The last three years saw governments around the world engaged in unprecedented borrowing and spending. It unleashed a massive glut of liquidity that caused many assets to rise.

Gold benefited from that, but it just didn’t rise as you’d expect from 2001–11…after September 11, the War on Terror, the subprime crisis, and the US credit rating downgrade.

You can see in the figure below how gold in US dollar terms performed since the turn of the millennium:

|

|

|

Source: Thompson Reuters Refinitiv Datastream |

Let me be clear though…gold is in a bull market. However, it has recently been trading in a tight range between US$1,610–2,080. And because of that, many investors seem to be moving towards other assets that are offering more attractive returns than gold.

In theory, gold should rise more than it has. After all, it’s a proven store of value over the course of history. With the world slowly drowning in debt, the excess amount of currency flowing into the global economy should mean gold is soaking it up.

Global debt was estimated to be US$80 trillion in 2000, increasing to US$200 trillion in 2011. It continued rising steadily, and by 2019, it was at US$250 trillion. Within two years, it jumped to US$290 trillion by 2021 and is now over US$300 trillion.

So, debt rose by 150% in 2000–11, while gold rose almost nine-fold over the same period. Since 2019, global debt increased between 10–15% and gold increased by around 60%.

If you consider the increase in global debt in absolute terms, the last four years saw debt rise by just under half of that in 2000–11.

So, you’d be right to say that the rise in gold has been a bit underwhelming.

Today, I’m going to write about why that’s the case. Understanding this can help you weigh up the future potential of gold, silver, and its related assets. In turn, it’ll help you in positioning your portfolio to capitalise on the rewards on offer.

Gold behind the eight-ball

Last week, I attended the Australian Gold Conference at the Crown Towers Barangaroo in Sydney. This event brought together the precious metals industry, gold and precious metals mining companies, as well as private investors, to offer them an opportunity to share knowledge and insights.

My conservative estimate was that over 200 delegates attended the event over the two-day event. The atmosphere was relatively subdued given that gold mining companies have underperformed in the market for the last two years. Small-cap explorers, who formed a large proportion of the delegates in this event, have been especially pummelled over the same period.

Part of the reason for a lack of interest in gold stocks, especially explorers, is that the profitability of the larger producers suffered a hammering in the last 18 months. This is due to labour shortage and a sharply rising price of oil.

There were two events in this conference that I found highly relevant to today’s discussion. The first was a sessional address by Hedley Widdup, fund manager at a specialised resources investment fund Lion Selection Group [ASX:LSX]. The title of his address was ‘A tale of two commodities’, which covered the stark contrast in investor sentiment between lithium and gold.

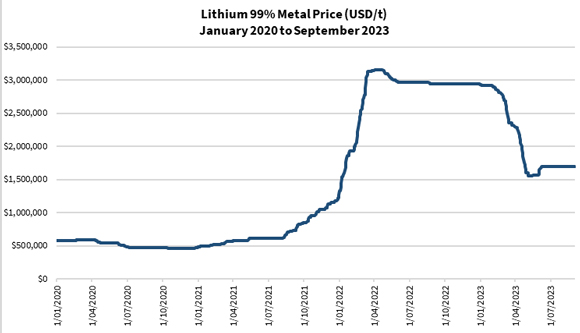

Many of you won’t need me to tell you about the bull market in lithium over the past five years. It’s likely many of you who read Fat Tail Commodities own lithium stocks such as Pilbara Minerals [ASX:PLS], Mineral Resources [ASX:MIN], Allkem [ASX:AKE] and Liontown Resources [ASX:LTR], possibly even making quite a killing in recent times.

Just look at the price of lithium in recent times in the figure below:

|

|

|

Source: Thompson Reuters Refinitiv Datastream |

Suffice to say, the enthusiasm by international think-tanks, governments, and certain businesses to embrace and rush through the clean energy revolution has played a huge role in fuelling a lithium boom. This in turn caused many resource investment funds and private investors to jump on board the lithium train.

Recall that price is a measure to reflect the flow of funds. It’s that simple.

Even at the conference, I noticed that several gold explorers paid homage to lithium and rare earth elements (REE). Those who discovered these metals on their properties enjoyed a flurry of buyers joining their share registry, pushing the share price upwards.

I’ve seen several companies enjoy a boom off the back of lithium and REE while the pure precious and base metals plays are looking forlorn. That’s just the way it is.

The other event I wanted to mention was the panel discussion about the future for the price of gold, featuring Sean Russo of advisory firm Noah’s Rule, Lynette Zang, Barry Dawes (Executive Chairman of broker Martin Place Securities), Jordan Eliseo (General Manager at ABC Bullion), Alex Scanlon (CEO of South Australian mining explorer Barton Gold Holdings [ASX:BGD]) and Hedley Widdup.

The consensus among this panel was that there are many events looming that could threaten to destabilise the world geopolitically and financially, and that gold has a track record of providing stability in such times of uncertainty.

I took the opportunity to ask the panel about the potential for a dark horse to steal gold’s thunder in the upcoming crisis, as cryptos managed to do in 2020–21. Remember how Bitcoin [BTC] and Ethereum [ETH] went on a tear during this period (see figure below):

|

|

|

Source: Thompson Reuters Refinitiv Datastream |

Notice that I left gold out in the figure above? It’s because gold would be a horizontal line that hardly moves since it’s up by 30% over this period.

So, Jordan’s take on this was that cryptos are a small and immature market, having broken past the US$1 trillion mark for the first time in January 2021 and peaking at almost US$3 trillion in November 2021. Compare that with gold, which has a market value of over US$13 trillion, and you’ll see that it’s really apples versus oranges.

In my opinion, the investor appeal for cryptos needed to account for the interest rate being near-zero so there was a clamour for capital gains. Things are quite different now (yes, it’s different this time, haha!) as the central banks have raised interest rates sharply over the last 18 months. That’s why cryptos have come back down to earth while gold has been relatively stable.

In that way, gold may’ve looked like it’s been eclipsed but it’s been a bastion of stability during a volatile period.

Will gold rally hard in the coming crisis?

Many gold enthusiasts are hanging on for the hope of seeing gold rally to US$5,000, US$10,000 or even more.

Mathematically, that’s what gold should be worth, given the tsunami of liquidity the world’s created via debt. But many assets such as properties, shares, cryptos and critical metals have come to dilute those gains.

The US$300 trillion question remains: Will gold be ‘third time lucky’ in the next global crisis?

I’d hope that gold rises steadily rather than rocket to the moon like Bitcoin or lithium. I haven’t accumulated enough for my household, and I suspect many of you haven’t either.

But just in case it does, you might want to plan and ensure you’re not caught short.

This is where you might want to check out my investment newsletter, The Australian Gold Report. It’s a one-stop shop for building and managing your precious metals portfolio — bullion coins and bars, precious metals ETFs and mining stocks. We have a special offer available right now if you want to check it out.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

![Bitcoin [BTC] VS Ethereum [ETH]](https://fattail.com.au/wp-content/uploads/2023/09/COM20230904_3_580.jpg)