In 1979, Warren Buffett wrote in his annual letter to Berkshire Hathaway shareholders:

‘One friendly but sharp-eyed commentator on Berkshire has pointed out that our book value at the end of 1964 would have bought about one-half ounce of gold and, fifteen years later, after we have plowed back all earnings along with much blood, sweat and tears, the book value produced will buy about the same half ounce.

‘A similar comparison could be drawn with Middle Eastern oil. The rub has been that government has been exceptionally able in printing money and creating promises, but is unable to print gold or oil.’

They say history doesn’t repeat, but it does rhyme.

Many are seeing close correlations between the 1970s and today.

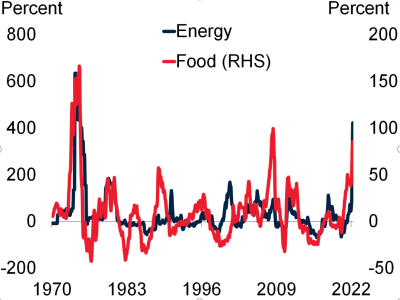

For instance, check out this chart of food and energy prices:

| |

| Source: Brookings |

You can see the twin spikes of 1970 resemble what we saw in 2022.

Add surging debt, runaway inflation and slowing growth; it all looks eerily familiar.

But there’s a few important differences to think about…

Flip the denominator

Funnily enough, Berkshire Hathaway was back buying oil stocks recently:

| |

| Source: Bloomberg |

He must see some correlations with the 1970s and today too.

However, some things have changed.

Back in the 1970s gold was still money…and the only hedge against the debasement of the currency brought about by inflation and debt.

In today’s modern economy, I think the better hedge is digital gold — Bitcoin [BTC].

In fact, I’ll prove it to you.

Check out this table:

| |

| Source: Priced in Bitcoin |

Remarkably, every major stock index has become cheaper over time, when you price it in Bitcoin (not US dollars).

And if all you’d done is buy and hold Bitcoin over the past five years, you’d already have smashed most investment professional’s results.

If you’d bought Bitcoin five years ago, you could buy the Nasdaq — which is near record highs — for a 64% discount!

It’s even 37% cheaper than one year ago when priced in Bitcoin.

See what happens when you flip the denominator to a better monetary asset?

What about real estate?

Again, if you’d bought Bitcoin five years ago, you could buy the real estate index (XLRE) at a whopping 83% lower.

Think about it…

House prices are getting cheaper under a Bitcoin standard!

In fact, nearly every single sector of the stock market:

| |

| Source: Priced in Bitcoin |

Interestingly, there’s only one sector that’s got more expensive — even when priced in Bitcoin — over the past three years.

That’s energy.

And it brings up an important point…

Buy what they can’t print more of

Just as Buffett observed in the 1970s, when governments take over an economy you want to buy assets they can’t print out of thin air.

That’s why the returns on energy have matched Bitcoin over the past three years.

As Buffett noted:

‘The rub has been that government has been exceptionally able in printing money and creating promises, but is unable to print gold or oil.’

Going forward, I think the governments of the world will continue to debase their currency in order to prop up the economy.

Gold and oil will still offer some protection, just as they did in the 1970s

But some things will do better.

Like I said, you have Bitcoin as an alternate store of value digital asset these days. And at 1/20th the market cap of gold still, I think the upside potential here is still extremely high

There’s also other important scarce assets that are likely to be in demand.

Take copper for instance.

It’s a key component not only in infrastructure but also the electrification and renewable energy trends that, like them or not, governments are continuing to support.

And yet, our in-house geologist here at Fat Tail Investment Research James Cooper wrote recently that:

‘As commodity prices rise and decade-old mines finally expire, mining giants will be forced into a fierce bidding war to secure the next generation of deposits. Except these deposits are yet to be discovered. Given there is a 15–20-year time lag from discovery to production, a critical supply gap looms.’

This looming supply shock in copper could be the trade of the decade at one point.

Another scare item that can’t be printed?

How about Microchips.

You might think as a consumable good, chips can be created at will.

But the truth is, microchip fabrication is hard and very expensive to set up.

Which means supply can’t easily react to the surge in demand coming from all sorts of industries such as AI, automotive, machine learning, virtual reality, and other data intensive fields.

Indeed, it was reported last week that automakers cut global production by 141,506 vehicles over the past five weeks due to microchip shortages.

My point is…

The technology sector is a lot more important than it was in the 1970s and big countries can’t afford to fall behind in the tech-race.

So I’ve a working thesis that demand for certain key tech will remain high, no matter the market gyrations.

It’s something for you to consider.

Simple ain’t easy

There are correlations with the 1970s, but there are differences too.

But I think following the same principles — if not the same investments — will work for the 2020s, as much as it did in the 1970s.

Simply put, you buy important assets that will continue to be in demand and can’t be ‘printed’ or ‘produced’ at will.

Gold, oil, Bitcoin, certain key commodities, and strategically important tech assets fit the bill here in my opinion.

It might sound simple, yet few will do it.

But a few well-placed investments now, may be all you have to do for a few years to come.

Good investing,

|

Ryan Dinse,

Editor, Fat Tail Daily

Comments