I get many letters from property investors wanting to know what to do with their property investments at the peak of the real estate cycle.

The question — ‘when should I sell? 2025 or 2026?’

No matter what stage of life you’re at, the answer will always depend on what kind of real estate you’re holding.

Even within the context of the boom/bust cycle — what you buy is far more important than trying to time the peak.

Let me explain. Back in 2007 — the peak of the last real estate cycle — a member at Prosper Australia was gearing up to sell his property.

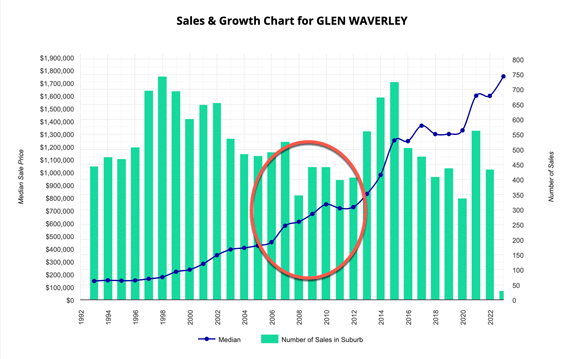

He owned a nice suburban house in Melbourne’s middle-ring suburb of Glen Waverley.

I’ll call him David.

David was very familiar with the real estate cycle — he’d worked in real estate and researched it in detail.

He was set on selling out at the peak.

2007 was good timing. Melbourne’s property market was going berserk in 2007.

It was at the end of the ‘winner’s curse’ phase of the property cycle (2005–2007). (It’s named the winner’s curse because the winner’s success in securing a foot onto the mythological property ladder is about to become their curse.)

This phase of the cycle usually evidences itself in the final two years prior to the crash.

It’s the point at which the gap between reality and fantasy reaches its widest point.

A flipper’s paradise.

Buy a property now, sell a few months later, and you’ll still bag a profit.

David sold into the winner’s curse, and he got a great price!

Then 2008 hit with a vengeance.

I remember it clearly.

I was working as a buyer advocate at the time for a small family-owned business. The drop-off in buyers was instant.

We lost all our clients!

Multiple real estate agencies had to let staff go.

Sellers panicked.

And for a while there, it looked like we’d be plummeting into another property crash akin to the 1990s downturn. David was thanking his lucky stars that he sold when he did.

However, shoot forward two years and prices in Melbourne’s Glen Waverley hadn’t crashed. In fact, they had shot up by another 22% to a higher peak (2010)!

|

|

| Source: Price Finder |

Had David held on for two more years, he’d have secured a bigger windfall.

He’d let go of a quality piece of real estate. Paid the capital gains, sales commission and advertising costs.

And now he was reassessing if he had made the right choice.

In this instance, the accelerated rise to a new peak was in response to market incentives put in place by then PM Kevin Rudd.

Buyer grants and so forth.

However, note this important point.

In the major international cities that chime with the cycle — I’m talking about the ones that attract the speculators like Melbourne, Sydney, London, New York, etc — the peak of the previous cycle is typically exceeded within the first few years of the following real estate cycle.

By that, I mean prior to the next mid-cycle recession.

How soon the new peak comes, depends on government policy to some extent (as you saw in the example above).

And we’re also assuming nothing will interrupt the start of the next cycle (war, for example — which is a possibility).

If not — the rule holds.

At least, that is, for the larger capital cities.

The smaller states by population hold more risk that the downturn can be extended — so keep that in mind.

In the 1990s downturn, the bigger cities took a few years longer to recover to previous highs.

However, the median price in Sydney and Melbourne still exceeded the previous peak prior to 2000 and the start of the mid-cycle recession.

It tells us a lot about quality real estate as an investment.

The best real estate investors understand this.

As a rule, the wealthiest never sell their quality assets. They leverage and build their portfolios in the good times — with a balance of growth and yield — and time the cycle accordingly.

It reminds me of a recent email exchange I had with Philip Soos whilst preparing the last monthly edition for my Cycles, Trends, & Forecasts subscribers.

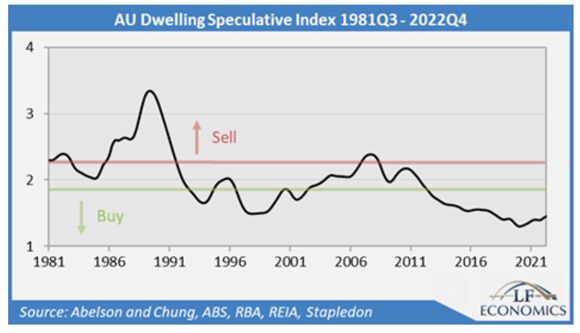

In that edition, we used Philip’s ‘Speculation Index’ state-by-state to illustrate how you can time the peaks of the market in advance.

The index is simply the mortgage rate divided by the yield.

Essentially a measure of the cost of renting finance from the bank vs. the cost of renting from a landlord.

A valuation metric.

When mortgage rates are closer to property yields (the earnings) — at 1.5 times — it is theoretically a good time to buy.

Assisted by favourable tax policies and low-interest rates, there’s plenty of steam left in the economy for land prices to trend higher with speculation, and money is cheap.

This typically occurs earlier on in the cycle when interest rates have been set deliberately low to stimulate the economy post the last downturn.

We saw it through the first half of the property cycle — between 2010–2020.

When the ratio or lending rates to rental yields peaks at over 2.3 times, however, irrational exuberance has well and truly taken over.

This usually occurs just prior to the peak — signalling it is time to sell — as you’ll see on the chart below.

Note that the peak always comes at a time when punters will ignore the fundamentals of buying based on earnings and yield (not that many know how to do this regardless).

At this point, the motivation is quick ‘flips’ that can only make money in the rising phases of a speculative land bubble.

They are not buying for yield — they’re buying in speculation of future land appreciation.

Because speculation rules the cycle, and property is valued on the calculation of speculative gains, the crisis always ends in an environment of rising interest rates.

This exacerbates the gap between interest rates and earnings even further.

Over the last few months, this has been relevant — we’ve had the fastest rate hiking cycle in recorded history.

However — rents have also been rising rapidly. Many investors are still paying below the market lending rate due to fixed-interest loans taken out through the COVID mid-cycle panic.

Therefore, the index will likely look a lot more dire next year than it does now — showing that we’re nearing the peak of this current cycle.

For now, however, it’s showing we have more steam ahead!

|

|

| Source: Philip Soos — LF Economics |

Back to the subject of this email.

Philip initially left the buy/sell markers off the index. Only adding them in on my request — as they assist in showing us the opportunities within the cycle and warning of the peak.

However, as Soos rightly points out:

‘From the chart, it would make sense to get out at the peak, but where would you be if you sold out in 1989 or 2008? Worse off.’

Don’t get me wrong, timing the real estate cycle — getting in at the right time and getting out at the right time — will maximise your gains and is invaluable for knowing when and how to leverage.

However, the value of well-located real estate is enduring.

If you focus on purchasing the right property, in the right position within a well-facilitated established suburb, for the right price — you’ll be well-rewarded within the two booms of the cycle.

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor