- One of the biggest headwinds for the market last year was the rising interest rate environment and the uncertainty when it would end.

We’re getting inklings that the world is turning back in the favour of you and I as share investors.

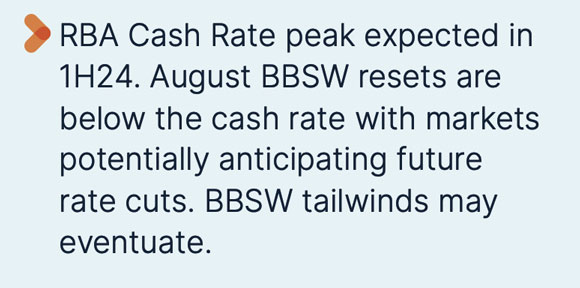

As far as rates go, case in point is this snapshot I took from financial firm Resimac’s results yesterday:

|

|

|

Source: Resimac |

I doubt they say this lightly. Their business model is very sensitive to moves in the cash rate and wholesale funding.

The market is still jumpy around many stocks like this. Resimac shares took a panicky dive before their results release.

Then the shares rallied 20% yesterday on relief. It’s been a tough 18 months…but it’s not 2008 here.

They are a profitable, dividend paying stock and, yes, their arrears are rising, but it’s not a disaster, as many quite rightly feared last year.

In fact, it was an interesting day yesterday.

I also tuned into a webinar from the team at Yarra Capital.

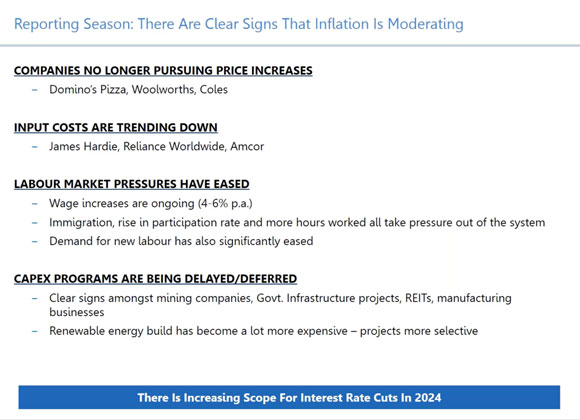

I took a screen shot of this slide that points to their increasing confidence we could see rate cuts next year:

|

|

|

Source: Yarra Capital |

We can’t be certain this is the way the cookie will crumble. But it’s a bet I’m willing to take and am positioning for accordingly.

I suggest you do the same. Inflationary pressure is fading fast.

You can make very good money when the weight of market money begins to move in a new direction.

Yarra also made an excellent point that any Aussie investor must know.

59% of the top 20 stocks are either exposed to banking, iron ore, or fossil fuels.

That doesn’t exactly scream ‘the future’, as I’m sure you’ll agree.

While they may all be profitable sectors, the market is unlikely to put a high forward multiple on their earnings.

The growth rate just isn’t high enough. That limits the capital growth you (and me, and everyone else) can expect.

Point being: if you want your portfolio to get a kick and actually go somewhere, you need to look at stocks outside this range.

I agree. Personally, I specialise in small caps and am astonished how negative everyone is relative to the opportunities presenting.

Curious?

Go here for my top five ideas to get you started.

- Another year and another fake China crisis has washed through the Aussie market, scaring everyone…and yet, there seems to be little signs of genuine financial distress anywhere. It’s almost a tradition now.

I told you last week that this was a chance to buy the dip. The market has rallied up since.

Take mining conglomerate Mineral Resources [ASX:MIN]. It was close to $100 per share at the start of the year.

It fell to about $64.50 as lithium, iron ore, and mining in general came off the boil.

But it jumped nearly 8% yesterday after releasing its results on Monday night. That’s a big move for a big stock like that.

One reason is that iron ore is still at US$110 and, paradoxically, looking bullish.

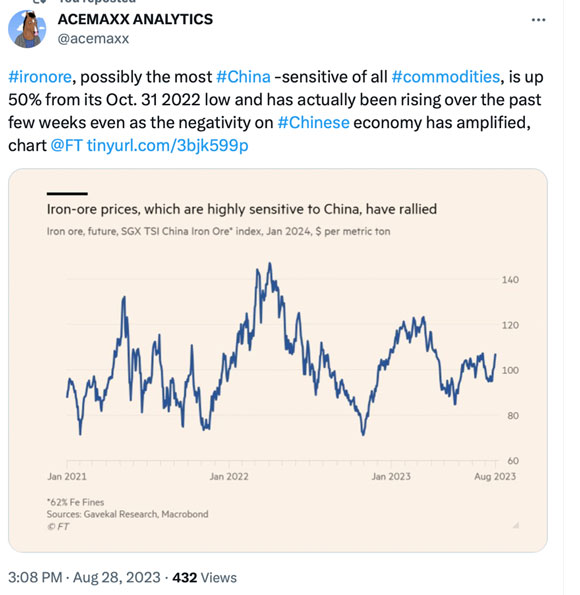

Check out this chart from the Financial Times via X:

|

|

|

Source: X (Twitter) |

Why is this so? Truth be told, I’m not 100% sure, except to say perhaps China is stronger than most presume.

I do know that iron ore stocks like MIN have taken a battering but are still enjoying good margins at this price. That’s a tailwind for the market overall.

And you can catch some nice trades and investments when you get a dynamic like this.

Again, when everyone goes one way, but the market current is going the other way — well, what a great time to grab value and the potential revaluation that must come if it continues.

- All we ever hear lately is about Australia’s cost-of-living crisis. There is truth to this — if you’re under 50.

Two stocks that have posted very decent results are travel firms Helloworld Travel [ASX:HLO] and Tourism Holdings [ASX:THL].

HLO is up about 40% since March. It’s smashed the return of the general market.

Whatever consumers think about the world, travel remains a top priority, and it’s flowing back to shares previously hammered.

It’s one thing to recognise an economic problem. HLO and THL show that not every stock is going to be affected. Individual analysis matters.

Don’t let the doomers block you from seeing opportunities like this.

Best wishes,

|

Callum Newman,

Editor, Money Morning