Would you like an 89% salary increase this year?

Who wouldn’t, right? Everyone can use extra cash.

Well, in December 2022, the average yearly salary increase hit 89%.

As you may have figured out, I am not talking about wages in Australia…but Argentina.

While an 89% salary increase may seem like a lot, the annual consumer price index in Argentina hit 94.8% in December, up from ‘just’ 50.7% in January 2022.

So even with an average 89% increase in salaries in 2022, workers in Argentina lost purchasing power to inflation.

Numbers may vary, but it’s a similar story here in Australia.

According to Seek, on average, advertised salaries increased by 4.4% year-on-year to January 2023. Workers that saw the largest increases were in the trades and services sector, with wage growth hitting a whopping 6.3% in the 12 months to January 2023.

It may sound high, but keep in mind that these increases aren’t keeping up with the 7.8% inflation rate.

Inflation is a real wealth killer, a hidden tax. And inflation can quickly erode your salary and your savings.

I don’t say this lightly.

Growing up in Argentina, I saw first-hand the devastating effects of inflation and hyperinflation.

Once people received their pay at the beginning of the month, they would rush to the supermarket to buy groceries for the month. By the end of the month, their salary was worth less, much less.

That’s why they would also face large queues at the banks…to exchange their money into US dollars.

You see, that was the only way to keep the value of your salary until the next pay cheque. But it was all a vicious cycle, the fact that people were getting rid of their Argentinean currency would feed inflation even more.

Argentina has been battling high inflation for decades.

Still, for governments, inflation has a silver lining…

Inflation makes it easier for government to pay debt

For all the bad news on high inflation, there’s been one piece of good news about it: global debt is falling.

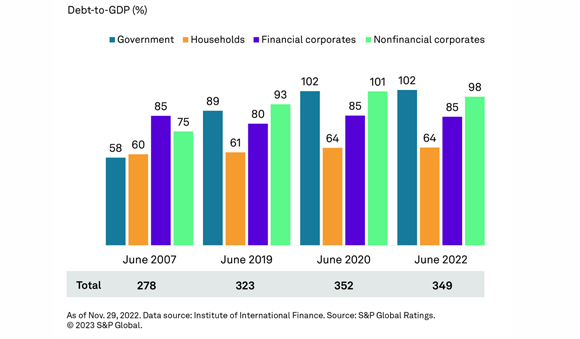

We’ve seen a big increase in debt since the financial crisis, in particular increases in government debt, as you can see below:

|

|

| Source: S&P Global |

According to the Institute of International Finance, global debt fell by US$4 trillion. The fall has brought debt back down under US$300 trillion, decreasing the global debt-to-GDP ratio by 12%, or 338% to debt-to-GDP.

The drop is basically due to high growth and high inflation.

Most of these drops came from developed countries that saw their total debt drop by about US$6 trillion to US$200 trillion.

On the other hand, debt in the developed world saw a new record of US$98 trillion because of the USD strengthening against their currencies. Developing countries usually hold debt in US dollars and a stronger USD drives investment away and increases costs.

But I digress.

My point is, you can blame supply chain disruptions and the war in Ukraine for inflation all you want, but there’s been a lot of money added into the economy in recent years.

All that money is still sloshing around the economy and has likely contributed to much of the inflation we’re seeing today.

And inflation is likely to stay high for longer. The US Federal Reserve may be increasing rates to tame inflation, but the US Government is still planning on more spending…which in turn will keep feeding inflation.

High inflation makes it easier for governments to pay off debt, in particular when interest rates continue to lag against inflation.

Living with high inflation

With salaries coming in below the inflation rate, we are losing purchasing power and wealth.

There’s not a lot you can do to battle these macro scenarios, except to hold on to real assets that’ll keep their value.

Gold is a great example.

Another is investing in commodities needed for the energy transition. In particular, since governments are pouring lots of money into building battery supply chains through measures like the Inflation Reduction Act.

Stay tuned for more on that soon…

Best,

|

Selva Freigedo,

Editor, Money Morning