The Afterpay Ltd [ASX:APT] share price is down as investors continue to cycle out of growth stocks, and after ASIC flagged a BNPL (buy now, pay later) probe.

At time of writing, APT’s shares are down 4.1%, or $4.76, to trade at $110.50 per share.

The company’s recent selloff has seen its share price well off its 52-week high of $160.05, achieved on 11 February.

The recent rout was enough to see APT shares decline 30% over the last month.

Afterpay’s recent slide follows big declines in Zip Co Ltd [ASX:Z1P] and Xero Ltd [ASX:XRO].

Why is the APT share price down?

Something strange happened this week.

Something strange yet symbolic.

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

While the NASDAQ 100 slumped, the Dow Jones Industrial Average rose to yet another intraday record.

According to Bloomberg, it is the first time ‘since 1993 that the Dow rose and closed within 1% of a record, while the tech-heavy gauge was down more than 10% from its high.’

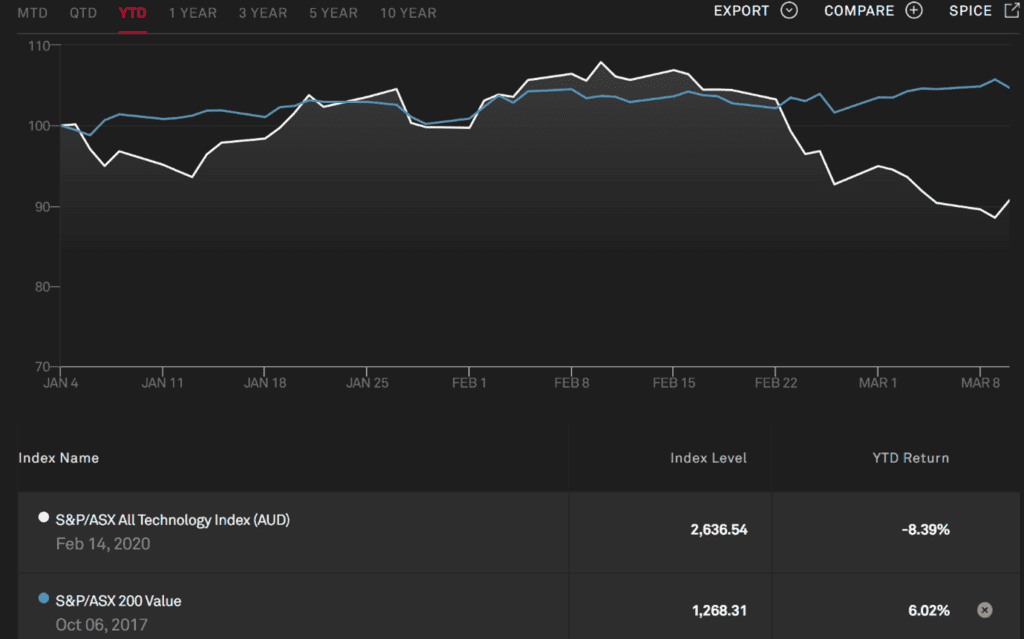

Closer to home, the S&P/ASX All Technology Index is currently down 8.4%, while the S&P/ASX 200 Value Index is currently up 6%, according to S&P Global.

It is yet another manifestation of swelling recovery hopes that has seen investors flock back to value and strong fundamentals, leaving bubbly growth stocks in the lurch.

Importantly, the S&P/ASX 200 Value Index is up 6% year to date, according to the same S&P Global data.

As Ryan Clarkson-Ledward pointed out back in January, the ‘true beauty of a stock like Afterpay is that it is a barometer — the kind of company that can give you a relatively good picture of the market’s appetite.’

The point is that with bond yields rising on recovery hopes, investors are cycling out of growth stocks in favour of value stocks.

As Mike Bailey, director of research at FBB Capital Partners, told Bloomberg:

‘Investors are feeling better about the recovery and looking to own improving fundamentals within large caps outside of tech and growth where valuations are more reasonable.

‘The focus on better fundamentals at a reasonable price may be driving the Dow to new highs.’

As VanEck managing director Arian Neiron told The Australian Financial Review:

‘We’re seeing the value factor really come to the fore.

‘If the current complex remains the same, then we think there could be a sustained value rotation away from over-priced growth.’

And according to Drummond Capital Partners chief investment officer Nick Reddaway, ‘since the first vaccine on November 9, US value has outperformed growth by 5.5 per cent.’

Afterpay’s fundamentals

Afterpay has been one of the premier growth stocks on the ASX, but investors may now be taking a closer look at its fundamentals.

For instance, APT’s recent half year results to 31 December 2020 revealed impressive underlying sales growth of 106% from the previous corresponding period.

Afterpay’s active customer base also expanded by 80% to total 13.1 million.

Active merchants, likewise, grew 73%.

Investors are accustomed to seeing such impressive growth figures from APT.

But in today’s investing environment, which is leaning more towards value and fundamentals, Afterpay’s other financial metrics — the ones usually overshadowed by merchant and customer metrics — are suddenly flashing bright.

For instance, H1 FY21 statutory loss after tax came to $79.2 million, while total comprehensive loss for the period, net of tax, totalled $128.3 million.

ASIC’s BNPL probe

Adding to Afterpay’s immediate concerns is a probe into the ‘buy now, pay later’ sector by ASIC.

On Wednesday, ASIC said its investigation is designed to ensure BNPL leaders like Afterpay and Zip adhere to new design and distribution obligations (DDOs).

ASIC’s acting chairperson, Karen Chester, stated that Afterpay’s sector will be the ‘first near-term cab off the rank’ when it comes to ASIC’s new DDO powers.

The new powers allow ASIC to require product providers to set up governance frameworks that cover their target consumers.

And, according to the AFR, DDO powers allow ASIC to ‘step in and block products that could be deemed harmful.’

Afterpay’s share price outlook

Although APT attributed the loss ‘primarily’ to a net non-cash loss on financial liabilities at fair value of $64.8 million, its EBITDA (excluding significant items) of $48 million is dwarfed by its $32.9 billion market capitalisation.

Afterpay’s latest ASX update did state that its balance sheet ‘remains robust with over $1.7b of pro forma liquidity and growth capacity as at 31 December 2020.’

According to the company, this position can ‘facilitate several years of self-sustaining high growth in Underlying Sales.’

Whether that’s true or not, investors are showing that facilitating high growth is not all they are expecting these days.

As I’ve said recently — and without going too much into the technicalities of bond yields — the higher yields rise, the less appealing the future earnings of growth companies.

Additionally, inflation can also eat away at growth stocks’ already slim or anticipated profits.

Investors may find fast-growing companies — which rely on posting strong growth without necessarily posting profits — less appealing if bond yields and inflation rise.

That said, APT shares are still up 290% on the ASX 200 and up over 300% over the last year.

Clearly, investors still believe Afterpay can continue to grow and consolidate its position in the sector. However, they are signalling that growth is not the ‘be all and end all’ right now.

Meaning, it’s important to gather the right information, sift the credible investment ideas from the incredible, and invest wisely.

COVID-19 has also cast a long shadow over the economy and markets, making investment choices harder.

But our editorial director Greg Canavan is pretty excited about the opportunities the current environment presents.

We’re not talking about crypto plays or small-cap plays or more fintech plays.

We’re talking about ideas that can help manage your whole portfolio.

If you’re interested and want to learn more, then click here!

Regards,

Lachlann Tierney,

For Money Morning

P.S: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments