Star Entertainment Group [ASX:SGR], the embattled Australian casino operator, saw its shares surge by over 22% today after revealing it has received several takeover proposals, including from a consortium involving Hard Rock Hotels.

Star’s shares jumped to 55.3 cents in morning trading following confirmation from Star, which disclosed that multiple parties have submitted non-binding indicative offers.

Among the interested consortiums is one led by Hard Rock Hotels & Resorts (Pacific), the local partner of the famous US casino and entertainment brand.

The disclosure comes as Star continues to face intense scrutiny over governance issues and struggles to retain its Sydney casino licence amid allegations of money laundering and organised crime links.

So is this a turning point for the company? Or just the latest dramatic development in Star’s ongoing troubles?

Let’s take a closer look.

Source: TradingView

Star’s troubled past

Star has faced a tumultuous few years, with the latest saga surrounding a second public inquiry into its Sydney operations due to failures to address money laundering risks.

This led to the suspension of its Sydney casino licence in October 2022 and the resignation of its CEO, Matt Bekier, along with several other senior executives.

The company has been working to restructure its operations, implement anti-money laundering reforms, and rebuild trust with regulators.

However, Star admitted just last month that there is ‘significant risk’ it could lose its license permanently when the review concludes later in 2024.

Its Queensland casinos are also facing increased scrutiny, with a separate probe underway into their operations.

So Star is clearly in a weakened position, battling to demonstrate it can meet governance and compliance standards across its remaining core assets.

Enter Hard Rock consortium.

Today, the Hard Rock-led consortium has emerged with a potential takeover play.

According to the AFR, Hard Rock’s proposal involves injecting fresh capital into Star while separating and rebranding its casino properties away from the main operating company.

This early reporting suggests Hard Rock wants to transform Star’s venues into ‘entertainment destinations less reliant on casino revenue’ by focusing more on live music, food/beverage, and hotels.

This would be a large strategic pivot for Star’s existing assets in Sydney, Brisbane and the Gold Coast toward the integrated resort model that Hard Rock operates globally.

For its part, Star has only confirmed the existence of ‘confidential, unsolicited, and non-binding’ proposals from multiple parties, including the Hard Rock consortium.

It stressed that none of the approaches have resulted in ‘substantive discussions” at this stage’.

A Turnaround Play or a Big Gamble?

So how should investors view this approach, and the potential for a deal?

On the one hand, a takeover could provide a lifeline for Star to secure fresh capital, leverage an established brand like Hard Rock, and move on from its recent scandals under new ownership.

The proposal to separate the casinos could help ringfence risk, while a strategic shift towards entertainment could revitalise Star’s stagnant properties.

However, pursuing a deal will add yet another complex chapter in Star’s efforts to stabilise its licensing position and regain the confidence of regulators.

There’s also no guarantee that authorities will view a buyer like Hard Rock favourably or that a deal will be struck.

For now, it’s likely too early to say whether this is a genuine turnaround opportunity for Star or just another dramatic plot twist in its ongoing struggles.

But the news has certainly reinvigorated investor interest, with Star’s shares surging today on hopes of unlocking value from its assets amid the takeover interest.

Whether that speculation proves justified remains to be seen as this story continues to play out.

But if investors are looking for speculative plays, then why settle for something with so many downside risks?

The next major mining theme that could define your future

In the last mining boom, a little-known 2-cent share went to $10 in just five years.

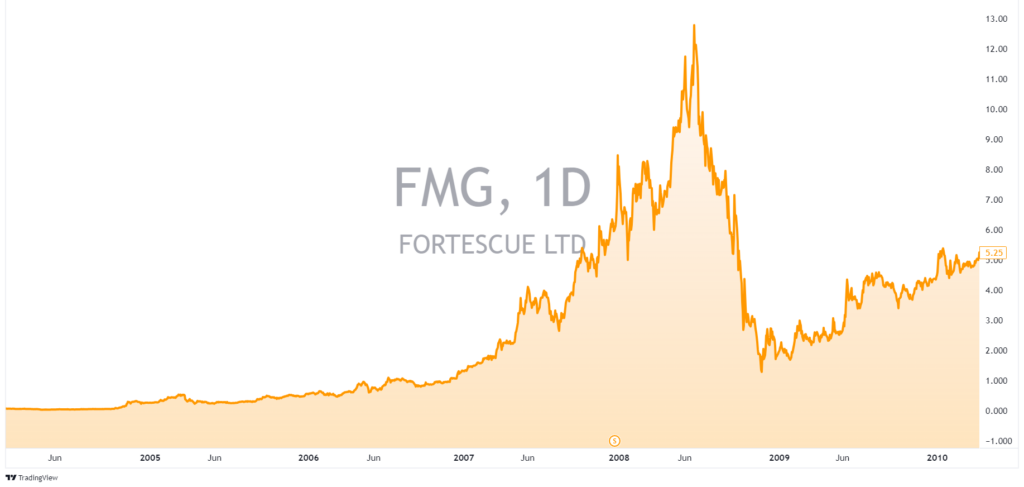

That’s an incredible 50,000% return from Fortescue Metals.

Source: TradingView — FMGs Breakthrough

But finding those kinds of winners is never easy.

Our geologist and resources expert, James Cooper, set out to find the next big disruptors in Australia’s mining sector.

And he has five candidates that could emerge in 2024.

A new mega-theme is developing in mining, and we think five companies should be at the forefront of it.

The signs are all there, and you only have to follow the big miners’ actions to see that the smart money is heading this way.

If you want to learn more about what’s in store for Australian mining and some of the best stocks to play this next trend.

Then click here to learn more about the next breakout stocks.

Regards,

Charlie Ormond

For Fat Tail Daily