In today’s Money Morning…here’s the latest news out of China…the New Game gathers force: China is serious about crypto crackdown…new money is energy and energy is money…and more…

Editor’s note: In the latest episode of The Money Morning Podcast, I sit down to chat with Stewart Dickson of Variscan Mines Ltd [ASX:VAR], which recently shot up the charts on promising grades from its mine in Basque country, Northern Spain. We talk about the critical role of zinc in the global economy and the prospect of a stimulus-lead commodities boom.

Yesterday, I wrote to you about some big moves in crypto over the course of the last few days, and today continues on the same theme.

You see, China is deadly serious about pushing crypto out of the country.

That’s a good thing — a long-term net positive, despite the disruption and short-term pain.

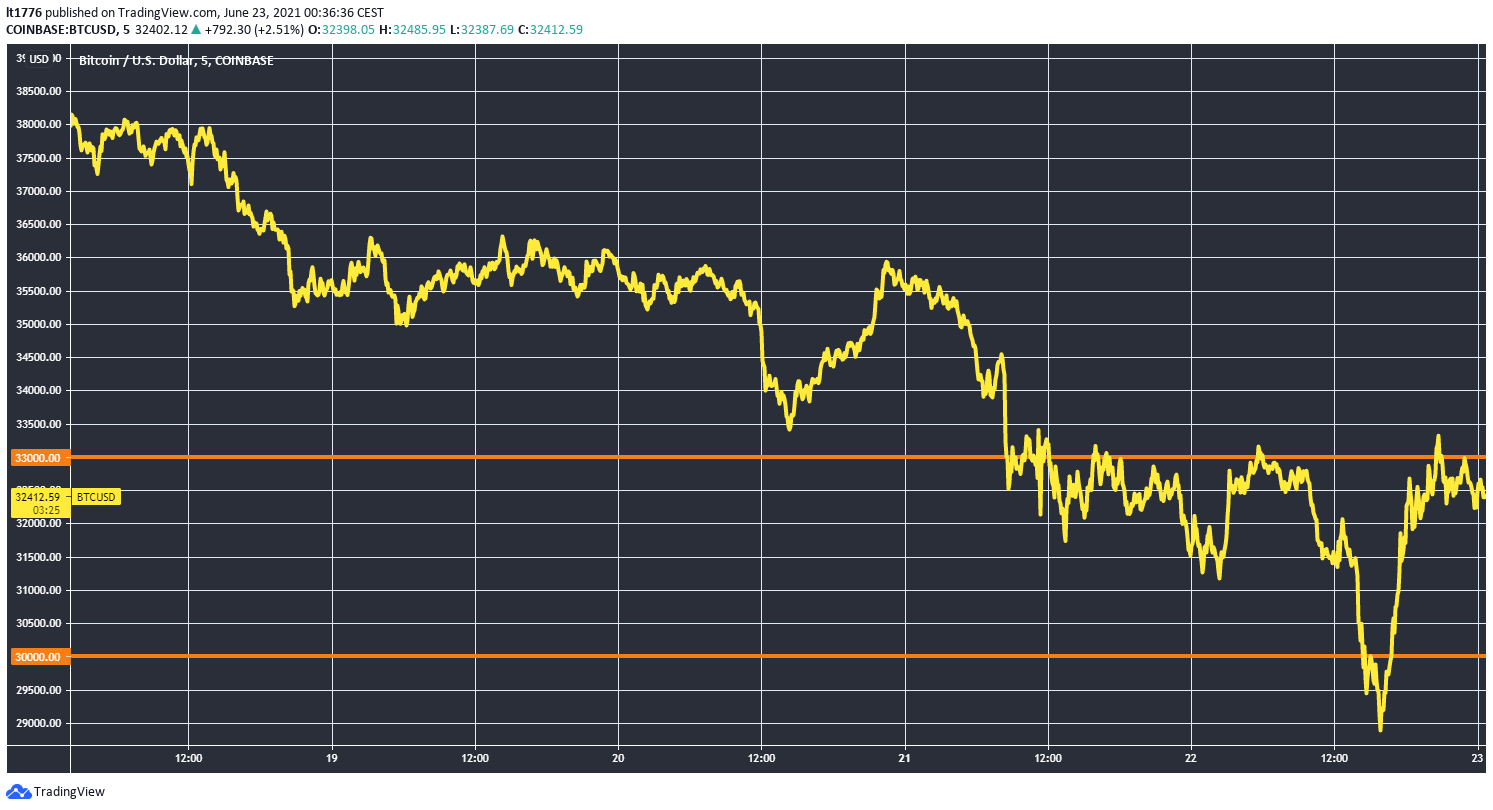

You can see this pain playing out on the chart for Bitcoin [BTC] right now (last five days of trading):

|

|

| Source: Tradingview.com |

The bitcoin price breached the important support lines of US$33,000 and US$30,000, even going as low as US$29,000 briefly before some buying came in.

Here’s the latest news out of China…

The New Game gathers force: China is serious about crypto crackdown

We’ve talked a lot about ‘The New Game’ here at Money Morning — which is the idea that the concept of money is evolving rapidly and requires attention from investors.

But even we are surprised at how quickly things are moving in a ‘techno-monetary’ competitive landscape.

And now, China’s banks are implementing transaction surveillance processes, *coughs*, I mean ‘due diligence’.

Bitcoin vs Gold — Which Should You Buy in 2021? Download your free report now

As per an excellent CoinDesk article by David Z Morris:

‘The Agricultural Bank of China, for instance, said on Monday it would implement a due diligence process to spot cryptocurrency-related transactions. Detection of such activity, AgBank said, could lead to account suspension.

‘It’s important to note this scrutiny would likely fall on individuals as much or more than on cryptocurrency businesses. That’s because such businesses are thin on the ground in China proper: Most notably, cryptocurrency exchanges were banned from the country in 2017, leading to the shutdown of domestic operations by the likes of Bobby Lee’s BTCC.’

Which is accompanied by a BTC miner exodus from Chinese borders:

‘By now, it should be clear the “hashrate migration” is real: Miners are leaving China for good. As of April 2020, an estimated 65% of bitcoin hashrate was domiciled in China; with confirmed bans across the country, that figure will be far lower 12 months from now. The precise magnitude and schedule for the westward move is currently unknown, but all signals seem to be indicating the greatest shakeup in the geographic makeup of bitcoin mining since the start of the industrial mining era.’

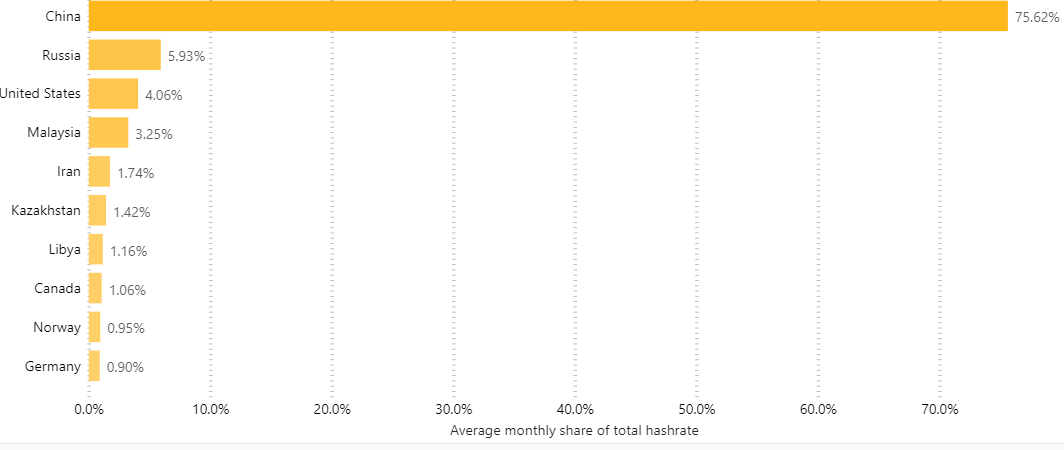

China has long dominated mining which is reflected in Cambridge University’s Centre for Alternative Finance numbers going back to 2019:

|

|

| Source: Cbeci.org |

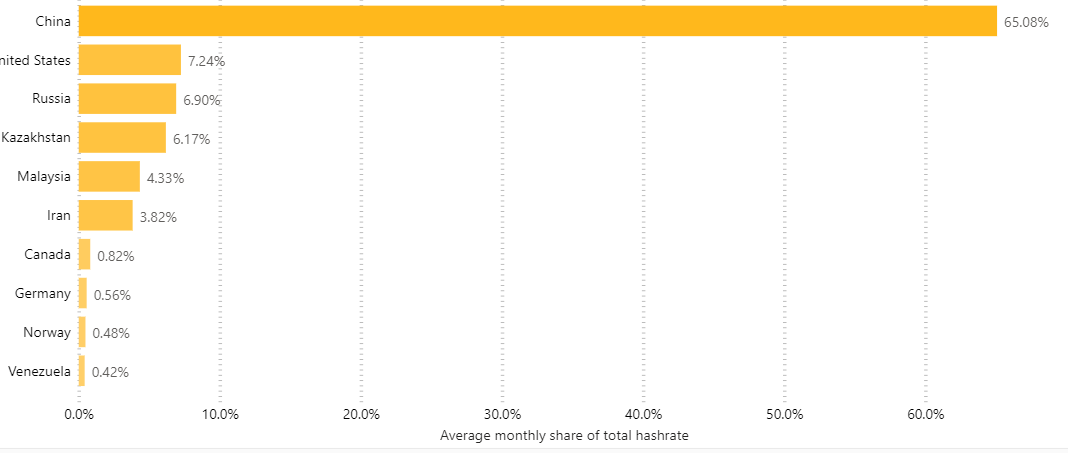

But Cambridge University’s map of bitcoin hash rate growth (BTC mining power) is particularly interesting because it shows the US soaking up a portion of the hash rate exodus from China over time.

|

|

| Source: Cbeci.org |

The US essentially doubled its share of mining power over the last two years.

That trend should continue in a country that despite its best efforts remains relatively ‘free’.

Conclusion, the hash rate exodus from China is a good thing because new miners will spring up in jurisdictions that are friendlier to crypto, further distributing and democratising bitcoin mining.

A more competitive structure, a more robust structure, and ultimately a net positive for the crypto world.

Which brings me to a really intriguing proposition…

New money is energy and energy is money

Remembering that Mr Musk’s main criticism of BTC was that it is powered by dirty energy, it’ll be very interesting to see how the renewables revolution collides with crypto, which in turn will collide with massive geopolitical shifts around new money.

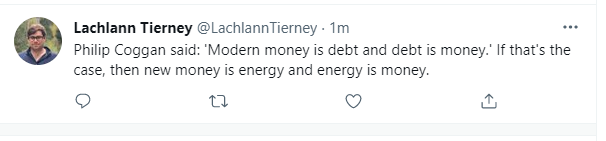

Philip Coggan who writes for The Economist said the following:

‘Modern money is debt and debt is money.’

Let’s flip the script:

|

|

| Source: Twitter |

Adding it all up, if we can mine bitcoin or any crypto for that matter in an efficient way…

The last major criticism of the crypto movement will fall by the wayside.

The only criticism left standing will be ‘Well, it will displace a whole industry of workers.’

That’s the regulators, the middlemen, the brokerage houses, the hedge funds, and the ‘you name it’ suit types.

Just like the Luddites and their destruction of textile machinery, do we really need these jobs? How many children when they grow up say, ‘Mum, I want to be a forensic auditor for a Big Four bank’?

I’d go out on the smallest of limbs and say not one. And if they did, that’d be one child to be seriously concerned about.

So, if you’re worried about being a Luddite or want to start trading crypto, be sure to catch Ryan Dinse’s latest presentation on his crypto trading strategy right here.

It will open your eyes to the opportunities available and give you useful pointers on how to get started.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.