Only 40 stocks in the ASX 200 are in the green this month.

The rest are either neutral or in the red.

Some, like Star Entertainment Group [ASX:SGR], are hitting all-time lows in September.

Others, like Lake Resources [ASX:LKE] and Brainchip Holdings [ASX:BRN], are registering new 52-week lows.

Markets are blaming rising bond yields.

So where do things stand?

Will interest rates remain ‘higher for longer’ and further depress stock valuations?

Or will the economy buckle under the high interest rate regime, forcing central banks to cut rates? And will that really be a boon for markets (hint, no, it won’t).

Are we entering a new bear market?

And is there still room for a skilled stock picker to snag bargains?

Greg Canavan and I covered all this and more in the latest episode of What’s Not Priced In.

We also discussed a more pressing issue: Broncos or Panthers; Pies or Lions?

‘Higher for longer’ drinking game

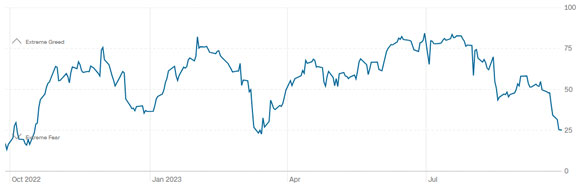

Since hitting their 2023 highs in July, the key US indices — the S&P 500 and the Nasdaq — are down over 7%.

The indices’ peak coincided with market sentiment — measured by CNN’s Fear and Greed Index — also peaking at Extreme Greed in July.

But sentiment has now fallen all the way to Extreme Fear.

It’s the lowest reading since March 2023.

|

|

| Source: CNN |

That’s partly to do with the recent surge in bond yields.

US 10-year bond yields lifted to 4.607% on Thursday, a 17-year high.

The US 2-year yield is at 5.129%, another decade high.

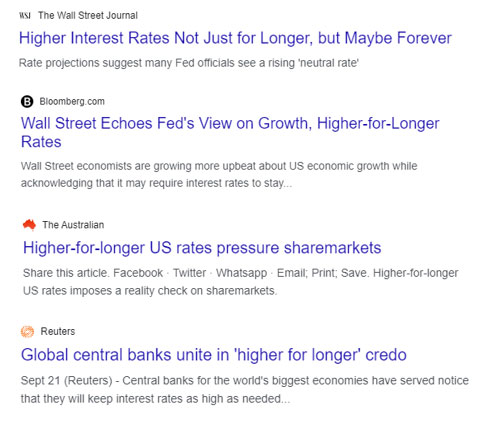

Yields are rising on market bets that central banks will keep interest rates high for a while yet.

Or, as the popular mantra has it — higher for longer.

Here’s a new drinking game to poison your liver.

Take a shot every time you hear or read about ‘higher for longer’ interest rates. For the abstemious, do 10 push ups.

|

|

| Source: WSJ, Reuters, Australian, Bloomberg |

The Magnificent Seven and the Laggard 493

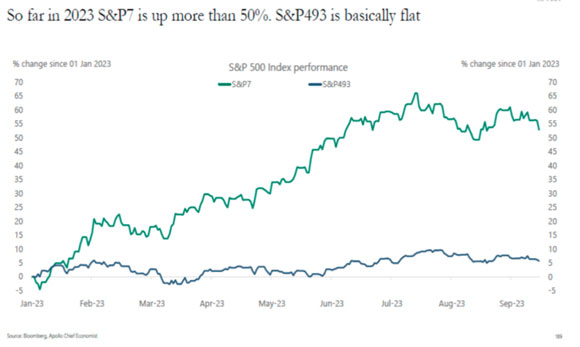

Rising bond yields — and the market’s acceptance of the ‘higher for longer’ credo — have even subdued the enthusiasm for the biggest US stocks like Meta, Apple, Microsoft, and Nvidia.

The Magnificent Seven — as the S&P 500’s seven largest stocks are called — have been less than magnificent lately.

Since late July:

- Tesla is down 17%

- Apple is down 13%

- Microsoft is also down 13%

- Meta is down 8.5%

Even Nvidia — the hottest stock in the world, up nearly 200% this year alone — corrected ~14% since late August.

The Magnificent Seven are no longer propping up the S&P500.

And if not them, then who?

|

|

| Source: Torsten Slok |

Aussie stocks take a beating in September

Aussie stocks are also not faring well this month. As Greg pointed out in the episode, only 40 stocks in the ASX 200 are in the green this month.

The rest are either flat…or down.

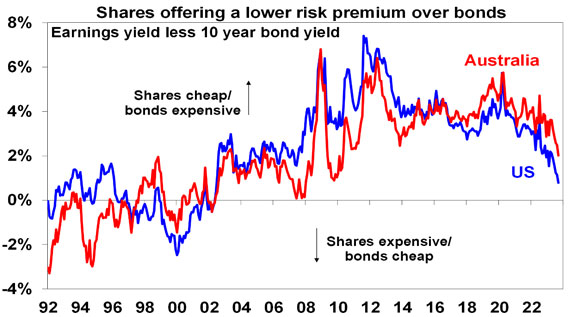

But despite September’s correction, stocks are still expensive relative to bonds.

With bond yields hovering well over 4%, the equity risk premium here and in the US is historically small.

As AMP’s chief economist Shane Oliver wrote in a research note this week:

‘Allowing for the rise in bond yields — by subtracting 10-year bond yields from the earnings yields (using forward earnings) — shows US and Australian shares now offer a reduced return premium over bonds of around 0.8% in the US and 2% in Australia.

‘For the US this is the lowest risk premium over bonds since after the tech wreck whereas current uncertainties (around interest rates, recession risk & geopolitics) suggest the risk premium should ideally be higher. Fortunately, that for Australian shares is more attractive. But ideally bond yields need to fall to improve the prospects for shares.

‘In the near term the risk of a further correction in share markets led out of the US remains high reflecting the deterioration in US share valuations particularly for tech stocks which are very sensitive to bond yields.’

|

|

| Source: AMP |

Interest rates and reasoning from a price change

A few episodes ago, we warned that the market’s strong consensus about the onset of a ‘higher for longer’ rate regime warranted contrarian scrutiny.

Greg then canvassed the possibility the ‘higher for longer’ outlook could be supplanted by a ‘lower and sooner’ one.

Which is the more likely now?

Greg still thinks the market is overestimating the extent and longevity of high interest rate policy.

So what would happen in a monetary regime characterised by lower interest rates delivered sooner than expected?

Some investors would venture this development will be a boon for stocks.

Just look at what expectations of prolonged high interest rates — and concomitant high bond yields — have done to stock prices this month.

But we should be careful.

Lower interest rates on their own are not sufficient for good news.

The reason behind lower interest rates matters most.

This is what economist Scott Sumner calls never reasoning from a price change. Applying the principle to interest rates, Sumner wrote:

‘It’s nonsensical to talk about a change in interest rates having any sort of predictable effect on the economy. Rather it’s the things that cause interest rates to change that will have an effect.’

It is the reason behind the fall in interest rates, not the fall itself, that matters.

Discretionary spending and inflation

So let’s focus on the potential reasons.

We’ve canvassed weaking leading economic indicators last episode but further evidence popped up this week.

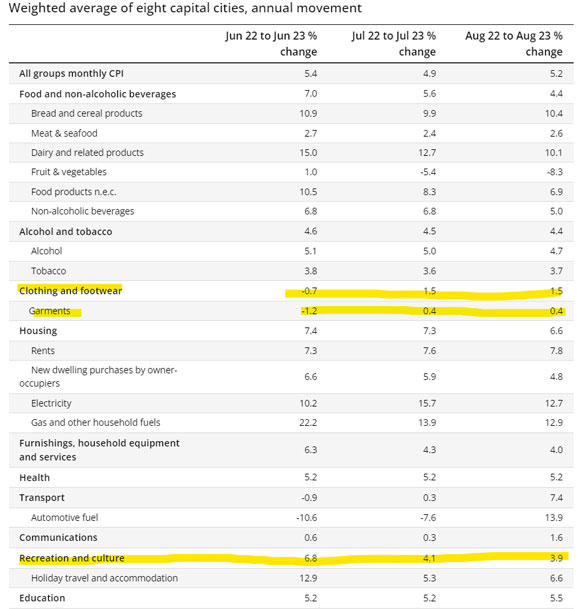

For one, August’s monthly CPI indicator showed inflation in discretionary categories is either weak or cooling.

|

|

| Source: ABS |

And two, August’s retail sales data only rose a paltry 0.2%, down from a 0.5% rise in July.

Household goods retailing fell a third straight month, down 0.4%. August’s fall was the category’s ninth monthly fall in the past 12 months.

ABS’s head of retail statistics Ben Dorber was blunt in his assessment:

‘In trend terms, retail turnover rose 0.1 per cent, and was up only 1.3 per cent compared to August 2022 — the smallest trend growth over 12 months in the history of the series.

‘Considering how high inflation and strong population growth has added to retail turnover in the past year, the historically low trend growth highlights just how much consumers have pulled back in response to cost-of-living pressures.’

Households are curbing spending, stock markets are falling, and economies are creaking under the weight of high interest rates.

Higher for longer?

Or lower and sooner?

Watch the full episode for the answer!

Enjoy the episode!

Regards,

|

Kiryll Prakapenka,

Editor, Money Morning

|