For years gold enthusiasts have longed for gold to shoot to the moon: US$5,000, US$10,000 and even US$50,000 an ounce.

The belief is that this’ll make them very wealthy — whether they hold physical bullion or gold mining company stocks, they’d be set for life.

It’s for this reason that many (myself included) put their wealth into gold. We’ve seen so many things wrong with our financial system — monetary policy will fail and cause hyperinflation, the property market is set to burst, cryptocurrencies are being considered a fad, and talk of a gold-backed currency to replace the failing US dollar — to back up our view that gold’s due for a meteoric rise.

Let me be clear on where I stand regarding this.

I’m of the view that gold is currently undervalued. It should be worth much more than US$1,960 (A$2,910) an ounce.

However, I’m not of the view that a soaring gold price is necessarily a good thing nor, that it’ll transform gold bulls into tycoons overnight.

In fact, it could cause the opposite! We may all be poorer for it.

I can imagine your shock and surprise. It’s as if I’m committing sacrilege!

So please indulge me a little in why I hold these views.

Prices are rising but why are only the few, rather than most, getting richer?

We currently live in a petrodollar system where the US dollar is the basis for pricing everything. It’s used in buying and selling crude oil, which the world still runs on.

The dollar is a debt instrument that the US Federal Reserve lends to the US Government to finance its programs (hence they call it the ‘Federal Reserve Note’). This note is interest-bearing, with the US Government repaying principal plus interest to the Federal Reserve.

Since the US Government spends more than it receives from tax revenues, duties and investment returns, it must continue borrowing from the US Federal Reserve.

Coupled with that, fossil fuels still account for over 81.8% of our world’s energy needs as of last year. Since the world is still predominantly trading crude oil and other commodities using US dollars, this contributes to its immense global demand.

Therefore, the supply of US dollars has grown massively over the last six decades.

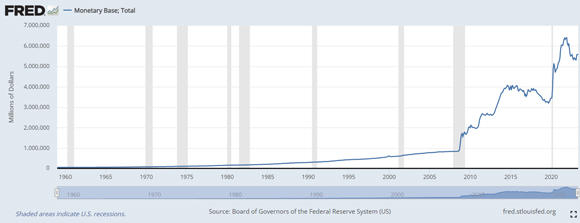

For the sake of simplicity, let’s look at how base money has risen over this period in the figure below:

|

|

| Source: Board of Governors of the Federal Reserve System (US) |

Currently, there’s over US$5.8 trillion of base money in the system, which has doubled in just the last decade and almost 60 times since the 1970s.

This doesn’t include debt created by fractional reserve banking whereby banks can lend many times their cash holdings. If you include that too, the estimated US dollars circulating in the system likely exceeds US$100 trillion!

For this reason, almost everything has risen in price over time. Things haven’t become more valuable — the currency has lost value as its supply exponentially increased!

Relative prices, affordability and wealth

Perhaps what I just said sounds a little abstract. Let me use something you can relate to.

How about the relative prices of a bar of gold and a property?

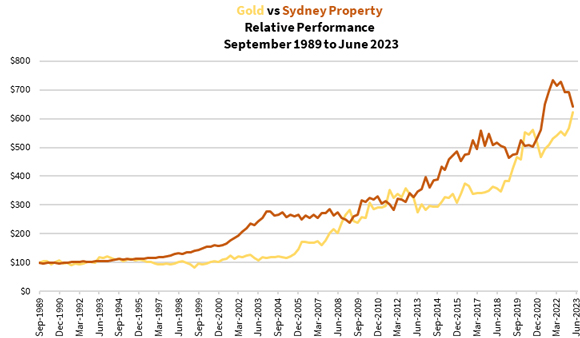

To present my case, I’ll use the median price of a house in metropolitan Sydney. It’s one of the world’s most expensive cities when it comes to home buyers, ranking 18th according to Money Inc.

In 1994, the median price of a Sydney home was around $200,000, rising to $500,000 by 2003, breaking $1 million for the first time in 2017, and it’s currently $1.2 million.

At the same time, gold was worth AU$500 in 1994, $550 in 2003, $1,600 in 2017 and $2,915 today.

Both gold and properties have risen at a breathtaking pace in the last 15 years as you can see in the figure below:

|

|

| Source: Thomson Reuters Refinitv Datastream |

Properties have led gold in the rally for much of the last three decades, but gold is beginning to catch up. The main causes are central banks cutting interest rates to near-zero in 2020–22 and governments launching an unprecedented wave of spending during the Wuhan virus outbreak.

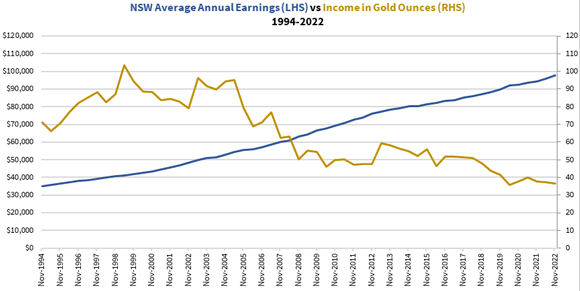

As asset prices rose, the typical employee isn’t earning enough to keep up. The average total income in NSW and the equivalent amount in gold ounces are shown in the figure below:

|

|

| Source: Australian Bureau of Statistics, Thomson Reuters Refinitiv Datastream |

Can you see how the typical employee has become poorer in terms of gold since 1998? If the same standards were maintained, the annual income should be over $300,000 today!

Similarly, housing affordability has moved further out of reach as you can see in the figure below:

|

|

| Source: Australian Bureau of Statistics |

Before the turn of the millennium, a median Sydney home would be worth around six–seven years of one’s average income. It’s now more than doubled, being less affordable than ever.

I can imagine it won’t get better soon.

And how many people are imagining themselves getting richer if property prices continue to rise? Only those who currently have properties under their name.

Mind you, not all of them would be cheering the prices rising further, especially if they’re looking to upsize or buy an investment property. That’s because they can afford less.

The same logic should apply to gold.

How many of you own enough gold bars and coins such that you can put your feet up? And are you aware of how much you’d need to set you for life?

A median Sydney home is currently worth around 400 ounces of gold. That’s not quite enough.

I’d hazard to say no less than 1,000 ounces of gold will allow you a bit more freedom.

Unless you own that much, you certainly don’t want gold to suddenly take off.

Not only is a stress-free life increasingly out of reach, but just imagine how much the price of food, clothes, petrol, properties, commodities…everything is going to rise!

And those who own mining stocks wouldn’t necessarily strike it rich either. You saw what happened in the past two years, didn’t you? Oil rose faster than gold and other commodities, causing the profitability of resource producers to suffer, so their shares plunged.

That’s why we have lingering inflation to this day. There’s still a lot of demand for goods but insufficient supply as production is down…not a good place to be!

Hope for gold to rise steadily…for now

Look, I’m all for gold asserting itself and trading at what it really should be worth.

But can you see from my reasoning above why you should be careful what you wish for?

As much as I’d love to see gold rise as Bitcoin [BTC] has, I reckon it’d spell an epic disaster to the world as we know it, should it happen.

I’d rather for gold to rise steadily and that the fiat currency system dies slowly as it drowns beneath the sheer volume of increasingly worthless paper and digital bits. That’s how the veterans in the gold investment community struck it rich.

You still want to buy gold bars, coins and good quality mining companies while they’re affordable, right?

If you want to make the best of this opportunity, sign up now with my investment newsletter, The Australian Gold Report.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities