If you ever want a quickfire example of how tricky the stock market can be, check out Beach Energy [ASX: BPT] and JB HiFi [ASX: JBH] lately.

Let me give you the context first…

For what seems like forever, you and I both have been battered over the head with two different ideas.

One is that Australia’s energy market is bonkers, and domestic gas suppliers are set to cash in.

The second is that Aussie consumers are under the pump and retailing is down in the dumps.

Both arguments have merit.

The natural and obvious thing you might do in this scenario is buy BPT and sell JBH.

In this case, I hope you didn’t.

That’s because BPT got smacked down on its recent results…and JBH went up.

Ha!

This is an example of why “themes” in the market can only get you so far.

Here’s what you need to know…

Never – EVER – forget that each stock is subject to unique and individual pressures, catalysts, management and more.

What I mean is you can have a gold boom, for example, and still have a dud gold stock.

Just because gold is booming does not mean the gold share you own is making money, or lots of it.

Maybe their cost of production goes too high, or something stops the operation. Believe me, it happens.

As we saw with BPT, gas prices in Australia on the east coast are high.

But Beach has many moving parts to its business.

It keeps tripping up on some of these different components. The gas price is just one input to the share price dynamic.

Let me give you a different example.

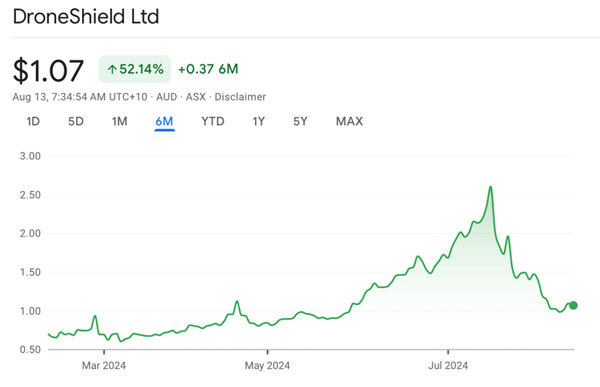

Earlier this year I recommended a stock called DroneShield [ASX: DRO], for my paid subscribers.

DRO was already moving up before I made that move…but by jingoes it kept going up after too.

I made the recommendation in February. By June I told my readers to bank their juicy win.

Some of the feedback I got was intriguing to me.

A few readers told me that they WEREN’T going to sell.

Now, there’s nothing wrong with that. Each subscriber can march to their own drum.

I was going for the short-term double. Maybe there is a lot more in it over 3-5 years.

What was interesting, however, was the reasoning I was told for holding on.

The gist of their argument, as such, was that drones were clearly a “thing”, and would be for the foreseeable future.

Therefore, DroneShield remained a compelling proposition.

OK.

However…

Absolutely no one that wrote to me made the case for holding on based off hard evidence via the company accounts or projected sales, margins or profits.

The reasoning didn’t get far beyond news about drone attacks, war around the world and the powerful share price drive happening at the time.

There is no guarantee that these “macro” factors will convert into actual sales and profits for DroneShield.

That’s what led me to bank the profit. DRO’s share price moved as if it had banked many big contract wins.

As it happens, for a month after my sell recommendation, DRO kept inflating higher.

Then came the reckoning…

Check out this massive drawdown on the chart below…

| |

| Source: Google Finance |

DRO is now down over 50% from its recent peak.

Why did this happen?

Clearly the stock was overbought at the top.

But the main crunch came from the fact that DRO went to a 2 billion dollar valuation without the profits to back it up.

At the peak it was simply trading on wildly inflated expectations and the unverifiable promise of potential big contracts.

DRO hasn’t been able to meet these expectations lately, and hence the big drop back toward $1 (still higher than last year, mind you).

I’m not bagging DRO, by the way.

As it happens, a different history could’ve seen DRO release big contract wins and my sell alert look like a shocker. They might still do so shortly. In which case, investors can buy back in now, at a much cheaper price.

I’m only using this as an example to illustrate how it’s very easy to buy a “story” in the market. The danger is you end up with a simplified approach.

High gas prices? Buy Beach. Tough retailing? Sell JBH. Drone attacks in Yemen? Buy Droneshield.

Admittedly, this can work for a time…but the market will expose this cavalier approach eventually. Trading sentiment, instead of hard numbers, is a dangerous game.

The way to give yourself the best chance is to really know your stock as much as you can.

You’re much less likely to get blindsided by events…and/ or better able to see timely opportunities to buy more, or take profits.

Regards,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments