In today’s Money Morning…gas has this one company flying…the other gas and hydrogen airplanes!?…pot stock craze to come back in 2021? I wouldn’t bet against it…and more…

Yesterday, my good friend Ryan Dinse boldly claimed that a ‘monkey with a dartboard could’ve made bank this year.’

And he’s certainly right, especially if you weren’t a big fund pouring money into ASX 200 stocks in January.

But today’s ‘third wave’ of positive vaccine news requires us to look further ahead.

As per the Australian Financial Review:

‘Pharmaceutical company AstraZeneca said Monday that late-stage trials showed its coronavirus vaccine was up to 90 per cent effective, giving public health officials hope they may soon have access to a vaccine that is cheaper and easier to distribute than some of its rivals…

‘AstraZeneca is the third major drug company to report late-stage results for a potential COVID-19 vaccine as the world anxiously waits for scientific breakthroughs that will bring an end to the pandemic.

‘Millions of doses of the Oxford vaccine are already in production in Melbourne at a CSL factory with plans to roll out vaccination in the coming months across Australia if it proves effective.

‘The Therapeutic Goods Administration has given it provisional approval and is awaiting data from AstraZeneca before granting the final tick.’

With a trio of vaccines on the cusp of being deployed, will 2021 be another everything rally year?

Here are two investment themes that I think you should look out for.

[conversion type=”in_post”]

Gas has this one company flying

This country’s energy policies are a constant sore spot.

We can’t seem to figure out exactly what we want to do.

Much of the discussion at the moment is focused on gas, which flows through to companies that can provide the gas.

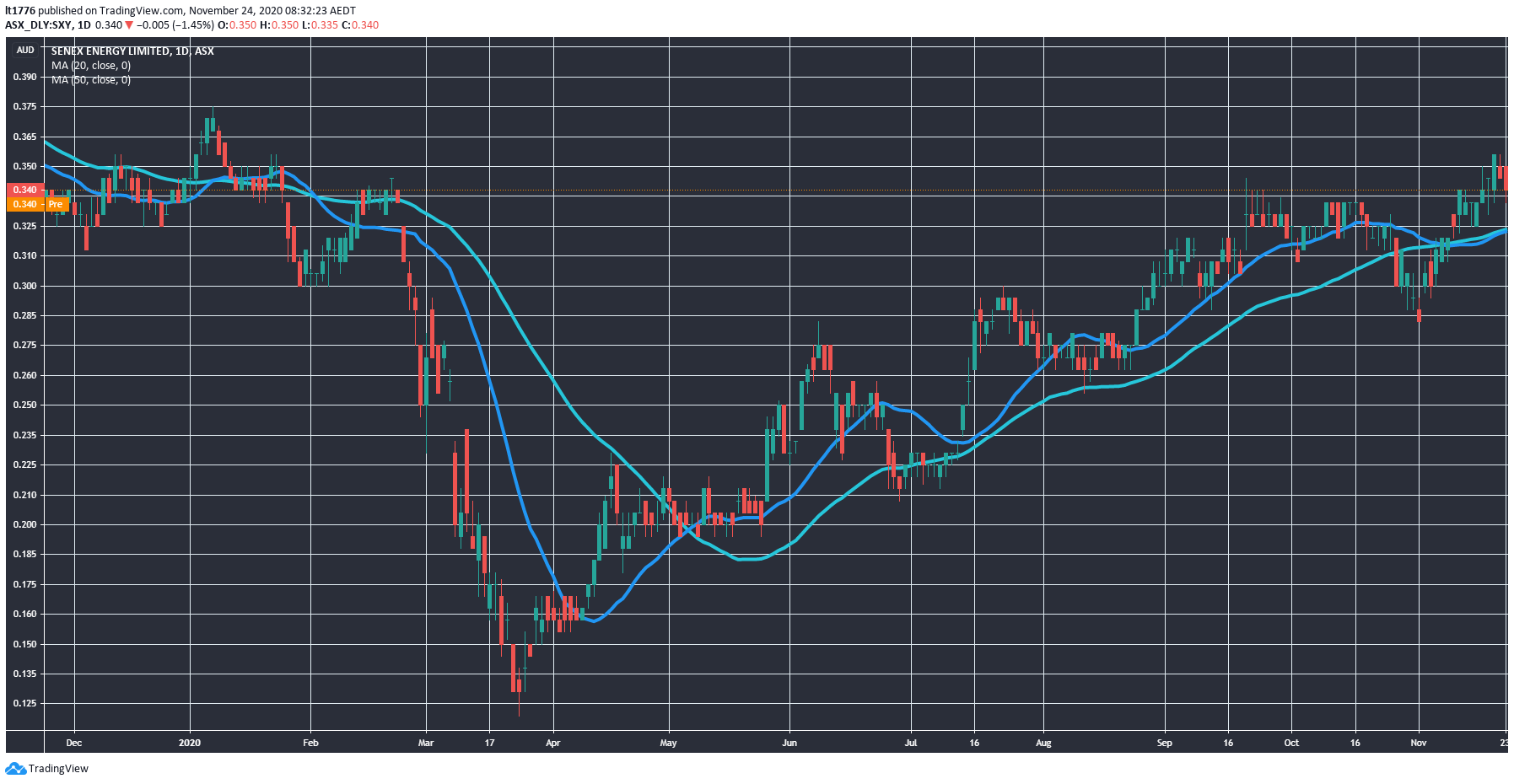

Take a look at the daily chart for Senex Energy Ltd [ASX:SXY], for example:

|

|

| Source: Tradingview.com |

That’s a pretty steady uptrend from the March lows for the nearly $500 million market-capped company.

But what are the prospects of a sustained push towards gas?

Well, a little birdy of mine at the top end of the superannuation industry says it’s more of ‘stop gap’ measure.

The bigger, more long-term story is about a different form of gas.

The other gas and hydrogen airplanes!?

Again, from the Australian Financial Review this morning:

‘Three of Australia’s gas chiefs told The Australian Financial Review Energy and Climate Summit the fuel had an important role to play as states side-step the federal government’s proposed gas-led recovery.

‘Tas Gas chief executive Phaedra Deckart said the proposed Marinus Link between Tasmania and the mainland was essential to shore the state up as the “battery of the nation”.

‘“The will is there to create a hydrogen industry for Australia,” Ms Deckart told the Summit. “With all of these technologies I think it’s important that we don’t pick winners, let’s fund and research and learn.”

‘Tasmania has thrown $50 million at developing hydrogen gas on the Apple Isle. Paraphrasing Mark Twain’s famous quote, Ms Deckart said, “Rumours of gas’ demise are greatly exaggerated.”’

Thrown into the mix is the fact airplane giant Airbus is planning to make a hydrogen-powered passenger aircraft a reality by 2035.

You can see a concept mock-up of what it would look like below:

|

|

| Source: Airbus.com |

So, I’d be watching the energy space very closely in 2021, for these reasons.

Pot stock craze to come back in 2021? I wouldn’t bet against it

I’m noticing a lot of early speculative action on ASX-listed pot stocks at the moment.

For investors who remember, there was a pot stock boom back in 2017/18.

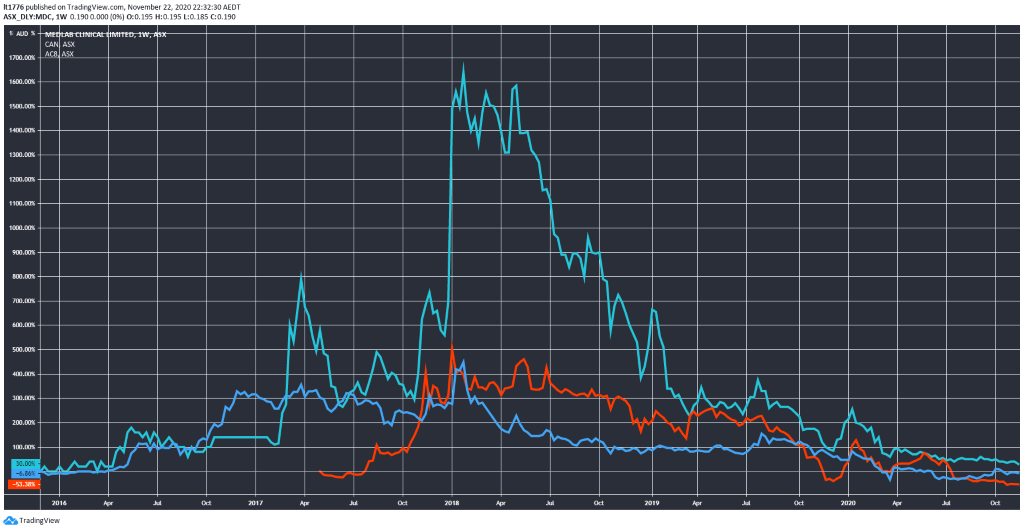

Here’s a chart that shows exactly how fast some of these stocks went up:

|

|

| Source: Tradingview.com |

That big teal line is AusCann Group Holdings Ltd [ASX:AC8], the blue line is Medlab Clinical Ltd [ASX:MDC], and the red line is Cann Group Ltd [ASX:CAN].

All three companies spiked hard at the end of 2017.

AusCann traded at $1.74 in early 2018.

And now?

AusCann shares are going for around 13 cents, at time of writing.

As 2018 progressed there was a long painful share slide for these companies which left many investors who bought into the hype at the peak feeling burned.

Turns out, it’s incredibly difficult to sustain a successful cannabis business when Australian regulations remain tight.

But things could be changing.

For one, the Therapeutic Goods Administration (TGA) is due to make CBD oil available over the counter in February 2021.

This should expand the Australian medical cannabis market with current estimates of its size hovering around $40 million.

With recent developments in the US, it’s possible that 2020 was the bottom for these companies.

Time will tell of course, but these are just two investment themes that could burst onto the scene in 2021.

Act early, and you could be richly rewarded.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments