The recent floods in Queensland and northern New South Wales have had a devastating effect on the property market.

It’s estimated that more than 17,300 Queensland homes were affected by flooding in the most recent crisis. And 9,200 homes in the Northern Rivers region of NSW.

Historically, floods have the greatest impact on the Australian economy of any natural disaster. And the magnitude of this event could turn out to be the costliest natural disaster Australia has ever experienced.

Some analysts have suggested it could wipe 0.5–0.7% of annual GDP growth.

That would have to be balanced against reconstruction efforts as well as rising food prices from destroyed crops.

But whether we slip into recession or not, the effects on the back pocket of the average Joe in the regions affected, are going to be lasting.

Compensation payments for a lost crop or loss of income doesn’t insure against loss of output in the following years.

We know some of what to expect from a 2021 study undertaken by Curtin University et al.

They analysed the effects on state GDP for 47 major floods and 36 major bushfires in Australia from 1978–2014.

Floods had the most devastating effect:

‘On average, a typical major flood in our study reduced a state’s output in the following sectors in both the year of the disaster and the subsequent year. The effects over the two years (compared to other states that did not have a disaster) were:

- ‘In mining, down 12.8% in the first year, 12% in the second;

- ‘In agricultural, down 5.6% in the first year, 6.2% in the second;

- ‘In construction, down 3.2% in the first year, 1.5% in the second;

- ‘In property and financial services, down 3.62% in the first year only;

- ‘In wholesale/retail trade, down 2.34% in the second year only; and

- ‘In recreation, down 2.93% in the second year only.’

As for the direct effect on property, a study from Queensland University of Technology et al. ‘Assessing the immediate and short term impact of flooding on residential property participant behaviour’ used data locally and internationally to conclude the following:

- ‘Sales listings fall immediately after the flood in the affected areas (but unaffected suburbs had no fall or increase in listings).

- ‘There was a significant decrease in the number of rental listings areas close to the flood affected suburbs.’

And significantly:

- ‘House prices could decrease by up to 17%, and in severe cases, values can take up to 10 years to recover to levels in non-flooded areas.’

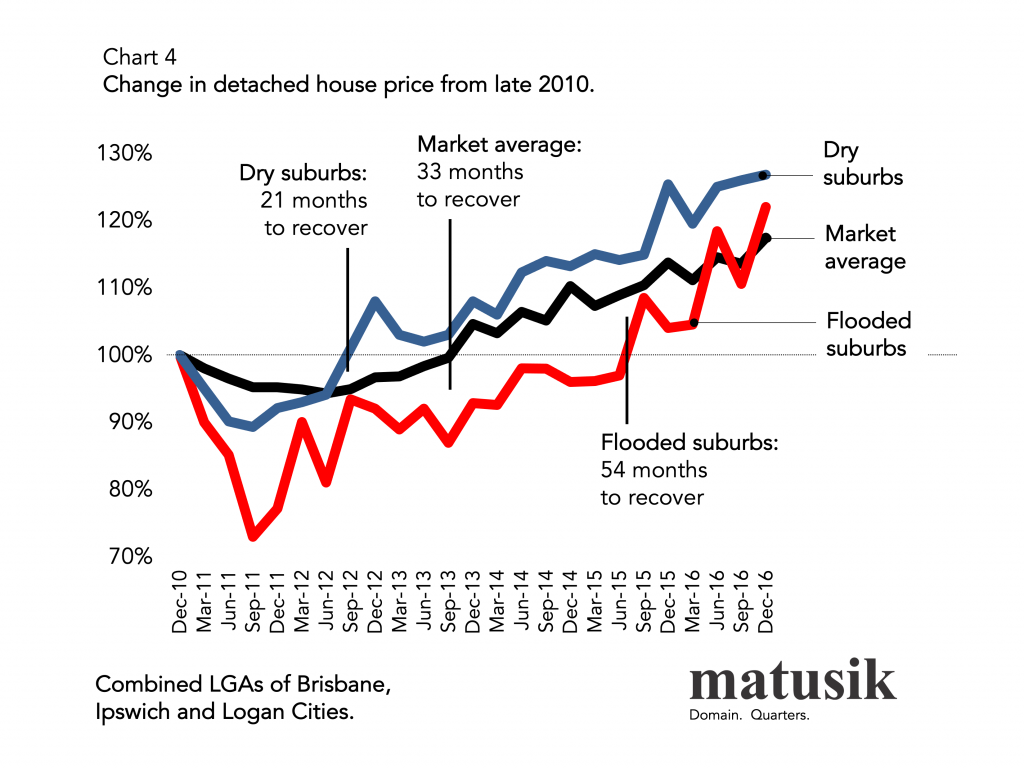

Queensland property specialist Michael Matusik has also written an enlightening paper looking back at the effect of the 2011 Brisbane floods on the market.

It’s well worth a read — the charts are priceless.

He shows:

- ‘It took 33 months (or just under three years) for Brisbane house prices to recover to the same level they were in late December 2010.

- ‘Suburbs not affected by rising flood waters took 21 months, on average, to regain pre-flood price points. Whilst it took, 54 months (4.5 years on average) in the flooded suburbs to recover.

- ‘Dwelling approvals fell for several years after the 2011 flood and there was an increase in the properties for sale, as some decided to sell rather than stay put and rebuild. (In comparison listings are in decline today.)’

|

|

| Source: Matusik Missive |

Putting this in context, the floods will of course have an immediate and lasting impact on the suburbs severely affected.

However, a few points to bear in mind here.

We’re at a very different stage of the property cycle compared to the last major flooding event in (2011/2012), which occurred in the first half of the real estate cycle (find out more here).

The second half of this cycle is extremely bullish for the smaller states by population.

South East Queensland has been capturing the lion’s share of population growth.

The state’s net interstate migration in 2021 hit its highest rate since 2005, with 31,000 new residents.

Vacancy rates in the flood affected areas are at decade lows.

In regional locations across Northern NSW and South East Queensland, the vacancy rate is close to zero.

Inflation and shortages of building materials, along with an increasing number of insolvencies in the development sector, will additionally put a hand break on construction and hit recovery efforts.

As such, established housing in non-affected areas will continue to fall under increasing high demand.

Add to this the opening of international borders, and it continues to be an overall bullish story for the South East Queensland and the regional property markets outside of those regions directly affected.

(Note: Regardless of what state or territory you buy in, it’s prudent to always check the zoning certificate to assess if a site falls in a flooding zone. The detail will be listed in the overlays that affect land and typically result in higher construction and insurance costs.)

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia