Two weeks ago, I attended and presented at the Noosa Mining Conference.

This is where junior miners present their story and credentials to investors.

I went to get an ‘on the ground’ idea of the key talking points within the sector…gauge investors’ sentiment and look insiders in the eye as they spoke to get a sense of what’s happening.

But before we get into it, please consider the notice below as it links directly with what I uncovered in Noosa:

I then caught up with Greg Canavan on camera after the event to talk about what I learned (video above!).

Here’s the crux…

It’s still tough out there at ‘the coalface’…but in some other less talked-about areas, things are starting to come alive.

Trump’s election victory has led to a big fall in precious and base metals. Although, gold has since recovered a little.

A pullback here was understandable given these metals have been running up hard for some time now. So the correction wasn’t surprising.

As you can see, copper futures have given up most of their gains from the late September China stimulus announcement:

| |

| Source: Trading View |

Three major factors are driving this sell-off:

- China’s inability to follow up on more stimulus.

- Concerns over Trump tariffs and the impact on China’s growth.

- And, critically, a strengthening US dollar.

Now, these are all important factors, but as resource markets cool off, let me remind you of this critically important point…

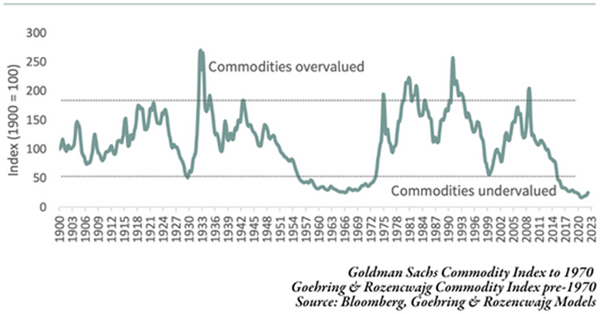

Relative to US equities:

Commodities have reached a level of undervaluation unprecedented in modern markets

We’re in uncharted territory here.

As US stocks melt higher, commodity markets are melting lower.

In my mind, there’s far more risk in holding richly valued US stocks versus a sector that’s been pummelled, ignored and dismissed by investors for over a decade.

Keep that in mind as investors pile into US stocks on the back of Trump’s victory.

This graph from Wall Street firm Goehring and Rozencwajg clearly shows what I mean:

| |

| Source: Bloomberg, Goehring & Rozencwajg Models |

Investors have maybe one or two opportunities in a lifetime to capture value like this!

Note, too, that G&R compiled this data back in 2023.

Since then, US equities have continued increasing while resources have fallen even further.

Now, there are two ways to look at this:

Will US markets eventually fall precipitously, bringing them back to historical norms?

Or will commodity markets play catch-up in a big way?

Whatever happens, the long-term upside for US equities is limited.

But for commodities, the downside risk is relatively low, yet the upside could be huge.

The US market is sailing through dangerous, uncharted territory.

Right now, it’s pricing in a rich premium based on ‘Trump promises’.

Corporate rate cuts to just 15%, slashing government spending, China tariffs, and re-shoring the country’s manufacturing—all this while cutting inflation.

These are big promises, and so far, the market is taking the bait!

But remember, Trump is a populist, which means he tends to say whatever pleases the crowd or, in the latest case, win votes.

Don’t get me wrong, I’m not anti-Trump, neither am I left or right-leaning.

But I think it’s important not to align your investment strategy with political promises. But that’s exactly what the majority are doing!

What Trump’s honeymoon means

for commodities

Few would remember that the US Dollar rallied after Trump’s victory in 2016, just like it’s doing today.

Back then, investors were similarly bullish on what this self-made billionaire could deliver for the US economy.

Yet, once Trump took office, the US Dollar declined for the bulk of Trump’s presidency!

Check it out below:

| |

| Source: TradingView |

Over those four years, from 2017 to 2021, the US dollar fell 9.85% against the euro, shown in red above, and 10.79% against the Japanese yen, shown in yellow.

Of course, the US dollar is just one barometer to measure the success or otherwise of an economy, but it does play a critical role in commodity prices.

As I pointed out earlier, the strength of the US dollar has been one of the major forces driving weakness across resource markets since Trump’s re-election.

But from what I’ve shown you, there’s still a long way to go before we understand what Trump Part II might serve up.

And don’t for a second believe commodities will remain weak under Trump’s leadership.

Now, I mentioned an immense opportunity.

I’ve been working on a brand-new report. It started out months ago as a thought experiment, which took into account how previous major resource cycles played out…and the type of companies that rose to rule it.

In every case, these dominating companies controlled the sector over the next 20-30 years.

I believe we are reaching a such a convergence point… Where a wave of resource stocks could emerge as the new dominating players.

This is a speculative play on the commodities sector. It’s also fascinating. And, if we get it right, immensely beneficial.

If you’d like to be on the list to receive this new presentation as soon as it is released…GO HERE to see what it’s all about…and get your name on the list.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments