Mineral scarcity.

Since starting at Fat Tail Investments, I’ve touched on this theme many times.

For me, the idea was born from anecdotal evidence after years spent as an exploration geologist. Deposits are becoming harder to find.

But as the years pass, this so-called ‘scarcity problem’ is gaining traction among a wider audience.

You may have heard about the issues surrounding copper supply:

Declining grades and aging deposits.

These concerns could have a meaningful impact on global inventories.

But did you know that gold supply faces a similar dilemma?

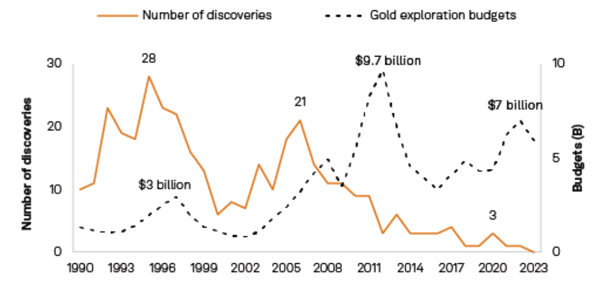

To show you what I mean, let’s step back to a time of abundance… The period 1990-99.

Over this decade, explorers uncovered no less than 183 ‘significant’ gold deposits across the globe.

According to official statistics, that added around 1,660 million ounces of untapped bounty.

Interestingly, the discoveries occurred despite a prolonged downcycle in commodities.

Seek, and you will find! The ’90s were blessed with a plethora of quality gold finds.

But that Biblical adage has lost its way in recent times.

In the following years, challenges emerged in the hunt for new gold.

Despite record prices and massive investment in exploration, the commodity boom period from 2000 to 2009 witnessed just 120 new gold discoveries.

That equated to around 900 million ounces.

A big fall from the decade prior.

But get this: once the commodity boom began to wane (after 2011) and investment dried up, the rate of new discoveries collapsed.

The decade from 2010 to 2019 witnessed just 42 discoveries worldwide!

Adding a measly 312 million ounces of untapped reserves.

That represented a major 70% drop from 20 years prior.

Despite many commentators coming out and challenging the idea of ‘mineral scarcity,’ these numbers don’t lie.

Minerals are, in fact, a finite resource.

If you have any doubts, check this out from S&P Global, showing the terminal decline of gold discoveries:

| |

| Source: S&P Global |

Gold was scarce 2,000 years ago, but it’s even rarer today!

But there’s another problem with all of this…

Companies are already throwing vast sums at trying to uncover new gold deposits.

Worldwide, rigs are spinning at record-high volumes, yet discovery still isn’t happening!

The payback for explorers is exceedingly poor.

So, what gives?

Have geologists lost their way? Are they even capable of finding new deposits?

Well, that could be part of the problem here.

You see, mining, especially exploration, suffers from severe boom-to-bust cycles.

And according to 40-plus-year industry veterans I’ve spoken to, the last down cycle, from 2013 to 2019, was among the worst.

A depressed employment market sent many veteran ore hunters packing and searching for new careers.

Or just taking on an early retirement if they had the means.

And from what I’ve seen on the ground, young geos are being put in charge far too early in their careers.

There was a time when a senior exploration geologist required around 15 years of experience to get the job.

Today, that’s down to just 3-5 years!

It speaks to the sector’s inexperience, generating a crunch moment for the mining industry as it attempts to replace ageing deposits with new supply.

And since deposits are becoming deeper and thus harder to find, more experience is needed now than ever!

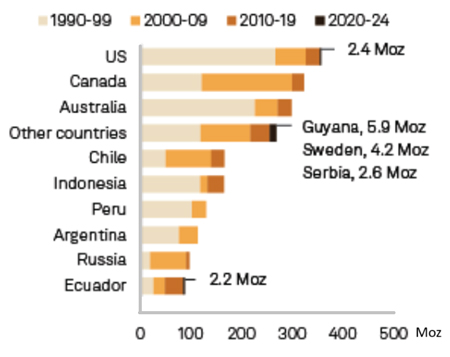

Australia, not the discovery centre

it once was

Digging into S&P Global’s latest data, Australia is clearly waning in its role as a hub for gold discovery.

The country’s ‘golden years’ was back in the 1990s.

Success back then has kept Australia’s gold production strong today.

Yet, that can’t last against a long-term background of falling discoveries.

It puts Australia’s role as a major gold producer under threat… A slow-moving train wreck.

In contrast, Canada is one of the few jurisdictions revelling in new discoveries.

The country has tapped into new northern frontiers, including the richly endowed Yukon Territory—previously unexplored areas are now delivering rich rewards.

Yet Canada is an outlier; discoveries have been in steep decline worldwide since the early 2000s.

| |

| Source: Market Watch |

Scarcity: the foundation for higher prices

With all that in mind, it’s not likely we’ll see an oversupply of gold anytime soon!

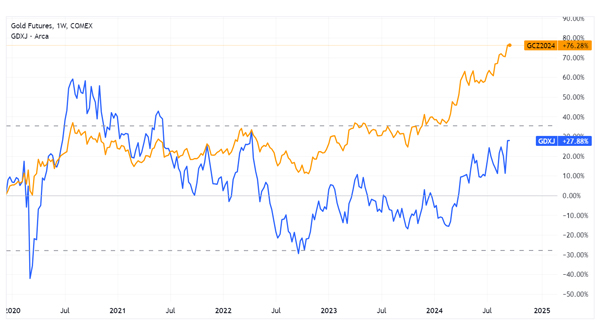

That will offer strong support for gold over the coming years despite it already trading at record prices:

| |

| Source: Trading View |

So, where does gold go from here?

Forecasters have thrown some big numbers into the mix…

The commodity research firm Goehring & Rozencwajg (G&R) estimates that gold will reach US$15,000 per ounce in the years ahead!

That makes for a punchy headline, but it’s also a wild bet.

Regardless of where gold might go in the coming years, not many punters will have guessed it would breach US$2,500 per ounce this year.

Fewer could have fathomed that junior gold stocks would continue to trade at rock-bottom prices despite this bullish backdrop.

To show you what I mean, here’s the VanEck Junior Gold Miners ETF [NYSE:GDXJ], in blue, versus the underlying gold price in yellow:

| |

| Source: Trading View |

Over the last five years, gold has surged 76%.

Meanwhile, junior miners, including developers and explorers, are only up a measly 27%!

Remember, these stocks are supposed to deliver investors outsized returns when metal prices surge.

But that’s not happening.

Undervaluation in the junior mining sector persists, but I don’t believe it will last!

Remember, the scarcity problem worsens without capital filtering into junior mining stocks.

These companies are tasked with the monumental challenge of finding new gold deposits. Thus alleviating future supply problems.

Eventually, the market will reach a tipping point…when a wider audience recognises this deep undervaluation.

And when it finally lands, prices for small juniors could move very quickly.

Position yourself now!

If you’ve been patient, waiting for junior gold stocks to turn… Good on you.

You’ve preserved your capital amidst a torrent of volatility in the junior mining sector.

But that puts you in a prime position to capitalise on the gaping pit between junior mining stocks and gold prices.

You probably know junior mining stocks are one of the riskiest investment options.

But at certain times, the risk-reward premium becomes highly enticing.

I believe we’re at that point now.

But to increase your odds, I suggest focusing on juniors already holding ounces in the ground. Not true explorers but companies with vast deposits looking for development.

The bigger the deposit, the better!

This is where you can uncover some of the greatest value in the junior gold sector.

Companies holding large undeveloped deposits mean investors have no ‘discovery risk’—the deposit has already been found!

Yet, it also sidesteps the hazards of owning established gold producers. Companies that will need replacement reserves as their assets deplete.

These large, undeveloped, unloved, and untapped motherlodes are honeypots in the ground waiting to be scooped up by the market!

If you’re interested in learning the names of the stocks I’m recommending to my paid readers, you can join me at Diggers and Drillers.

I look forward to seeing you there!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments