

It is going to take a lot of input from all sides involved in payments, including consumers like you and me, and balancing all these stakeholders’ needs and wants is certainly not going to be straightforward.

My concern, as I’m sure many others share, is how these stakeholders will be weighted, because as Michael Harris of crypto exchange Swyftx told Cointelegraph:

‘The devil will be in the detail though and we are especially keen to avoid a system that reduces customer choice by stacking the decks in favor of big, traditional financial players.’

The worst possible outcome is one that will stifle the natural innovation of these technologies, perhaps even empowering these traditional financial institutions at the expense of newer, more robust offerings.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

After all, the entire point of a payments overhaul is to make things more efficient and effective, not to shore up the providers and systems that are bogging us down currently.

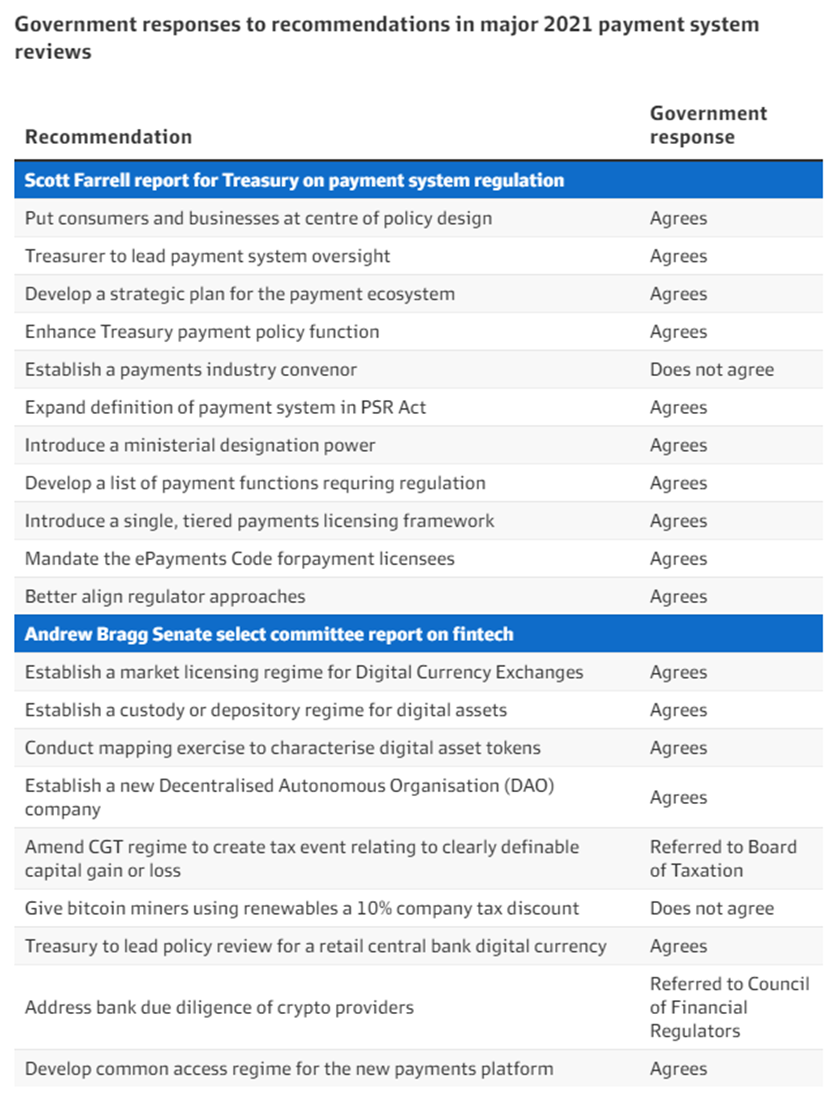

Fortunately, with the little insight we have, it doesn’t look like that is the case right now. Here is the current list of proposed recommendations and the government responses, summarised by the AFR:

|

|

| Source: AFR, Treasury |

A turning point for Australia’s future

So with this surprise reveal from the government, there are unfortunately a lot more questions than answers.

One of the most pressing, in my view at least, is the potential for a local Central Bank Digital Currency (CBDC). In other words, a crypto-like coin issued by the RBA itself — something that could end up replacing cash entirely.

If you’re a frequent reader of Money Morning, then you’ll know we’re not too fond of these CBDC abominations…because unlike their crypto counterparts, these digital coins aim to maintain the centralised status quo that fiat provides.

In other words, the central bankers would still have the ability to tamper with everyone’s money, a decision that totally goes against the decentralised power of the blockchain.

Plus, it incentivises the government to crack down on any competitors. All of which can be justified under the guise of consumer protections, or a need for currency stability.

That’s why we should all be sceptical of this payments overhaul.

But it certainly isn’t guaranteed to pan out like this.

There is still a chance that we could see the government give crypto and blockchain a chance to flourish naturally. An outcome that really could put Australia at the forefront of the financial revolution that we’ve discussed countless times already.

All we can do is hope that they choose the right course of action.

At the very least, though, we know we have a year ‘til change arrives. Whether it will be for better or worse, only time will tell.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.