Have you ever felt confused by the conflicting news headlines in global markets?

Well, you’re not to blame.

I firmly believe that most analysts, investment bankers, and expert commentators leading the narrative are just as confused as the everyday punter!

The commentary on China over the past two months clearly demonstrates this.

Virtually all the major investment houses covering commodities pivoted from bullish to bearish in early September.

That was thanks to deep fears of a China crash.

But with Chinese authorities announcing major stimulus efforts late last month, those bearish pivots are rapidly unwinding!

Fundies, investment bankers and analysts have all been caught in the whip-saw action that’s sent capital flowing in and out of the resource market.

In my mind, that shows a clear lack of conviction on their part.

The Goldman Sachs example

This high-profile investment bank is the pinnacle of top finance grads hoping to get a crack at one of the world’s most prestigious firms.

But does that mean it can offer a deeper insight into market forecasting?

Not from what I’ve seen…

Earlier this year, Goldman put a price target on copper of up to US$15,000/tonne by 2025.

One of the most bullish forecasts among the top investment firms.

But as fears of China’s economic weakness began to spread, this major banker suddenly slashed its long-term forecast by a third!

Its copper outlook dropped from US$15,000/tonne to US$10,000/tonne.

From bullish to bearish, virtually overnight.

That was a major adjustment for a firm that’s spent years staking its reputation on surging copper prices.

Here’s what Goldman stated during the depths of last month’s China panic:

‘The copper rally is delayed.

‘As a result, and given the continued weakness in China’s property sector, we believe that copper inventory depletion — and its accompanying price rally — will probably come much later than we previously thought.’

However, since those statements, copper futures have steadily been rising.

Meanwhile, some copper stocks have surged!

That includes Capstone Copper [ASX:CSC], a company I advised my premium readership group at Mining: Phase One to buy.

We recommended it right around the time Goldman crumbled on its long-term copper outlook!

And since then, the stock has surged around 27% in just four weeks.

To be fair, Goldman couldn’t have known China was about to hit the stimulus button.

And perhaps we were a little fortuitous in our timing.

But it’s a good example of why you need to stick to your guns…

Don’t let market fear direct you away from your long-term convictions.

And if you have been confused, don’t worry; the market elites are, too!

2024 has been an emotional rollercoaster for resource investors, and I certainly haven’t been immune to that.

But I’ve never allowed emotions to seep into our investment decisions.

For my paid readership group, we held onto all of our existing positions during that deeply pessimistic phase.

Plus, we capitalised on the steep discounts by buying more!

Why this cycle continues to turn

As I outlined to my readers on Tuesday, China stimulus is just another cog in the upward turning of the commodity cycle.

Not a pivot; rather further confirmation that the cycle remains on track.

The foundation for this conviction is the lack of investment in future supply.

This is the key element driving our long-term bullish outlook.

Interestingly, supply was also the grounding for Goldman Sachs’s original view.

Yet, that crumbled last month when the investment bank abandoned its long-term price forecasts amid the China panic!

While the China stimulus rally will undoubtedly run out of steam, I’m not concerned.

The important thing here is the turning of the commodity cycle.

In my mind, that trumps short term moves in the market, no matter how important they appear at the time.

To show you what I mean, let’s step back to the early 2000s boom…

This was a period of intense investment activity, which drove a wave of new development activity.

While conditions were extremely bullish, few were considering the potential consequences of what might come in the years ahead.

A surge in investment activity can only have one outcome: surplus supply.

Booms are the precursor to an inevitable demise; as supply rises, prices fall.

It seems obvious in retrospect, but very few can see the cycle turn from week-to-week.

And that’s what causes them to buy and sell at precisely the wrong time!

Today, we have the opposite condition from that bullish early 2000s boom period.

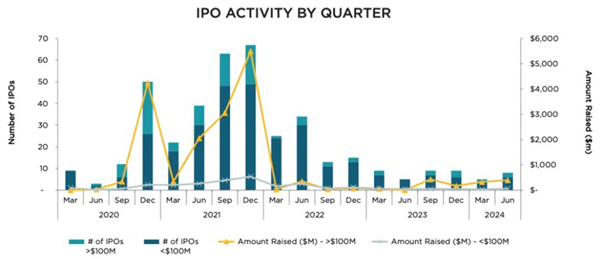

Liquidity in the junior mining sector has dried up and that’s weighed heavily on the number of IPOs in Australia:

| |

| Source: Mining.com.au |

Other than a temporary spike in 2021, conditions have remained extremely tight for junior mining stocks over the last several years.

As I showed you last week, investment activity on new mine developments and exploration is weak.

Liquidity is tight.

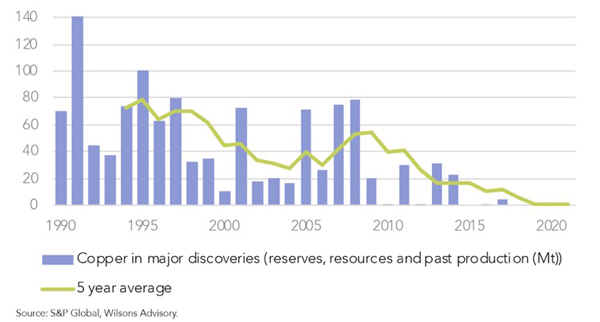

And that’s having a tangible impact on the number of new discoveries across the globe:

| |

| Source: S&P Global, Wilsons Advisory |

Since the end of the last commodity boom, which peaked in 2011, 5-year average discovery rates have fallen dramatically.

This symbolises the inevitable turning of the cycle, the inevitable set-up for a return to bullish conditions.

But it’s also the ideal time for investors to accumulate positions in the sector.

Commodity markets are a long term game

It’s important to recognise that supply constraints take time to play out. Existing mines can temporarily maintain supply while demand stays subdued.

But as ageing deposits deplete, problems begin to emerge.

I believe we’ve seen flickers of that in today’s market…

The sudden closure of First Quantum’s Cobre Panama Mine in late 2023 pushed the copper market into deficit in early 2024.

What followed was a surge in copper prices and a rapid spike into all-time-new highs, breaching US$5 per pound for the first time in May 2024.

Yet, that mine supplied only 1% of global output.

In my mind, that demonstrates a market running on tight supply.

So, what happens next?

Conditions for a bull market take years to form, and it begins with declining investment.

This sets the stage for the next upward leg.

However, that can’t take shape until existing supply is tested. In other words, a tick-up in demand.

China’s stimulus efforts could be an important catalyst.

But also consider the impact of rate cuts in the West…

Will more market liquidity drive investments back into renewables and critical minerals?

That’s a question no one’s asking right now.

For the first time in a long time, commodity supplies are set to be tested. The traditional front (China) is re-emerging as an important driver.

But so is the bourgeoning pivot back to renewables.

Whichever way you square it, we have a strong set-up as we head into 2025.

And if you want to be part of it, you can start your journey here by joining us at Diggers & Drillers.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments