As I’ve mentioned already, Greg and I recently launched the What’s Not Priced In podcast.

The podcast is driven by one question – what has the market not priced in yet?

It’s a great question to get in the habit of asking.

And, boy, did the market not price in Tuesday’s 25 basis point hike by the Reserve Bank.

Did you see it coming?

21 out of 32 analysts polled by Refinitiv didn’t, expecting the RBA to keep rates steady. And traders pinned the chance of a hike at 35% leading up to the announcement.

Fat Tail gold bug Brian Chu note to subscribers earlier this week that while boffins and traders were surprised, ordinary Aussies weren’t.

Maybe Refinitiv shouldn’t run polls, but pub tests.

Search “What’s Not Priced In” on your preferred podcast platform or hit play below:

Interest rate surprise

In this week’s episode, Greg and I covered the rate hike surprise and its implications in depth.

Clearly, the market was taken aback.

But what is the market’s thinking now?

Given the more hawkish stance assumed by Phillip Lowe, how has the market recalibrated its bets?

In his statement following the decision, Lowe said:

‘Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve.’

Following Tuesday’s decision, traders put the probability of a further 25bp hike in July at 11%. On Wednesday, the probability rose to 18%.

On Thursday, the market placed a 23% chance of an interest rate increase to 4.35% at the next RBA meeting.

Will it keep rising?

Greg thinks any further rate increases are fraught with risk.

Assuming there’s a nine-month monetary policy lag, Greg noted there’s still about 200 basis points of tightening coming.

Is raising further really a good idea?

We showed this chart during the podcast, illustrating just how rapid this hiking cycle is. The pace is historic.

The cash rate rose over 400 basis points in 14 months, the quickest pace in 30 years.

Source: Shane Oliver

Source: Shane Oliver

When you raise this fast, you risk breaking things.

Guess what?

Australia’s yield curve just inverted for the first time in over a decade.

Here’s the chart we showed on the pod:

Source: Trading View

Source: Trading View

The gap between the yield on the Aussie 10-year bond and the 2-year bond is now negative.

Meaning short-term rates are higher than long-term rates, often a harbinger of recession.

The Reserve Bank itself described an inverted yield curve thus:

‘An inverted yield curve might be observed when investors think it is more likely that the future policy interest rate will be lower than the current policy interest rate [and why would that be?]. In some countries, such as the United States, an inverted yield curve has historically been associated with preceding an economic contraction. This is because central banks reduce policy rates in response to lower economic growth and inflation, which investors may correctly anticipate will happen [bingo!].’

So, what’s not priced in?

A bad time for earnings.

Last month, MFS’s Rob Almeida released a research note showing equity markets are ‘late to recognise recession risks’:

‘Exhibit 1 illustrates forward earnings expectations for the S&P 500 Index overlayed with market drawdowns. Despite cautionary signals from the economy or the bond market in advance of most recessions, equities tend to wait until recession risk is looming before pricing in weakness. The equity market typically falls into a deep sleep late in the cycle and wakes up long after other markets, albeit with a jolt.’

Source: MFS

Source: MFS

Stocks of the week – Aussie banks

A highly interesting chunk of the episode focused on the ASX banks.

The key question animating the discussion was whether the big banks offer contrarian value right now.

With rates up, is it better to have cash in the bank or equity in the bank?

Greg argued that when cash is popular – as it is now – it’s a good time to look at other income options.

And while he’s not bullish on the wider market, he thinks opportunities abound for contrarian, long-term investors.

Many stocks are unloved right now, outcompeted by a desire for cash.

Like banks.

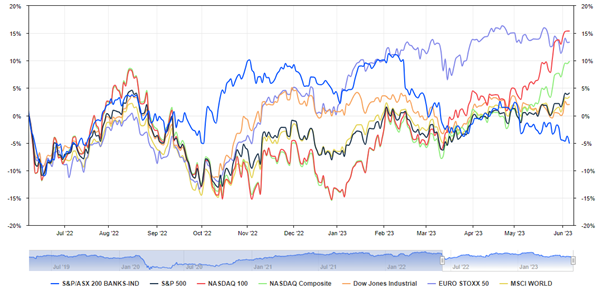

Here’s the S&P/ASX 200 BANKS (ASX:XBK) index over the past year. It’s underperforming the major indices in a big way.

But are the Aussie banks a good contrarian play from here or a value trap?

As Greg wrote in his latest monthly for the Fat Tail Investment Advisory:

‘When you’re investing for income in the stock market, you’re still investing in the stock market. It’s not like you can just go and buy a company and automatically expect to receive that income yield.

‘You might get a 6% dividend but lose 15–20% from a falling share price. Or the company may cut its formerly juicy dividend, meaning what looked attractive when you first bought, suddenly disappears.’

When it comes to banks, what’s not priced in?

A material hit to banks’ return on equity (ROE).

Banks are cyclical.

In good times, a bank like Commonwealth Bank [ASX:CBA] could see its ROE nearing 15%.

In bad times, ROE can tumble to 10%.

But markets seem too sanguine about the returns banks can achieve in the next few years, especially if the RBA’s rapid hikes continue to squeeze the life out of the economy.

Consensus analysts place CBA’s FY24 ROE at 13%.

That’s pricing in too much optimism and not enough reality.

Now, Greg and I discussed plenty more than I could cover here (like Greg labelling questions directed at Phillip Lowe at Wednesday’s Q&A ‘idiotic’).

So catch the full episode on your preferred podcast channels. And if you enjoyed it, please like and share!

Regards,

Kiryll Prakapenka