Iron ore is Australia’s number one export.

It’s the raw material used to make steel.

Steel production has been in great demand for almost two decades, mainly due to the rise of China and the building boom that came with it.

You need vast quantities of steel to make bridges, buildings, railways, airports and structures of all kinds.

Australia is the world’s iron ore powerhouse, with Brazil a close second. These two countries dominate iron ore production.

Source: Commodity.com

The price of iron ore is of great importance to the profits — and in turn shareholders — of our iron ore miners.

Big miners like Rio Tinto Ltd [ASX:RIO] and Fortescue Metals Group Ltd [ASX:FMG] have huge exposure to iron ore.

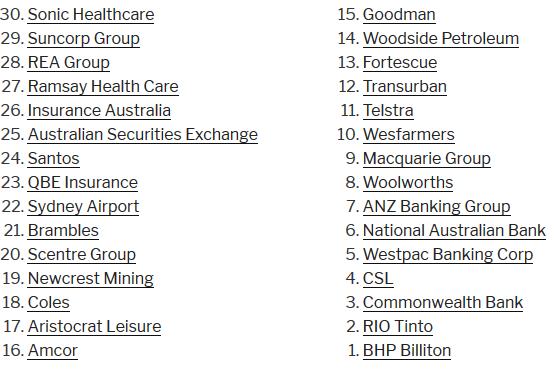

Both companies are in the top 20 ASX-listed companies.

They make up a big part of almost everyone’s superannuation holdings through managed funds.

Source: Disfold.com

But the price of iron ore isn’t just important to shareholders, it’s also important to the budget of the Australian government.

And that’s why the recent falls come at a bad time…

The effect on the bottom line

If you look at this chart you can see the price of iron ore is on the verge of starting a new downtrend:

Source: Incredible Charts

The key price support is around US$79.

If iron ore prices fall below that and keep falling this is bad news. It will have a big effect on the Australian governments bottom line — not a good thing given the crisis we’re in and the increased government spending that’s coming with it.

Analysis from Treasury last year stated:

‘If the iron ore price was to fall immediately to $US55 per tonne, four quarters earlier than assumed, nominal GDP could be around $5.8 billion lower than forecast in 2018-19 and $10.6 billion lower in 2019-20.

‘This would result in a decrease in tax receipts of around $0.5 billion in 2018-19, $2.6 billion in 2019-20 and $1.0 billion in 2020-21.’

Some think such falls are a distinct possibility.

Wood Mackenzie research director Paul Gray recently said:

‘We’re not yet looking at a glut of seaborne iron ore. But risks are escalating, and the balance is tilting towards a bigger hit to iron ore demand than supply.’

A key indicator

There’s no question this is a key commodity for Australian investors to watch.

Any surprise to the upside could be a great indicator that things could be about to get better. And that could be a contrarian signal to look out for.

Conversely if the bears are right, then watching this might allow you to act cautiously in the months ahead and not get swept up in any bear market rallies.

It’s certainly a key indicator for me right now…

Good investing,

Ryan Dinse

Editor, Money Morning

PS: Looking for assets that could handle a potentially lengthy bear market? Check out my analyst’s latest report ‘The Coronavirus Portfolio.’ You can get that for free here.

Comments