If you log onto X (formerly Twitter) and search the handle @actuariesinst, what do you find?

This…

| |

| Source: X |

Perhaps it’s temporary, nothing to see here.

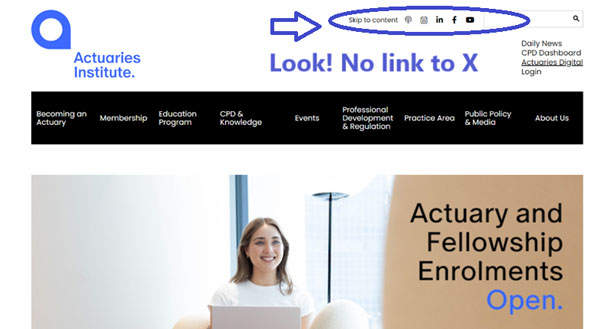

But go to the Actuaries Institute website and look at the organisation’s social media links:

| |

| Source: Actuaries Institute |

Maybe it’s nothing. They went off X because it’s now a hotbed for unhinged conspiracy theorists and purveyors of false information.

Before 2 May 2024, that wasn’t the case.

What happened?

When the medical malfeasance

becomes indefensible

Last week, I wrote about how the Actuaries Institute of Australia went all-in on defending the various measures imposed during the Wuhan virus outbreak. This included claiming that the mRNA drugs not only didn’t contribute to the excess mortality observed worldwide but also reduced the mortality from the virus.

However, two Thursdays ago, Dr Jeyanthi Kunadhasan revealed that Pfizer had omitted data used in its US Food and Drug Administration application to obtain the Emergency Use Authorisation to fast-track its rollout in November 2020. When one uses the data released in March 2021 under the Freedom of Information Act request, these omitted deaths would point to their drug being ineffective.

It’s possible to try to explain the claim of discrepancies in the trial data away.

Some have tried by citing the following:

‘Individuals that died in the placebo (after taking a shot that didn’t contain the drug) and treatment (after taking an mRNA shot) groups may have pre-existing conditions,

‘Individuals may have changed their mind and chose to take the mRNA shot, and

‘Claiming Dr Kunadhasan’s explanation was too simplistic given the study design and sample selection, etc.’

But if you include the following peculiarities with the way the FDA, the World Health Organisation, governments, drug manufacturers, medical and scientific research communities and the media behaved, your alarm bells may start ringing.

Let me list some out:

‘The immunity enjoyed by vaccine manufacturers since the US passed the National Childhood Vaccination Injury Law Act in 1986. This law has provided legal immunity for these companies if their products injure or kill a recipient. The US government becomes the adjudicator and the party bearing the liability. This clearly leads to moral hazard as vaccine manufacturers face little or no accountability for their products.

‘The re-definition of a vaccine to include the experimental mRNA drug by the WHO in 2021 by changing the word “immunity” to “protection”.

‘The unsuccessful attempt by the FDA in early 2022 to withhold information from the public relating to the trial data on these mRNA drugs (numbering over 450,000 pages) for several decades. A US District Court rejected this and instead required the FDA to begin releasing 12,000 pages of data at the end of January 2022 and 55,000 pages every month thereafter. The data release was completed by September or October 2022.

‘The admission under oath by an Executive Director of Pfizer, Janine Small, to the European Union Parliament that the company never tested the drugs’ effectiveness in stopping transmission because ‘it was moving at the speed of science’ (whatever that means).

‘The revelation by Elon Musk and Matt Taibbi through “The Twitter Files” that governments, health agencies, pharmaceutical companies, scientific communities, social media and medical professions colluded via emails and private messages on Twitter/X and other social media platforms to silence, censor and discredit those who spoke out or revealed the damage and deaths caused by the mRNA drug.

‘The revelation that staff working in the US Centre for Disease Control and Prevention (CDC) pocketed over US$690 million in royalties from pharmaceutical companies during the Wuhan virus outbreak.

‘The dogged attempts to discredit stories and claims above by media fact-checkers and members of the scientific research community, using circular citation (Woozle effect), ad hominem attacks and appeals to authority.’

I could go on but you get the idea.

In short, the behaviour of pharmaceutical companies and the full cast of stakeholders and so-called watchdogs (governments, regulatory bodies and the media) undermined the trust they took for granted from us.

None of this reflects integrity and transparency. Above all, it’s reprehensible that they have managed to absolve themselves of all liability and accountability while standing to pocket the gains from those they’ve potentially harmed.

The Actuaries Institute: An exposure,

silence, and going dark

Let me return to the mystery surrounding the Actuaries Institute’s X account.

On 2 May 2024, Senator Gerard Rennick posted on X an excerpt of a Senate Inquiry where he blasted the Australia’s Therapeutic Goods Administration and the Australian Bureau of Statistics for their inability to give a satisfactory answer regarding the rising number of excess deaths in recent years. This is despite the Wuhan virus and its various strains being less of a threat than in 2020-21.

You can read his post here.

Moreover, Senator Rennick pointed out how the TGA’s former Deputy Secretary John Skerritt claimed the ABS stated its mortality data was not useful for determining excess mortality. Instead, Skerritt used the reports by the Actuaries Institute which had concluded on several occasions that the mRNA drugs do not contribute to excess mortality.

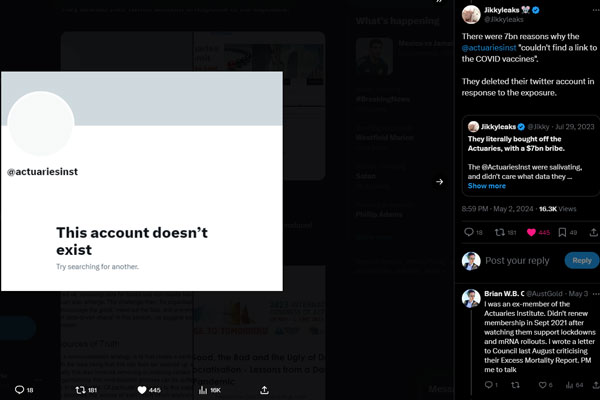

Responding to Senator Rennick’s post, an Australian-based investigative researcher using the pseudonym Jikkyleaks highlighted his own post in July 2023 revealing the Actuaries Institute was a party to a major global initiative, Insurtech. This initiative has around US$7.4 billion of funds to facilitate reform in analysing data relating to the Wuhan virus outbreak.

For more details, you can check out Jikkyleaks’ thread here:

| |

| Source: X/@jikkyleaks |

Now there’s nothing wrong with receiving funding from an international initiative to analyse what happened during the virus outbreak. It’s the purpose and the outcomes that may be problematic.

This is where it gets murky.

Firstly, within hours of Jikkyleaks posting a reply to Senator Rennick’s post on 2 May 2024, Jikkyleaks showed that the Actuaries Institute had deleted its account:

| |

| Source: X/@Jikkyleaks |

Furthermore, Jikkyleaks singled out two key figures in this initiative, namely Aaron and Karen Cutter. I’ve mentioned last week how Karen Cutter was a leading figure in the working group that published the reports on excess mortality on behalf of the Actuaries Institute. Jikkyleaks revealed that they started to scrub their data online in response to the posts.

While Karen Cutter’s X account remains online, she has amended her profile description from this:

| |

| Source: X |

To this:

| |

| Source: X |

Scrubbing her claim that she had no links with the ABS and government departments and then adding she ‘receives no payment for Covid analysis’ reminds me of a Chinese parable of ‘there aren’t 300 silver pieces buried here’.

Failing the test of professionalism

and integrity

Now I want to be clear about a few things.

Firstly, I’m not claiming the Actuaries Institute was corrupt in taking the funds from Insurtech. Nor am I proposing the funds explained the Institute publishing skewed reports vouching for the efficacy of the mRNA drugs while downplaying the negative impact. I can suspect that’s the case, but I don’t think Jikkyleaks has proven it beyond reasonable doubt.

Secondly, I want to clarify that some Institute members disagree with the body’s official stance as they have their suspicions about the data and the narrative. I spoke with a few about my concerns, and we found more common ground than disagreements.

Thirdly, I believe many members may not even be aware of what is going on. But if they conducted their own research, they could dissent because they are upstanding individuals.

Therefore, if there are any revelations of nefarious activities and corruption, please refrain from assuming everyone in the Institute was involved.

What I thought was most shocking with this exposure was not so much what Jikkyleaks revealed. It was the Institute’s response by deleting its content and trying to pretend nothing happened. This is more damaging as it shows their implicit admission of guilt.

They have fallen well beneath their standards for a body meant to be at the forefront of data analysis, data integrity and risk management.

And this should leave you concerned about the health of the Australian insurance industry.

As excess mortality mounts, these companies will face rising claims payouts. This could result in lower profit and even significant losses in the coming years.

But there’s another avalanche looming as the public realises what the pharmaceutical companies and medical research community did to cover up the dangers lurking within these drugs.

The battles over professional indemnity insurance and medical malpractice are going to be colossal as insurance companies and pharmaceutical companies wrestle to avoid footing the bill.

We’ll see where everything goes as time passes. But this scandal is far from over as investigations deepen.

The wheels of justice grind and

the hammer of justice pounds

Putting together what I wrote last week and this week, you should become more sceptical of experts and professional bodies.

The last four years have shown us how governments, health agencies, the medical research community, pharmaceutical companies, various professional bodies and the media can collude to act against your interests and keep you in the dark.

But this is changing.

For one, the hammer of justice is about to pound at the door of the pharmaceutical companies.

AstraZeneca had to withdraw its products off the shelf in early May. The company is likely to face a mounting bill for confirmed injuries and deaths caused by its product.

Meanwhile, Pfizer is now facing lawsuits from the State Attorney Generals in Kansas and Texas for misleading the public about the safety and efficacy of its mRNA drugs. More cases will soon follow as the pieces fall together with the exposure of their malfeasance.

One of the chinks in the immunity provided by the National Childhood Vaccine Injury Act is fraud. The government can waive the immunity and expose the pharmaceutical company if one can prove the company acted deceptively or committed fraud relating to its product.

In the case of the mRNA drug, it seems like the evidence is piling high. This includes:

‘Dishonesty in the application process to making bold claims of its efficacy and changing their narrative,

‘Colluding to censor and silence dissenting opinions,

‘Bribing regulators, researchers, institutions and the media to cover up, and

‘Abusing the public trust for profits.’

The dimension and scope of the coverup reveal the size of the crime.

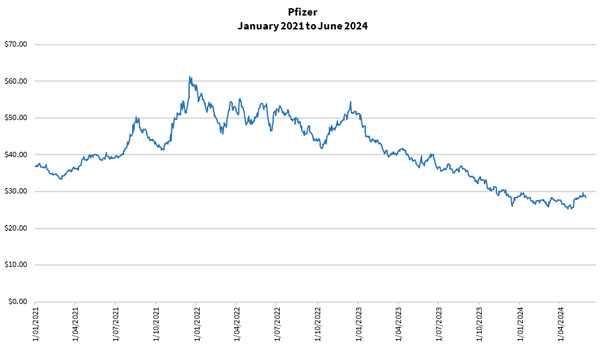

For Pfizer, its share price over the last three years shows an ominous future:

| |

| Source: Refinitiv Eikon |

I believe that Pfizer’s fall is not far away as more governments are turning against the company and trying to strip it bare in an attempt to appease the public seeking their pound of flesh.

And don’t expect that Pfizer’s demise is isolated either.

Our plan to help you protect yourself

The lockdowns which we endured led to governments borrowing an obscene amount of funds to keep businesses closed and households cooped up.

This led to a major productivity slump plus a wealth gap between those who could earn in the safety of their home and those who can’t.

All this is causing inflation in the global economy to spiral out of control, even as business activity has slowed down.

In the past, you can look to safe havens such as the US dollar, blue chip companies and even insurance policies to protect you against tough times.

As we’ve seen in today’s article, they’ve all stumbled and betrayed the public’s trust.

But now isn’t the time to despair and think the sky will collapse.

Most of you who followed me these few years have a clear head and can see through the smokes and mirrors. There are ways to navigate what’s to come.

As has been the case before, we’ve prepared a plan.

Learn more about this in ‘The Decade of Decimation’ and please start getting your house in order.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments